-

Robust growth in net income, showcasing a strong financial performance.

-

Strategic property sales contributing to significant gains.

-

Continued focus on high-growth markets for expansion and development.

-

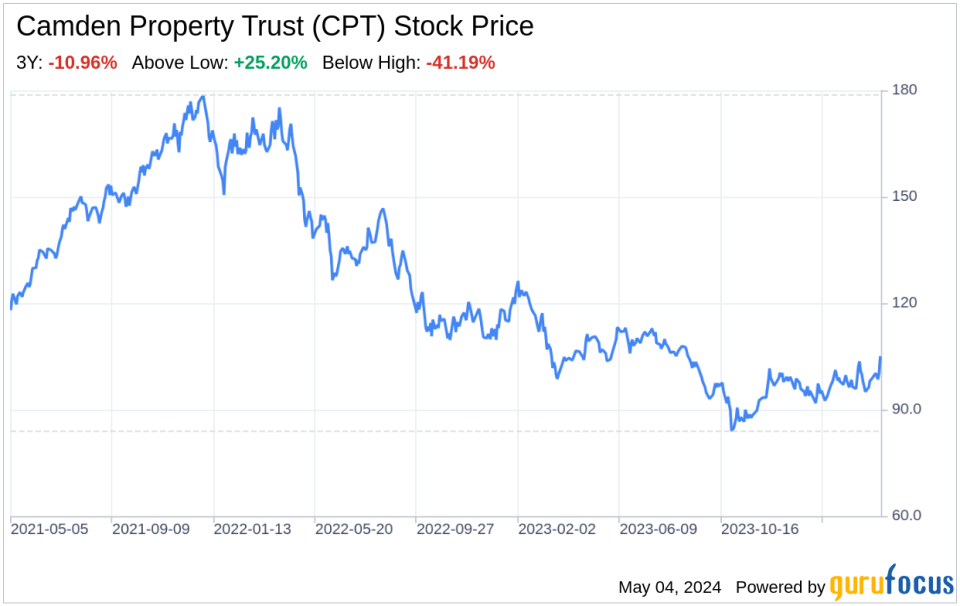

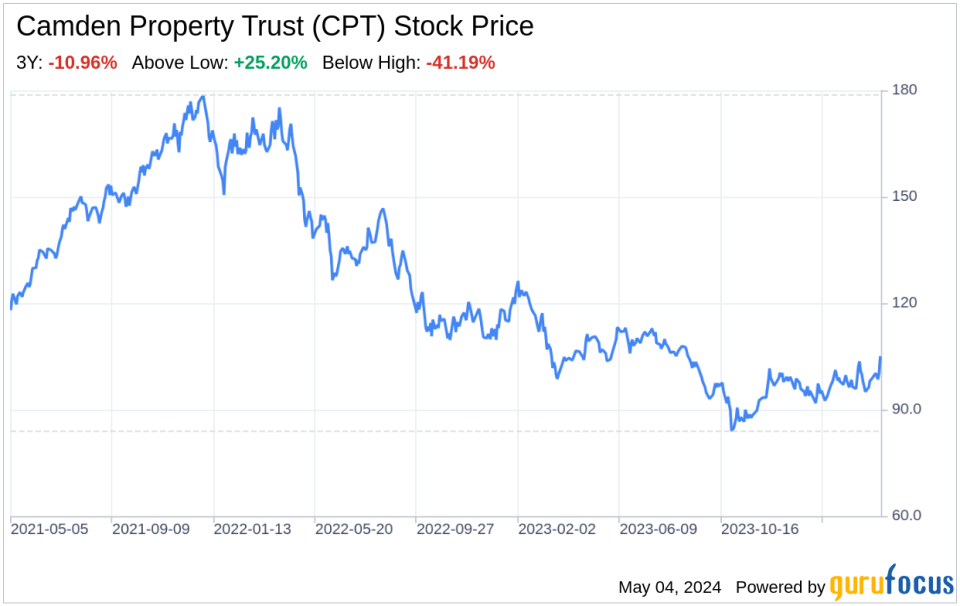

Legal and market risks present potential challenges to stability.

Camden Property Trust (NYSE:CPT), a real estate investment trust specializing in multifamily apartment communities, has recently filed its 10-Q report on May 3, 2024. This SWOT analysis delves into the company’s financial health and strategic positioning based on the latest financial data. The first quarter of 2024 has been financially promising for CPT, with property revenues increasing to $383.1 million from $378.2 million in the previous year. Net income saw a remarkable surge to $85.8 million, up from $43.6 million, partly due to a substantial gain on the sale of an operating property. The company’s earnings per share doubled, reflecting a solid operational performance and strategic asset management. With a focus on high-growth markets and a robust development pipeline, CPT is poised for continued expansion. However, the company must navigate legal challenges and market risks that could impact its trajectory.

Strengths

Financial Resilience and Profitability: Camden Property Trust’s financial performance in the first quarter of 2024 underscores its resilience and profitability. The company’s net income nearly doubled to $85.8 million, compared to $43.6 million in the same period last year. This increase is a testament to CPT’s effective property management and strategic sales, including the gain of approximately $43.8 million from the sale of an Atlanta property. The company’s earnings per share also reflected this growth, rising from $0.39 to $0.77. This financial strength provides CPT with the capital necessary to pursue further development and acquisitions, reinforcing its market position.

Strategic Asset Optimization: CPT’s strategic disposition of assets, as evidenced by the profitable sale of an Atlanta property, indicates a keen ability to optimize its real estate portfolio. This transaction not only contributed to a significant gain but also demonstrates CPT’s agility in capitalizing on favorable market conditions. The company’s approach to selective dispositions and reinvestment in high-growth markets is a critical strength that enables it to maintain a competitive edge and ensure long-term value creation for shareholders.

Weaknesses

Dependence on Select Markets: While CPT benefits from a strong presence in high-growth areas, its revenue concentration in markets like Washington D.C., Los Angeles, Houston, Atlanta, and southeastern Florida could pose risks. Economic downturns or adverse developments in these regions could disproportionately affect the company’s financial performance. Diversification across a broader range of markets could mitigate this vulnerability and provide a more stable revenue stream.

Legal Risks and Litigation: CPT faces legal risks, including ongoing antitrust lawsuits alleging collusion to fix rents using revenue management software. Although CPT believes these lawsuits are without merit, the potential for adverse outcomes could lead to financial and reputational damage. The costs associated with defending these actions and any resulting penalties could impact the company’s profitability and distract from its core business operations.

Opportunities

Market Demand and Development Potential: CPT operates in markets with favorable demographics and a high propensity to rent, which drives demand for multifamily housing. The company’s development pipeline, including four properties under construction, positions it to capitalize on this demand. With an estimated $97.4 million in additional construction costs, CPT has the opportunity to expand its portfolio and enhance its revenue-generating capabilities.

Financial Flexibility for Growth: The company’s strong balance sheet and access to capital provide the financial flexibility to pursue growth initiatives. With no outstanding amounts and approximately $1.2 billion available under its unsecured revolving credit facility, CPT is well-positioned to fund new developments and acquisitions. The ability to draw on various financing sources, including debt and equity offerings, supports CPT’s strategic objectives and potential market expansion.

Threats

Elevated Supply and Competitive Pressures: The multifamily housing market is experiencing elevated levels of new supply, which could lead to increased competition and pressure on rental rates. While CPT expects demand to absorb these new deliveries, any shift in market dynamics could adversely affect occupancy rates and revenue. The company must continue to differentiate its offerings and maintain high occupancy to mitigate the impact of competitive pressures.

Economic and Market Volatility: CPT’s operations are susceptible to economic fluctuations and market volatility, which can influence job growth, consumer behavior, and the overall demand for rental housing. Macroeconomic factors such as interest rate changes, inflation, and shifts in housing preferences can affect the company’s financial performance. Proactive management and strategic planning are essential to navigate these uncertainties and maintain financial stability.

In conclusion, Camden Property Trust (NYSE:CPT) exhibits a robust financial foundation and strategic acumen in optimizing its asset portfolio, as reflected in its latest 10-Q filing. The company’s strengths in profitability and market positioning are counterbalanced by its regional concentration and legal challenges. Opportunities for growth through development and financial flexibility are promising, yet CPT must remain vigilant against competitive pressures and economic volatility. By leveraging its strengths and addressing its weaknesses, CPT can capitalize on opportunities and defend against threats, ensuring its continued success in the dynamic real estate market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.