AN EXPERT financial planner has laid out steps for homebuyers looking to sell, but feeling trapped by low-interest mortgage rates and an abysmal housing market.

Homeowners who bought their homes using low-interest mortgages are now finding themselves trapped in “golden handcuffs” as moving would mean assuming mortgages charging double to triple their current interest rates.

The Wise Money Show, hosted by Korhorn Financial Group, releases a range of videos to help people increase their financial literacy.

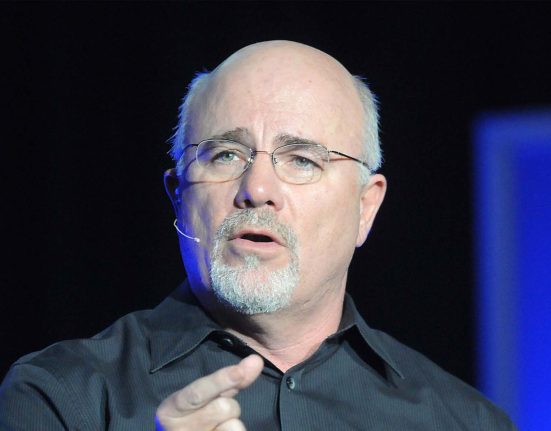

Mike Bernard, one of three financial experts on the show, tackled the issue of selling in today’s market, specifically when regarding feeling stuck by a low-interest mortgage, in a recent video.

“Do you need to move but you’re feeling trapped in your current house because of your low-interest rate and can’t believe that’s the thing it is a thing?” he introduced the video.

He explained some of his clients are facing this very issue; even a coworker is starting to become concerned as his family is looking to upsize to accommodate their growing numbers.

While some might argue that people selling in this market will make more off of their houses; Bernard says that the mortgage rate a person has to face when purchasing a new home could negate any profit from the previous property.

Bernard then explained that the high interest rates, coming in at around 7% rather than the 3% that many currently hold, are stopping individuals from selling.

This, in turn, drives up housing prices because there are so few on the market; compounding the issue so that low-interest rate mortgage holders are facing high house prices and hiked mortgage rates.

He then revealed three tips for handling such a situation.

GET THE FACTS

First, he says that prospective homebuyers need to focus on planning by seriously considering what a new mortgage would cost in interest.

“The first thing that you should do if you if you’re looking, saying, ‘This is not the house that we are able to stay in. We need to move,’ is calculate what your new mortgage,” advises Bernard.

While the financial planner acknowledged that this step might seem like skipping steps, he countered that it prepares buyers for the reality of what a home would cost in total.

He suggests going on the house searching site of the buyer’s choice and using the homes they would be interested in to estimate what a mortgage might ultimately come out to.

“If for example your current house is you know maybe $225,000 and the new house is probably going to be around $325,00 then what would that new mortgage be?” he proposes.

From there, the prospective buyer should subtract the cost of paying off the existing mortgage in full from the proceeds of selling their current house in order to calculate how much money will be left to put down on the house.

Then, subtracting that figure from the new house’s cost gives the buyer an amount to enter into a mortgage calculator to see what it would come out to.

Doing these steps and then exploring different mortgages, with different payment plans, gives buyers more solid information to plan with; which brings Bernard to tip number two.

BUDGET, BUDGET, BUDGET

“Once you’ve done that calculation of well here’s what the new payment would cost, here’s what the new payment would be at this more expensive and higher interest rate. You then open a savings account and build it into your existing budget,” he explained.

He advises that prospective buyers essentially start making that predicted payment into the new savings account to save up for when it becomes a reality.

“Not to your current mortgage because that would be paying extra on a really low interest rate,” he clarified.

You can be nimble if you need to be”

Mike Bernard

“Instead continue to make your normal monthly payment but open up a new bank account called, you know, ‘House Savings’.”

Bernard explained that doing this also starts building that increased payment into a buyer’s lifestyle and budget so that it is not a big shock when it comes to fruition.

“I’m a big believer in in the The Rock analogy famous made famous by Stephen Covey,” explained the financial planner.

“Basically what are your biggest priorities? What are your goals, or financially what are your biggest priorities?” he continued.

“Put those rocks in first and then the other important things will fit in around it and then all the gravel or the sand.”

BE READY TO SELL

The final piece of advice he provides is for homeowners to ensure that their house is ready to buy.

Since the housing market is so variable and subject to change with every piece of fiscal legislation or major historical event, being ready for when the market is optimal to sell is important.

“You can be nimble if you need to be,” Bernard put simply.

This planning can look like completing repairs that have been piling up on the to-do list or even enlisting professionals.

“Even if that means talking to a realtor today to say, ‘Hey can you walk through my house and point out the issues that might not help our house sell very quickly right now and talk through some things that we could do,'” Bernard scripted.

He ensures that this is a service that realtors provide called a market analysis.

Prospective buyer could also contact housing inspectors or other professionals, but that might add up in cost.

Bernard, true to his financial planner title, also suggests enlisting a certified financial planner to help with navigating the housing market as it applies to the buyer’s specific situation.

COMMISSION COSTS

Here’s what Joy Dumandan, Consumer Editor with The U.S. Sun, has to say…

The dream of becoming a homeowner comes at a price.

There are unexpected costs associated with buying a home. It’s best to make sure you save up for the added expenses.

The biggest upfront fees are closing costs.

These are fees you have to pay at your home closing when the title of the property is transferred from the seller to the buyer.

Commission earned varies from state to state.

Pricey payout

A recent $418 million settlement with the National Association of Realtors (NAR) is changing realtor commission fees.

The lawsuit claims the real estate industry conspired to keep agent commissions around 5% to 6% of the home’s price.

The plaintiffs in the lawsuit argued that commission rates advertised on a multiple listing service, (MLS), a database agents use to find homes for clients, allowed realtors to prioritize homes with higher fees.

Home sellers may not have been aware that they could negotiate the compensation for a buyer’s agent, which appears on the MLS, with the listing agent.

NAR admitted no wrongdoing but agreed to change its guidelines to make commission fees more transparent to consumers.

This could result in fees dropping by 1% to 2% for both home buyers and sellers.

Who pays the commission?

The seller pays the total commission at closing, but it’s usually wrapped into the price of the home.

So, for example, if a commission is 6% on a $300,000 home, that would equal $18,000, which is split between the buyer’s and seller’s agents.

A buyer can offer to pay some of the real estate agent fees. This strategy can be used to convince a seller to accept a buyer’s bid.

It’s important to know your rights, which will be spelled out in your real estate agent contract when you sign to hire a realtor.