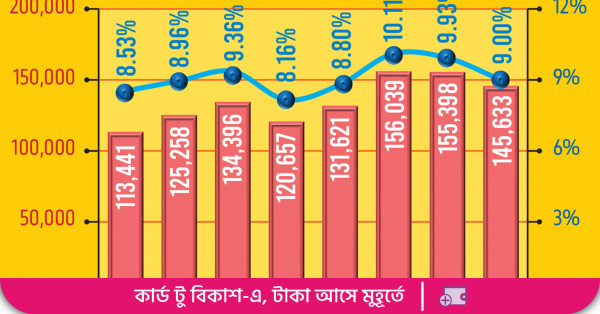

Default loans surge by Tk25,000cr, standing at Tk1.45 lakh crore in December, accounting for 9% of the total loans

The country’s banking sector experienced a steep rise in default loans by Tk25,000 crore in 2023 amid election-centric political uncertainties and a severe dollar shortage that slowed down business activities, making many borrowers unable to continue debt servicing.

At the end of December last year, the total default loan in the banking sector stood at Tk1.45 lakh crore, accounting for 9% of the total loans that stood at Tk16.17 lakh crore, according to Bangladesh Bank data.

In December 2022, the default loans had increased by Tk17,300 crore to Tk1.20 lakh crore, representing 8.16% of the total loans.

Default loans in the October-December quarter, however, declined by nearly Tk10,000 crore, breaking the rising trend as banks geared up their recovery drives to show a healthier balance sheet at year end.

The amount of default loans surged to a record high of Tk1.56 lakh crore in June last year, but it had begun to decline slowly since September.

Banks are now sceptical about the continuation of the declining trend as the implementation of the new default loan roadmap is assumed to increase fresh bad loans by Tk80,000 crore.

This is because the Bangladesh Bank, in its new roadmap unveiled to reduce default loans, hinted at cutting down on overdue time periods in line with international best practices.

The central bank is working to decrease the overdue time to three months from the existing nine months.

At present, if a term loan is not repaid within the fixed expiry date, the unpaid amount is treated as overdue after 180 days, and the loan will be categorised as “substandard” after 90 days of overdue.

The Bangladesh Bank recently unveiled its roadmap aimed at reducing default loans to 8% by June 2026 to comply with a condition imposed by the International Monetary Fund (IMF) as part of a $4.7 billion loan package.

Under this roadmap, the central bank has eased the loan write-off policy, empowering banks to expedite the process within a two-year timeframe instead of the previous three years. This policy adjustment is anticipated to contribute to a significant reduction of default loans by Tk43,300 crore, equivalent to 2.76% by 30 June 2026.

However, the decline in default loans through write-offs depends on the capacity of banks, as they will have to maintain 100% provision for written-off loans, which will have a huge impact on their profitability.

Considering that all banks collectively need to write off Tk43,300 crore in loans, it will take three years to achieve 100% provision based on current profits. If banks opt to allocate 50% of their profits, the timeline extends to six years, while a 25% profit allocation would extend the period to 12 years.

Additionally, some banks already maintain provisions for NPLs, with certain institutions holding over 100% of the provision to safeguard against potential future risks. However, concerns arise among bankers as several banks facing provision shortfalls may encounter challenges in writing off bad loans. A senior banker from a private commercial bank expressed this apprehension.

As of September 2023, the banking industry grappled with a Tk25,271 crore provision shortfall. Despite some banks meeting or exceeding the 100% provision requirement, eight banks, including certain state banks and the NBL, faced significant shortfalls.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, said global economic uncertainty and the country’s pre-election political volatility have decreased industrial investment and production. People’s purchasing power is also falling, reducing their ability to repay their debts.

“Many borrowers have to convert their one-year demand loans to term loans because they are not in a position to repay the loans at this stressful time,” he said, adding that this situation would linger till the election.

Welcoming the new roadmap, he said it will reduce classified loans and ensure good governance in the banking sector, but it will also impact the profitability of banks.

“Under the new policy, bad loans can be written off within two years. But banks will have to make 100% provisioning for the write-offs. This will significantly reduce the profits of banks,” he added.

Private banks led default loans in 2023

The country’s private commercial banks led the rise in default loans last year, with the amount increasing by Tk14,543 crore in 2023, while state-owned banks witnessed a rise in default loans of over Tk9,000 crore.

The default loan rate for private commercial banks surged to 7% in September last year from 5.13% in December 2022. But it declined to nearly 6% at the end of December 2023.

On the other hand, the default loan rate for state-owned banks rose slightly to 21% at the end of December last year from 20.28% in December 2022, central bank data show.

Provision shortfall rose by Tk8,200cr in 2023

The provision shortfall in the banking sector rose by Tk8,200 crore to Tk19,261 crore at the end of December last year.

Loan provisions are accounting measures that banks and financial institutions set aside as a reserve from their net profit against loans that may default or become non-performing.

Provision requirements increase with rising default loans, which erode the profit of banks.

At the end of last year, a total of seven banks – Agrani, Basic, Rupali, Bangladesh Commerce, National, Standard, and Probashi Kallyan – were in provision shortfall.