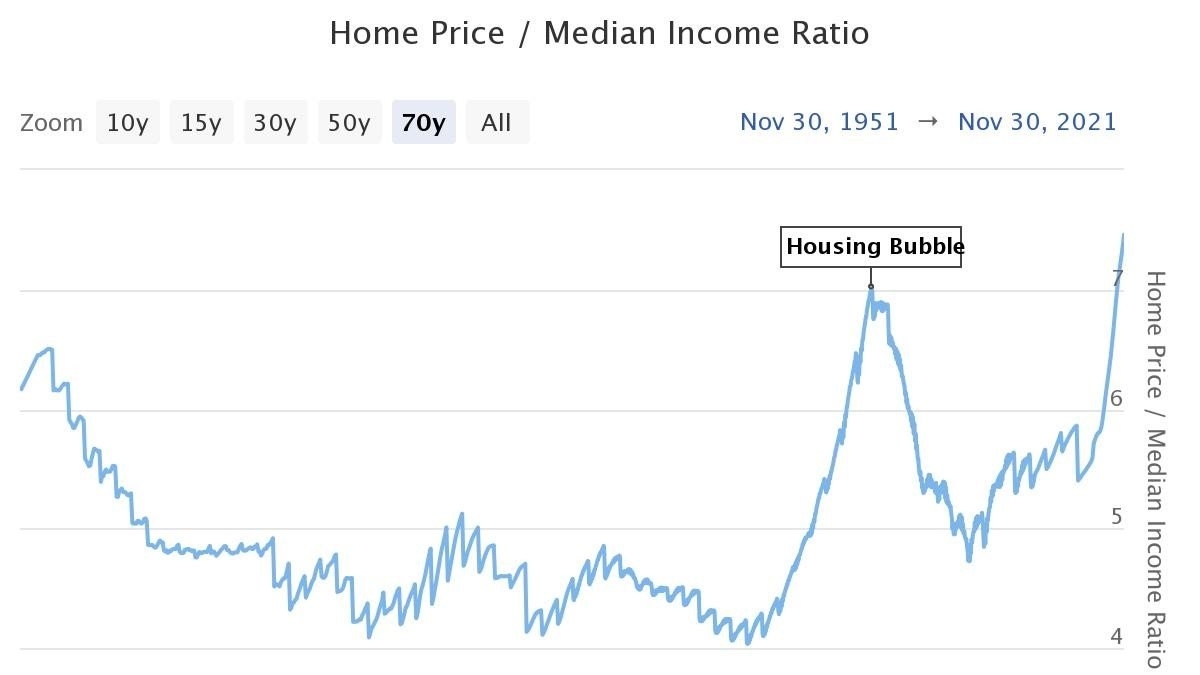

Global Real Estate Markets Face Uncertainty Amid Rising Home Prices and Mortgage Rates

Global Real Estate Markets Face Uncertainty Amid Rising Home Prices and Mortgage Rates In a shift from the norm, American homeownership is seeming increasingly elusive to a larger demographic. The pandemic’s financial pressures, coupled with an influx in home prices, have caused many aspiring homeowners to deem the dream unrealistic. Despite the surge in home