The country’s banking sector throughout 2023 faced a series of serious crises, including a dollar shortage, depreciating local currency, loan irregularities and liquidity crisis.

Economists and experts observed that due to the soaring level of bad loans, preferential treatment for loan defaulters, widespread irregularities and lack of good governance, the banking sector appeared to be overseen by a regulator lacking effective authority.

The volume of non-performing loans in Bangladesh’s banking sector soared to Tk 1,55,397 crore by the end of September from Tk 1,20,656 crore at the end of December 2022 and Tk 88,734 crore in December 2020.

The total distressed assets in the country’s banking sector reached Tk 3,77,922 crore, excluding loans that were unclassified by court orders, according to the central bank’s Financial Stability Report, 2022.

Despite criticisms from different corners, the central bank relaxed loan classification and rescheduling rules, which, along with a culture of impunity, allegedly encouraged fraudulent activities, leading to a substantial increase in non-performing loans in the banking sector.

Anonymous loans from several private commercial banks and Shariah-based banks were discussed throughout the year.

Recently, the National Bank board has been reformed by the Bangladesh Bank due to an extreme deterioration of governance and financial conditions in the bank.

Several banks, especially Shariah-based banks, were facing severe liquidity shortages, and the banks were being kept afloat by providing loans without collateral.

Mustafizur Rahman, executive director of the Centre for Policy Dialogue, emphasised that the banking sector, as the heart of the country’s economic activities, should be given top priority.

However, the sector faced challenges throughout the year, including high defaulted loans, a liquidity crisis, inflationary pressures and governance issues, which were indicative of the country’s ongoing economic crisis.

It was observed that many individuals did not repay bank loans and siphoned off significant amounts of money, but there was a weak response to stop these practices.

Mustafizur stressed the importance of the Bangladesh Bank being able to make decisions independently, in line with the authority granted to it.

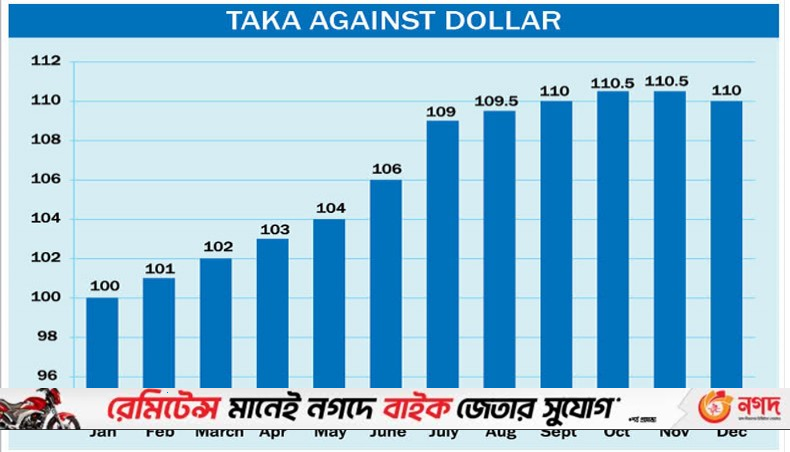

To add to the grim situation, the country’s economy faced significant challenges due to a dollar crisis in the financial market that began in mid-2022 and intensified in 2023, leading to a continued rise in the value of the US dollar.

Experts attributed the crisis to substantial import payments, low foreign direct investments, reduced remittances and export earnings, and increasing US interest rates.

The situation became so severe that many banks stopped opening letters of credit for imports, prompting the government to seek a loan from the International Monetary Fund.

Bangladesh›s gross foreign exchange reserve, as per International Monetary Fund guidelines, decreased to $21.44 billion on December 27 after the central bank increased dollar sales to meet market demand.

Over the past 29 months, the central bank sold approximately $27 billion from its foreign exchange reserve.

The limited availability of dollars has caused the value of local currency taka to depreciate, which makes it harder for businesses and individuals to plan and price their transactions effectively.

The current dollar shortage has already forced the government to secure $4.7 billion in loans from the International Monetary Fund over a period of three years.

To address the crisis, several banks are now charging as much as Tk 124 for remittance collection, despite the rate being set at Tk 110 by the Association of Bankers, Bangladesh and the Bangladesh Foreign Exchange Dealers’ Association.

Bangladesh’s external debts dropped slightly to $96.54 billion at the end of September.

On June 18, the central bank announced the adoption of a new interest rate regime in Bangladesh, removing the previously imposed 9 per cent lending rate ceiling.

To control inflation and regulate the overall interest rate environment, the BB raised repurchase agreement (repo) rate for several times, which now stands at 7.75 per cent.