MINOT — There have been a lot of headlines written, including by this humble columnist, about a proposed ballot measure that would “abolish property taxes.”

The committee backing the proposal is in the process of collecting the requisite signatures to be placed on the statewide ballot. The organizers have said publicly that they have more than half the signatures they need so far.

But what if I told you that this measure wouldn’t actually eliminate property taxes? That it would leave open avenues through which the Legislature, and local governments, could still tax your property?

The text of the ballot measure

states that “the legislative assembly and all political subdivisions may not raise revenue through the levying of any tax on the assessed value of real or personal property.”

Read that closely. State and local government can’t tax the value of your property, but they can still tax your property.

The measure would not eliminate special assessments, for instance. This means that local governments, needing to raise money for a specific project in a given neighborhood, may still tax the property there to pay for it. That tax isn’t levied on property. Rather, the cost is divided up among the property owners in the area based on things like curb footage.

Other types of taxes on property would be allowable under this amendment to the state constitution. For instance, the Legislature could approve a tax that charges a rate based on the square footage of your lot, or the number of structures you have on your property.

Or the Legislature could assess a tax on personal property, like cars or boats or recreational vehicles. Most other states have these taxes. In fact, one could argue that one reason North Dakota’s taxes on real property are so high is because our state has a narrower base since it doesn’t tax personal property.

But I digress.

Such a tax couldn’t be ad valorem, which is to say it couldn’t be levied on the value of the items, but it could be levied on another basis. The state could simply say that everyone who owns a boat has to pay a $100 yearly tax. Or that everyone who owns an off-highway vehicle has to pay $75 per year.

I bring these possibilities up because of another part of the ballot measure proposal: “The state shall provide annual property tax revenue replacement payments to political subdivisions in an amount equal to no less than the amount of tax levied on real property by the political subdivisions, excluding tax levied on real property for the payment of bonded indebtedness, during the calendar year in which this amendment was approved by the voters,” it states.

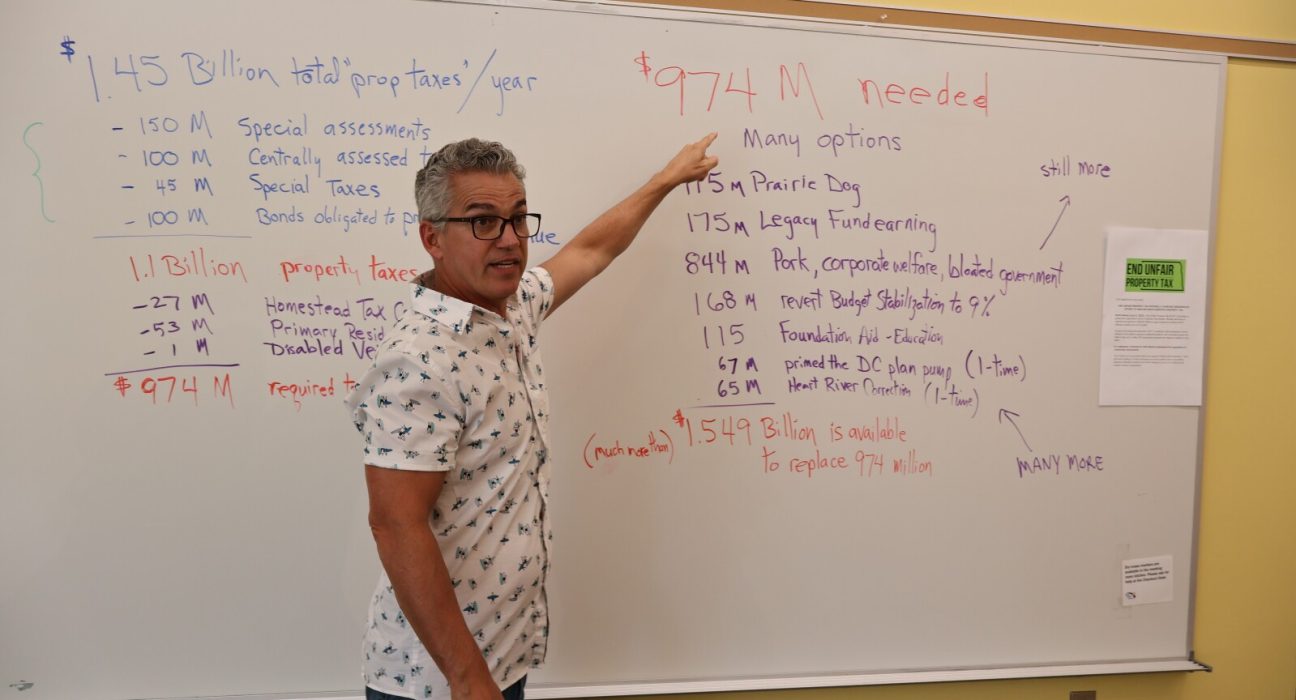

This measure will create a massive hole in local tax revenues. It also obliges state lawmakers to fill that hole with other revenues. Former state Rep. Rick Becker, who is also now a candidate for the U.S. House, has suggested that this could be accomplished by tapping into some of the state’s reserves, such as the Legacy Fund, or by cutting spending.

But lawmakers and locals would have another option Becker isn’t accounting for, which is levying new types of property taxes.