The head of the Biden administration’s federal student aid office is stepping down from his post, the Education Department announced Friday – a move that comes amid ongoing chaos over glitches in the federal student aid application process that have prevented hundreds of thousands of students from filling out the critical form.

Richard Cordray has been the chief operating officer of the department’s Office of Federal Student Aid since 2021, a three-year tenure during which the administration sought monumental restructuring of student loan repayment programs and set out on a mission to provide sweeping debt cancellation.

“We are grateful for Rich Cordray’s three years of service, in which he accomplished more transformational changes to the student aid system than any of his predecessors,” Education Secretary Miguel Cardona said in a statement that did not mention the federal aid application snafu.

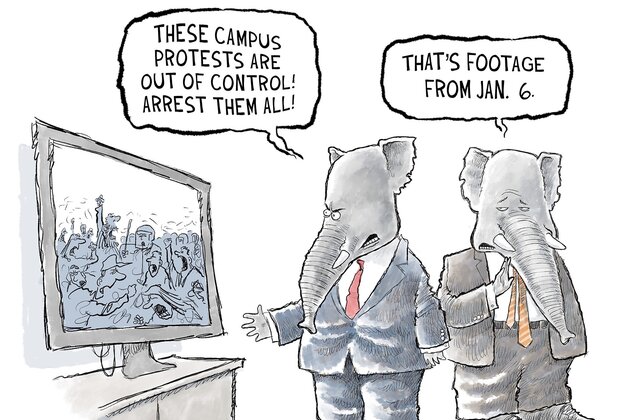

The Best Cartoons on Education

Instead, Cardona focused on what he called a “consequential tenure” that included overseeing major structural changes to federal student loan repayment plans, which resulted in billions of dollars in debt relief for millions of borrowers, as well as the design and implementation of a new, income-driven repayment system.

“It’s no exaggeration to say that Rich helped change millions of lives for the better,” Cardona said.

As it stands, the Biden administration has canceled $144 billion for 4 million loan borrowers. Its newest cancellation plan would wipe out billions more for as many as 30 million borrowers, including 23 million who will have all of their interest canceled if their balance is more than it was when they started paying back their loans.

Yet for all the department’s efforts on loan cancellation, it’s now facing a crisis that stands to undercut those successes. Every year more than 17 million students fill out a Free Application for Federal Student Aid, the gateway to securing federal loans to enroll in college.

For decades the form has been a bipartisan punching bag for how complicated it is to complete. The administration oversaw a relaunch aimed at streamlining the process, winnowing down questions from more than 100 to just 30, among other changes. But the rollout occurred later than expected and was rampant with technical glitches that sometimes prevented students from submitting the application and sometimes shut them out altogether. The system was also hampered by student aid index calculation errors and incorrect tax data provided by the IRS.

Additionally, U.S.-born students whose parents are in the country illegally and lack a Social Security number have struggled to complete the form, which until March wouldn’t allow their parents to fill it out at all. In a separate problem, parents in the country illegally are unable to pull in tax data from the IRS, requiring them to manually enter the information.

Combined, the issues have caused FAFSA completion rates to plunge: Just 33% of the high school class of 2024 has completed the aid form – a 29% drop compared to this time last academic year, according to the National College Attainment Network.

The network estimates as many as 700,000 fewer high school seniors might submit a FAFSA compared to last year, which would translate to a 4% drop in college enrollment – the biggest drop since the COVID-19 pandemic. And it’s an issue that’s impacting low-income families and first generation students.

Cordray, the former head of the Consumer Financial Protection Bureau, will continue on at the federal aid office in his role as Chief Operating Officer until June in order to see through to completion “key priorities” – likely the resolution of the FAFSA debacle.