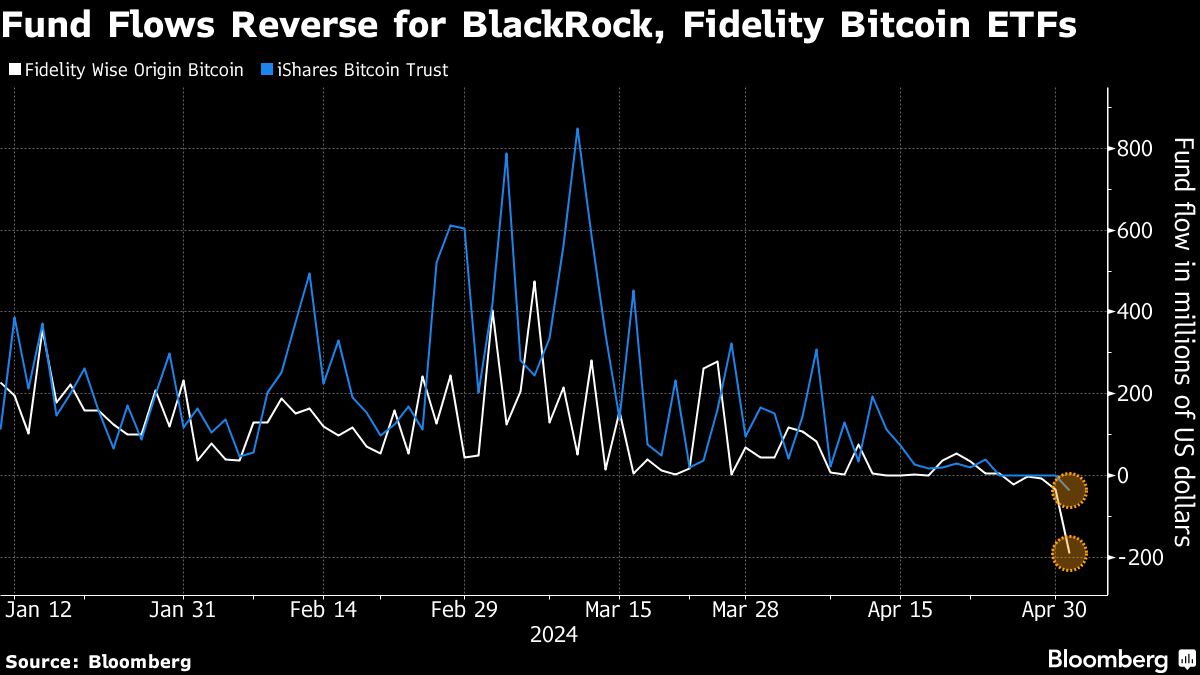

Record Bitcoin-ETF Outflow Buffets BlackRock, Fidelity Funds

(Bloomberg) — US spot-Bitcoin exchange-traded funds suffered their largest daily outflow as the digital token heads for its worst week since August 2023. Most Read from Bloomberg Investors pulled a net $564 million from the batch of almost a dozen funds on Wednesday, the biggest drawdown since the products debuted in January. The prospect of