Nearly half of American states are becoming negative equity hotspots with as many as one in 20 homeowners going ‘underwater’ on their mortgages, a new study suggests.

Overall US households saw their equity increase by $1.1 trillion in the third quarter of 2023 compared to the same period in 2022, reversing a trend seen at the start of the year. The number of homes in negative equity also fell by 7.7 percent, according to a report by property insights firm CoreLogic.

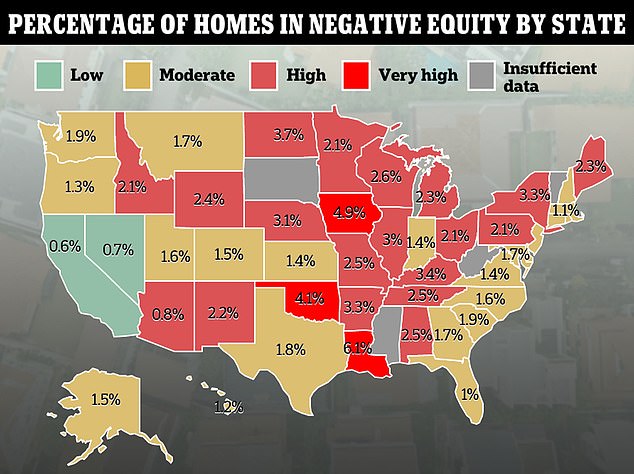

However a disturbing pattern is emerging as 23 states have ‘high’ or ‘very high’ rates of homeowners facing the issue, with those in Louisiana worst-affected.

Negative equity occurs when an individual’s outstanding mortgage balance is more than the value of their home.

In a strong market, properties should appreciate in value over time – meaning borrowers have little risk of falling into negative equity.

However a disturbing pattern is emerging as 23 states have ‘high’ or ‘very high’ rates of homeowners facing the issue, with those in Louisiana worst-affected

However, when prices start to fall and interest rates rise, those with small downpayments are at greatest risk of ‘going underwater.’

Falling into negative equity can make it difficult to sell or refinance a home – leaving many trapped in their property. The issue exploded into a crisis during the 2008 financial crash when house prices plummeted overnight.

According to CoreLogic’s analysis, there are three states that have ‘very high’ proportions of homeowners who risk going underwater.

Louisiana came out on top as 6.1 percent of its mortgage-holding residents are in negative equity. It was followed by Oklahoma and Iowa where 4.1 percent and 4.9 percent of citizens are facing the problem respectively.

A further 20 states were found to have ‘high’ rates of negative equity – meaning more than 2 percent of residents were affected.

Among them are: New Mexico, Alabama, Pennsylvania, New York and Maine.

Despite this, the report largely paints a positive picture of America’s home equity gains.

Between July and September, the average homeowner gained over $20,000 in equity compared to the same period last year.

Homeowners in Hawaii, California and Massachusetts experienced the largest gains, seeing their property values swell by $45,000 or more on average.

The rebound was attributed to the surprising resilience of America’s property market after mortgage rates edged towards 8 percent

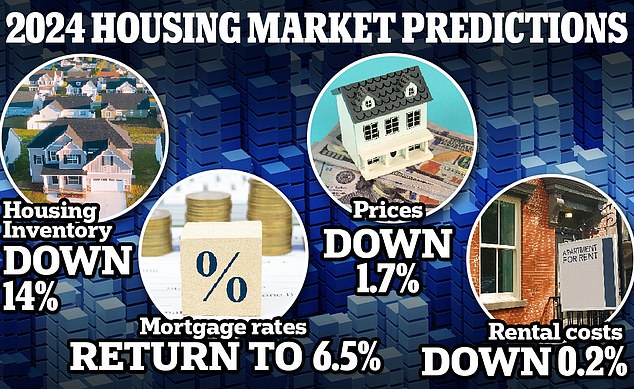

A new report by property portal Realtor.com predicts both prices and mortgages will drop next year – albeit modestly

It marks a stark contrast from the first quarter of the year when the average homeowner had seen their equity plummet by $5,400 compared to the same period the year prior.

The rebound was attributed to the surprising resilience of America’s property market after mortgage rates edged towards 8 percent. They are now hovering at 6.67 percent, according to data from government-backed lender Freddie Mac.

High rates were expected to pour cold water on red-hot prices as most buyers fixed 30-year mortgages when rates were at record-lows. Moving homes would mean adding around $1,000 on average to monthly mortgage payments.

However a lack of available housing inventory has kept prices abnormally high. Data from property portal Redfin shows the average US home sold for $408,732 in November, up 3.7 percent on the same time last year.

Dr Selma Hepp, chief economist for CoreLogic, said: ‘With price gains continuing to help homeowners build wealth, equity has reached a new high and regained losses that resulted from declines last year.

‘And while the average U.S. homeowner gained over $20,000 in additional equity compared with the third quarter of 2022, some markets are seeing larger increases as price growth catches up.’