The housing market began 2024 in the doldrums as housing starts and permits for new construction both fell, the Census Bureau reported on Friday.

Starts fell 14.8%, way more than the flat reading expected by economists. Permits fell 1.5%, in line with estimates.

“A home building revival is coming, but it didn’t arrive in January,” said Robert Frick, corporate economist at Navy Federal Credit Union. “High mortgage rates, with maybe a dash of cold weather, caused starts and permits to fall from December. We know that builders are ready to ramp up when rates fall, which could be as soon as spring.”

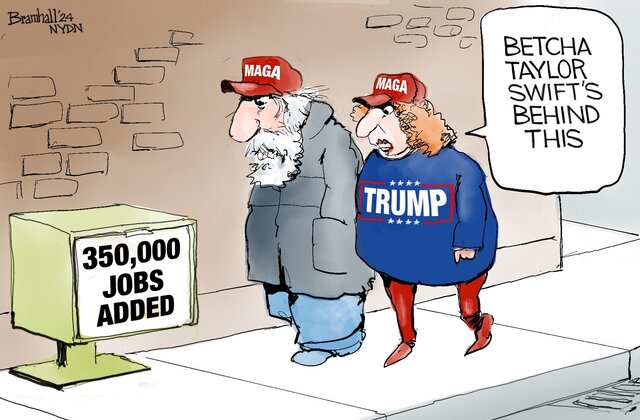

The Best Cartoons on the Economy

Although the housing market is grappling with elevated mortgage rates, bad weather in many parts of the country in the first month of the year looks to have been the biggest reason for the sharp decline in activity.

“The biggest declines in January were in the regions that were hit by the biggest winter storms,” said Bright MLS Chief Economist Lisa Sturtevant. “In the Northeast, new starts were down 20.6% month to month, while starts fell by 30% in the Midwest.”

Compared to a year ago, permits are up 8.6% while starts are a modestly higher by 0.7%.

“The outlook for the single-family new home market is positive, but challenges remain,” said First American economist Ksenia Potapov. “Potential homebuyers are sensitive to mortgage rate fluctuations while builders continue to face headwinds such as higher construction costs and shortages of buildable lots and skilled labor.”

“But builders continue to benefit from a lack of resale inventory,” she added. “They also have the ability to offer incentives such as mortgage rate buydowns or even price cuts to entice buyers. When there are no suitable existing-homes for sales, a new home at the right price can be a good alternative.”

The National Federation of Independent Business small business optimism index released earlier this week fell two points in January to 89.9, marking the 25th consecutive month below the 50-year average of 98. The percentage of business owners who expect real sales to be higher declined 12 points from December to a negative 16%, a sharply negative shift.

“Small business owners continue to make appropriate business adjustments in response to the ongoing economic challenges they’re facing,” said NFIB Chief Economist Bill Dunkelberg. “In January, optimism among small business owners dropped as inflation remains a key obstacle on Main Street.”

However, a survey from American Express on Thursday found that businesses are feeling optimistic going into 2024, with 85% of small businesses saying they are satisfied with the success of their business and 86% saying they achieved their 2023 business goals.

The optimism is a turnaround from August 2023, when 80% of small businesses surveyed said their long-term financial confidence was being negatively affected by the economy. Some 50% of small business owners said they were planning to expand in 2024.

“Even in uncertain economic conditions, small businesses continue to demonstrate resiliency and dedication,” said Gina Taylor, executive vice president and general manager, small business products and business blueprint at American Express. “Our latest data shows small businesses see a positive 2024 ahead and they’re taking steps, including hiring, and implementing new tools, in order to stay proactive and competitive.”