A HOMEOWNER has been left feeling like a prisoner in her own house after she secured a super-low interest rate.

Historically low interest rates were one of the best things to come out of the pandemic but some homeowners are now experiencing a phenomenon known as the golden handcuffs effect.

Sue Smith, who’s self-employed in the investment industry, refinanced her Nyack, New York, home in April 2022.

She originally applied for the loan in the summer of 2021.

The Empire State homeowner told Fortune it was the “perfect timing” to do a refinance, as she was able to lock in a 15-year fixed rate of 2.25%.

Prior to refinancing, she had a 30-year fixed rate mortgage below 4%.

While she isn’t saving money on monthly mortgage payments with her new rate, she will be able to pay the loan off sooner.

Her $900,000 mortgage payment is about $5,895 per month, not including taxes and insurance.

When asked if she’d consider selling her home as she inches toward retirement, Smith laughed and told the outlet, “No, we’re prisoners.”

“We will never find this rate again,” she added.

Smith explained that even if she sold her house and moved into one half the cost, “we would still be paying more on our mortgage … two-and-a-half to three times more than what we’re paying now.”

It makes her situation complicated as the New York homeowner said she hopes to move when she nears retirement.

However, it doesn’t make sense to sell her home as it’s locked in at such a low rate.

She told Fortune that she’ll consider using it as a rental property instead.

“You’ll never get this interest rate again, we’re not giving that up,” Smith said.

As of today, the average 30-year fixed rate is 6.92%, or more than double what Smith is locked in at, according to Nerdwallet.

Current mortgage rates and predictions

Mortgage rates for all types of mortgages are continuing to incrementally increase, according to the latest data shared by Forbes.

As of April 26, the average rate for a 30-year fixed mortgage increased to 7.75% from 7.65% on April 25.

The current average rate for this mortgage in April is 7.71%.

However, economists have predicted that over the year, mortgage rates will fall.

But, before homeowners and buyers breathe a sigh of relief, the drop is not expected to be dramatic.

“The Federal Reserve has indicated that there will likely be cuts to the short-term federal funds rate in 2024, which will put downward pressure on mortgage rates,” Bright MLS chief economist Dr. Lisa Sturtevant said.

“Overall, though, rates are expected to remain above 6% throughout [2024].”

Meanwhile, First American deputy chief economist Odeta Kushi said there will be “modest declines in mortgage rates” and the “journey towards [lower mortgage rates] might be slow and bumpy.

The 15-year fixed rate is currently 6.09%.

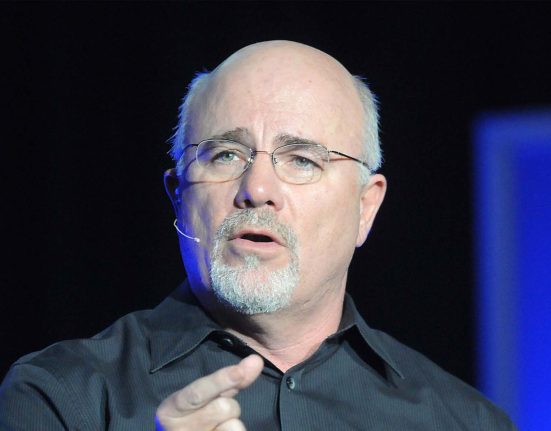

Redfind’s chief economist, Daryl Fairweather, told Fortune high interest rates are having a negative impact on the real estate market.

“High interest rates are constricting both buying, obviously because people can’t afford these higher mortgage rates, and selling because homeowners want to hold on to their low interest rates,” said Fairweather.

“There are fewer buyers and there are also fewer sellers, but the decline in buyers is what’s dragging down prices and the combination is what’s contributing to the decline in sales.”

Smith isn’t alone in her struggles.

John Dealbreuin, from San Francisco, California, said he retired at age 44 and a change in his family plans made him reevaluate his home.

He wanted his 78-year-old and 83-year-old parents to move from India and come live with him, he told The Wall Street Journal, but needed a bigger house to make it happen.

His 3.3.% rate was significantly lower than the current average rate.

Unlike other homeowners facing so-called golden handcuffs, Dealbreuin found a workaround that let him keep his home and low mortgage rate.

He built a 300-square-foot tiny home in his garden for his parents to live in but admitted that he would’ve preferred that they stay inside his own house.