Global Real Estate Markets Face Uncertainty Amid Rising Home Prices and Mortgage Rates

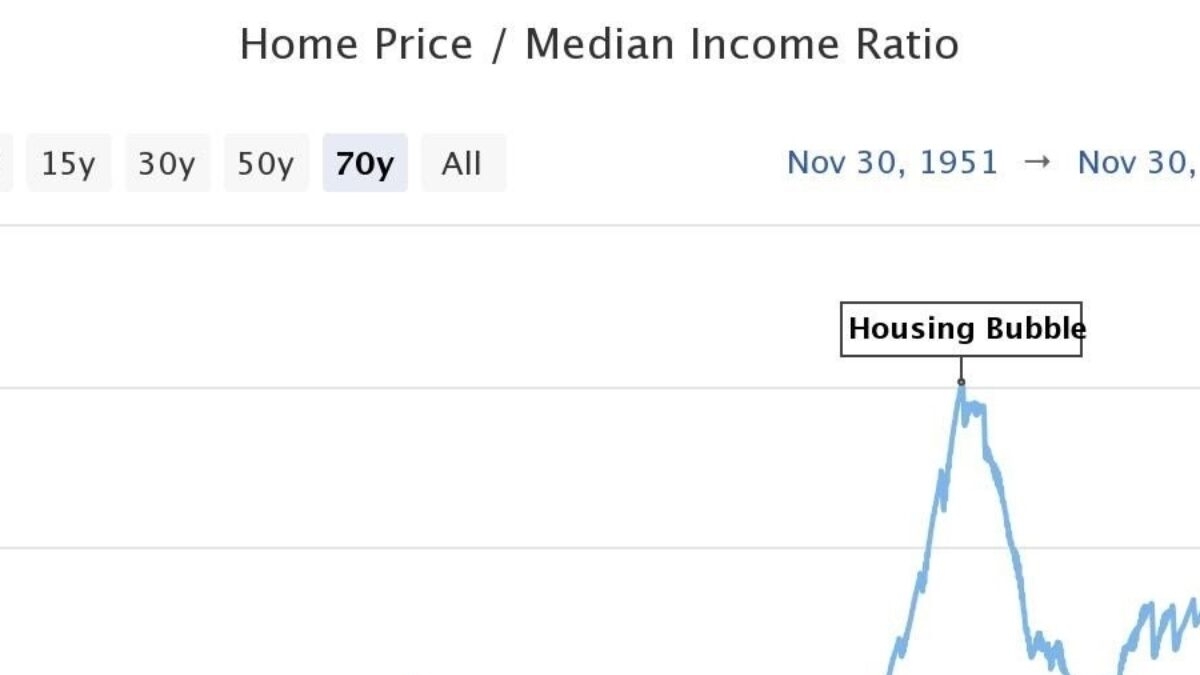

In a shift from the norm, American homeownership is seeming increasingly elusive to a larger demographic. The pandemic’s financial pressures, coupled with an influx in home prices, have caused many aspiring homeowners to deem the dream unrealistic. Despite the surge in home prices, low mortgage rates provided a glimmer of hope. However, with mortgage rates now on the rise, the financial burden has increased, leaving many to forego their homeownership ambitions. The combination of inflated home prices and elevated mortgage rates have constructed an insurmountable barrier, pushing the dream of homeownership further out of reach for those who could have afforded a home just a few years prior.

Australian Real Estate Market Faces Uncertainty

Meanwhile, the Australian real estate market is grappling with uncertainty in 2024. The market made an unexpected rebound in 2023, despite the Reserve Bank’s interest rate hikes. Unexpectedly, net migration grew, adding to the demand. However, factors such as escalating cost-of-living pressures, affordability challenges, poor consumer sentiment, and an increase in housing stock levels are anticipated to spill into 2024, potentially posing a downside risk for housing values. The government’s mid-year economic report predicted a decrease in net migration, which could impact the rental market.

Canadian Housing Market Faces Interest Rate Complications

In Canada, increasing interest rates have complicated the housing market. Many homeowners are facing potential financial shock during mortgage renewals. Banking regulators have raised concerns about extended amortization periods and the impact on borrowers, with potential risks of defaults and foreclosures. Financial institutions are working with borrowers to find solutions and prevent potential financial crises. The Bank of Canada is closely monitoring the situation and collaborating with banks to address potential repercussions. The future trajectory of interest rates will significantly impact the stability of the housing market, with potential consequences on consumer spending, housing affordability, and overall economic growth.

China’s Property Market Experiences Surges

China’s property market has experienced significant growth in recent years, with prices leaping 25% in 2009 alone. The central government responded with austerity measures, including lending curbs, higher mortgage rates, and restrictions on the number of homes each family can buy. Several of China’s major property developers have been delaying payments to small private suppliers or contractors. Distressed Chinese developer Powerlong Real Estate Holdings unveiled preliminary terms of a restructuring agreement with certain creditors. Three out of China’s four tier-1 cities saw new-home prices fall in November, with only Shanghai showing an increase. ‘Beijing’s policy change around home purchases has important implications for the whole country,’ said a senior Fitch Bohua analyst.