Sumitomo Mitsui Trust Holdings Inc. lessened its holdings in shares of Camden Property Trust (NYSE:CPT – Free Report) by 16.6% during the 4th quarter, HoldingsChannel reports. The firm owned 319,098 shares of the real estate investment trust’s stock after selling 63,427 shares during the period. Sumitomo Mitsui Trust Holdings Inc.’s holdings in Camden Property Trust were worth $31,683,000 at the end of the most recent reporting period.

Sumitomo Mitsui Trust Holdings Inc. lessened its holdings in shares of Camden Property Trust (NYSE:CPT – Free Report) by 16.6% during the 4th quarter, HoldingsChannel reports. The firm owned 319,098 shares of the real estate investment trust’s stock after selling 63,427 shares during the period. Sumitomo Mitsui Trust Holdings Inc.’s holdings in Camden Property Trust were worth $31,683,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds also recently added to or reduced their stakes in CPT. Raymond James Financial Services Advisors Inc. boosted its stake in Camden Property Trust by 9.6% during the 1st quarter. Raymond James Financial Services Advisors Inc. now owns 2,365 shares of the real estate investment trust’s stock worth $393,000 after purchasing an additional 207 shares during the last quarter. Cambridge Investment Research Advisors Inc. purchased a new position in Camden Property Trust during the first quarter worth about $961,000. Natixis Advisors L.P. boosted its stake in Camden Property Trust by 14.3% during the first quarter. Natixis Advisors L.P. now owns 11,555 shares of the real estate investment trust’s stock worth $1,920,000 after buying an additional 1,450 shares during the period. Prudential PLC acquired a new stake in shares of Camden Property Trust during the first quarter worth about $421,000. Finally, Cetera Investment Advisers lifted its position in shares of Camden Property Trust by 17.2% during the first quarter. Cetera Investment Advisers now owns 1,680 shares of the real estate investment trust’s stock worth $279,000 after purchasing an additional 246 shares in the last quarter. Institutional investors and hedge funds own 97.22% of the company’s stock.

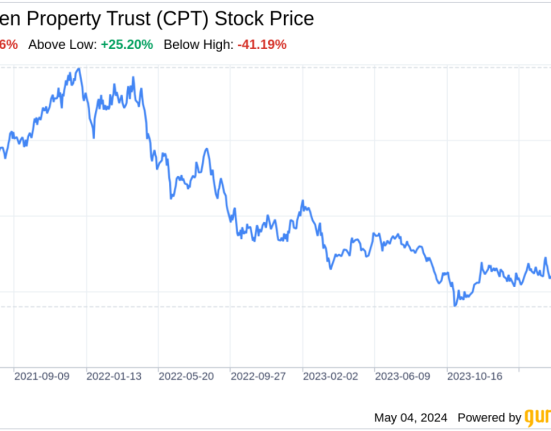

Camden Property Trust Stock Performance

Shares of CPT opened at $96.29 on Friday. The company has a current ratio of 0.88, a quick ratio of 0.88 and a debt-to-equity ratio of 0.74. The firm has a market cap of $10.48 billion, a PE ratio of 26.02, a price-to-earnings-growth ratio of 3.58 and a beta of 0.83. The company’s 50 day simple moving average is $96.92 and its 200-day simple moving average is $95.07. Camden Property Trust has a 12-month low of $82.81 and a 12-month high of $114.04.

Camden Property Trust (NYSE:CPT – Get Free Report) last posted its quarterly earnings data on Friday, February 2nd. The real estate investment trust reported $2.03 earnings per share for the quarter, beating analysts’ consensus estimates of $1.72 by $0.31. Camden Property Trust had a net margin of 26.15% and a return on equity of 8.07%. The firm had revenue of $387.59 million for the quarter, compared to analyst estimates of $387.33 million. During the same period last year, the firm posted $1.74 EPS. Camden Property Trust’s quarterly revenue was up 3.1% on a year-over-year basis. As a group, equities analysts predict that Camden Property Trust will post 6.72 EPS for the current year.

Camden Property Trust Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, April 17th. Investors of record on Friday, March 29th were given a $1.03 dividend. This represents a $4.12 dividend on an annualized basis and a yield of 4.28%. This is a positive change from Camden Property Trust’s previous quarterly dividend of $1.00. The ex-dividend date of this dividend was Wednesday, March 27th. Camden Property Trust’s dividend payout ratio (DPR) is 111.35%.

Analyst Ratings Changes

CPT has been the topic of several research reports. Morgan Stanley increased their price target on shares of Camden Property Trust from $95.00 to $98.00 and gave the stock an “equal weight” rating in a research report on Monday, February 26th. StockNews.com cut shares of Camden Property Trust from a “hold” rating to a “sell” rating in a report on Thursday, April 4th. Piper Sandler reiterated an “underweight” rating and issued a $90.00 price target on shares of Camden Property Trust in a research note on Tuesday, March 26th. The Goldman Sachs Group started coverage on shares of Camden Property Trust in a research note on Thursday, February 22nd. They issued a “buy” rating and a $112.00 price target on the stock. Finally, Truist Financial increased their price target on shares of Camden Property Trust from $113.00 to $114.00 and gave the company a “buy” rating in a research note on Tuesday, April 9th. Four analysts have rated the stock with a sell rating, eight have given a hold rating and six have given a buy rating to the company’s stock. Based on data from MarketBeat.com, Camden Property Trust has an average rating of “Hold” and an average price target of $104.29.

Check Out Our Latest Stock Analysis on CPT

Camden Property Trust Profile

Camden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,634 apartment homes across the United States.

See Also

Want to see what other hedge funds are holding CPT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Camden Property Trust (NYSE:CPT – Free Report).

Receive News & Ratings for Camden Property Trust Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Camden Property Trust and related companies with MarketBeat.com’s FREE daily email newsletter.