The Fading American Dream: Soaring Home Prices and Mortgage Rates Put Homeownership Out of Reach

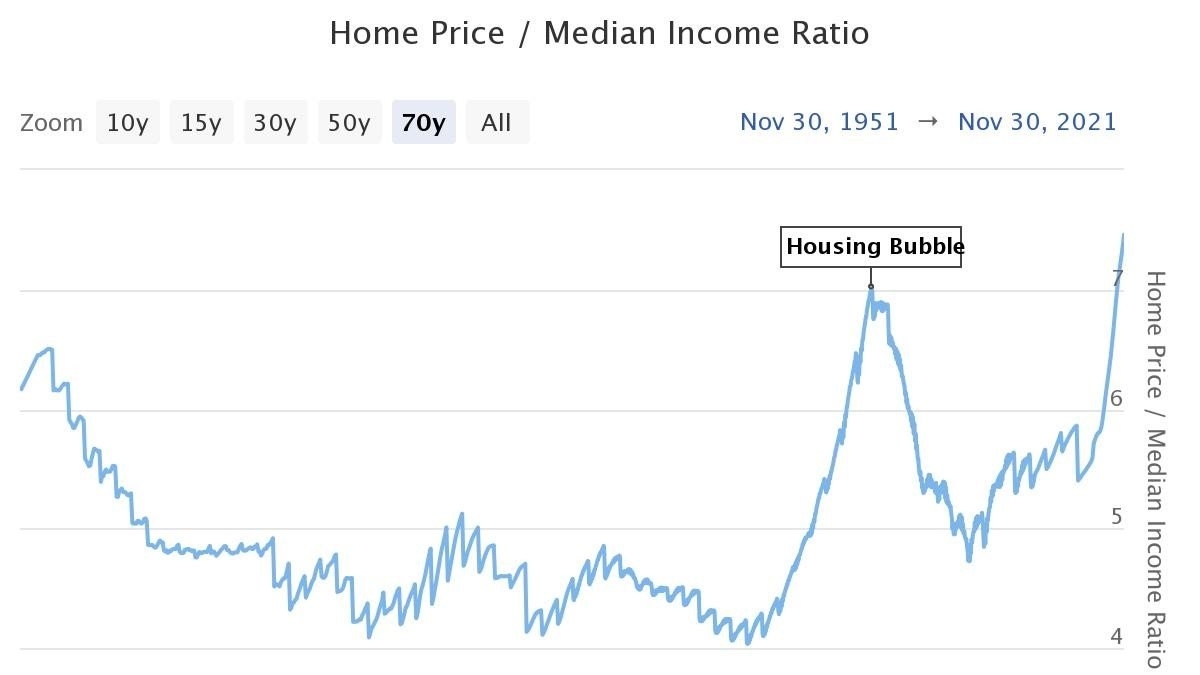

The American dream of homeownership is increasingly becoming a distant reverie for a growing number of citizens, a situation exacerbated by the ongoing pandemic. Despite a minor relief provided by low mortgage rates during the pandemic, the recent rise in these rates, coupled with soaring home prices, has effectively rendered the dream of owning a home a financial impossibility for many. The shift in affordability is largely due to the rapid inflation of home prices in conjunction with high mortgage rates, making home purchases economically unviable for a significant portion of the population.

The Current Mortgage Landscape

The national averages of 30-year and 15-year fixed mortgage APRs currently sit at 7.00% and 6.34% respectively. There was a slight drop in the average rate on 30-year mortgages to 6.88% from 7.21%, triggered by a downtrend in 10-year Treasury yields. The Federal Reserve has hinted at a possible rate cut in 2024, a prospect that has had a positive impact on mortgage rates.

Effects on the Real Estate Market

The current real estate market in Westchester County, New York, for instance, is experiencing a buyer’s market. This is due to a higher supply of homes for sale compared to the number of active buyers. However, the high interest rates are a significant barrier, deterring potential buyers despite the abundance of properties. The HARP 2 program, which allows underwater homeowners to refinance their mortgage at more favorable terms, is one of the strategies being employed to alleviate this situation.

Future Predictions

Mortgage interest rates are anticipated to continue their downward trajectory, with rates projected to drop by 1.18 percentage points in nine weeks. While the Federal Reserve suggests potential rate cuts in 2024, significant improvements in affordability aren’t expected until the second half of the year. This, coupled with a persisting low housing supply driving up home prices, means that home shoppers are unlikely to experience substantially better affordability in the immediate future. On the brighter side, cooling inflation and the end of the Fed’s current rate hiking cycle should help bring mortgage rates down in the long run.

In 2024, experts predict that the housing market will continue to feel the pinch from elevated mortgage rates and the wider cost-of-living squeeze. However, potential interest rate cuts and lower house prices in some locations may present new opportunities for house hunters.