Major Property Tax Reform Under Threat In One State

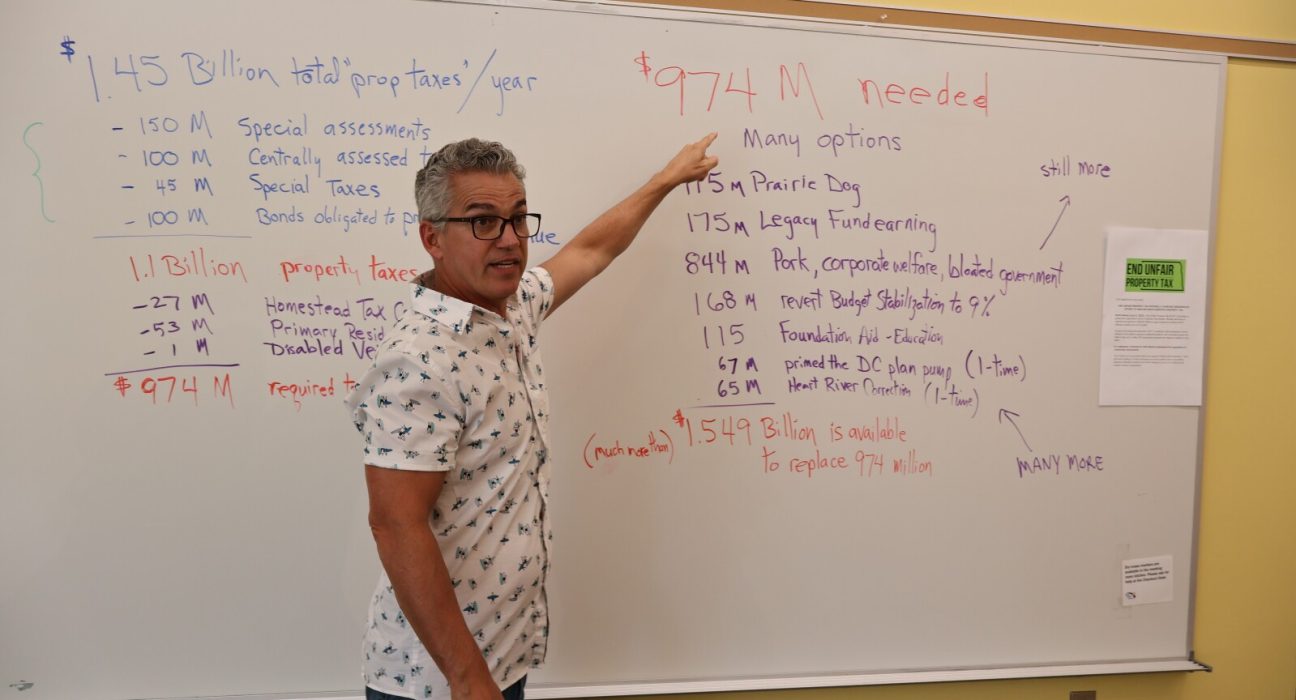

A bill that would significantly reduce property taxes in Nebraska is facing stiff opposition as it faces the last hurdle of the legislative process. Earlier this year, state Governor Jim Pillen called for a 40 percent reduction in property taxes, with Legislative Bill 388 being introduced to the Nebraska legislature on January 12. On Wednesday