The Education Department has released a detailed new student loan forgiveness proposal that could provide over a dozen new pathways to debt cancellation.

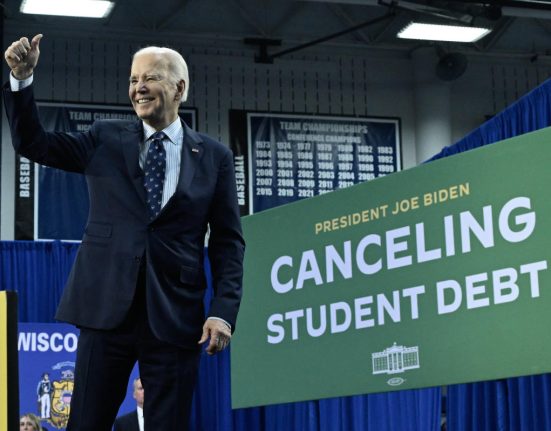

The plan is part of a broader effort by the Biden administation to establish new student loan relief. After last summer’s Supreme Court ruling that nixed President Biden’s first student debt cancellation initiative, officials have taken two parallel routes to enacting student loan forgiveness: reforming existing options to broaden access for millions of borrowers, and creating a new plan for wider relief.

The new student loan forgiveness plan will targeted specific groups of borrowers, according to draft plans released by the department. This includes those who have been in repayment for many years, borrowers who owe more than what they started with despite significant time in repayment, and former students of predatory schools. The plan has not been finalized; detailed proposals are being evaluated in a series of public hearings, after which the Biden administration will finalize the governing regulations.

Last week, the department released draft regulations which — if enacted — could offer several new routes to student loan forgiveness based on 17 “indicators” of financial hardship. Here’s a detailed breakdown.

Student Loan Forgiveness Based On Low Income

According to the proposed regulations, Biden’s new student loan forgiveness plan could be available to those experiencing financial hardship in certain specific ways. This includes those who have low “household income” and minimal “assets.” The department could also consider “student loan total debt balances and required payments, relative to household income.”

Advocates have been pushing the Biden administration to consider automating student loan forgiveness under the new plan wherever possible. In certain instances, the Education Department could have income information for a borrower already available, such as if they have been in an income-driven repayment plan. But to consider other factors, such as a assets (or lack thereof), borrowers may have to complete and submit some sort of form or application.

Student Loan Forgiveness Related To High Expenses And Other Debt Obligations

The draft plan also could allow for student loan forgiveness for borrowers who are struggling due to unreasonable expenses, including those associated with federal student loans and other debts.

Under the draft regulations, the Education Department could consider the “current repayment status and other repayment history information,” suggesting that borrowers who have clearly struggled with repayment for years (or perhaps have paid a lot on their loans but haven’t made a dent in the balance) could be eligible. The regulations also provide that the department can evaluate the “type of loans and total debt balance owed for loans… including those not owed to the Department.” This could encompass private student loan debt, which typically is not factored in for other federal student loan relief programs, such as income-driven repayment other loan forgiveness options.

The department could also look at other a borrower’s other financial obligations as indicators of hardship. The draft regulations include a provision for “total consumer debt balances and required payments, relative to household income,” as well as “high-cost burdens for essential expenses, such as healthcare, caretaking, and housing.”

Student Loan Forgiveness Based On Demonstrated Need

The proposed regulations, if enacted, would also allow the Education Department to consider borrowers for student loan forgiveness if they have already qualified for other government programs that are based on financial hardships. Since other government agencies may have already determined that a borrower qualifies for certain programs based on financial need, this could allow for automatic loan forgiveness in certain cases.

The draft regulations suggest indicators of hardship under this prong could include “receipt of a Pell Grant and other information from the FAFSA form” demonstrating that the borrower is low-income, as could the “receipt of means-tested public benefits.” Specific benefits are not referenced in the draft, but this could include food stamps, certain kinds of Social Security benefits, Medicaid, or healthcare subsidies under the Affordable Care Act.

Student Loan Forgiveness Tied To Personal Hardships

Personal hardships can also potentially be the basis for student loan forgiveness under the new Biden plan. The draft regulations say that indicators of hardship can include the borrower’s “age” and “disability” status. While there already is a disability discharge program for federal student loan borrowers, this option has a strict legal standard. The new plan could provide more flexibility for those who struggle with health issues (and perhaps are also elderly) but don’t necessarily have a “total and permanent disability” as contemplated by that existing program.

The new plan could also consider not only the borrower’s age, but the “age of the borrower’s loan based upon first disbursement or the disbursement of loans repaid by a consolidation loan.”

Loan Forgiveness Based On Student Outcomes

The draft rules released last week also would allow the Education Department to explore the “sector and level of institution attended,” and to consider student outcomes relative to “typical student outcomes at the last program attended.” This could provide a pathway to relief for someone who attended a school with low graduation or completion rates.

The proposal would also potentially consider “whether the borrower has completed any postsecondary certificate or degree program for which they received title IV, HEA financial assistance.” Failure to complete a degree or certificate program could be an indication of hardship (such as if medical or financial barriers interfered with the borrower’s ability to graduate). It could also indicate problems with the school itself, if available data suggests low graduation or completion rates.

Catch-All Provision For Student Loan Forgiveness

The regulations suggest that having one or more of the above indicators could provide a basis for student loan forgiveness under the new plan. But hardship is “not limited” to these indicators alone, according to the text. The Education Department could also consider “any other indicators of hardship identified by the Secretary,” as well as “the extent to which hardship is likely to persist.”

This could allow the administration to consider any number of other factors evidencing hardship as a potential basis for student debt relief, coupled with the extent and longevity of that hardship.

What’s Next For Biden’s Next Student Loan Forgiveness Plan

It’s important to note that so far, this is a student loan forgiveness proposal — not a finalized plan that is available now. Borrowers cannot apply at this time.

The Education Department will be holding a final round of negotiated rulemaking later this week to review the draft regulations pertaining to hardship indicators. Negotiated rulemaking is a process whereby a committee comprised of key stakeholders holds public meetings to evaluate proposed rules. The committee tries to reach consensus on regulatory text. If the committee ultimately agrees on the language, those rules would make it into the final regulatory text for the program. If not, the department can finalize the regulations largely independently of the committee.

The department is expected to publish final regulations for the new loan forgiveness program later this spring. After that, the initiative may not go live until mid-2025. However, the Biden administration is expected to provide for early implementation, perhaps as soon as this fall.

Further Student Loan Forgiveness Updates

Only 3 More Chances For Student Loan Forgiveness Under This Biden Plan

Switching Plans Could Be A Costly Student Loan Forgiveness Mistake For Some Borrowers

513,000 Borrowers Get Student Loan Forgiveness Due To Health Issues

4 Big Student Loan Forgiveness Updates As Biden Approves New Relief