The 2024 stock market rally has some everyday investors looking to ratchet up the risk.

The 2024 stock market rally has some everyday investors looking to ratchet up the risk.

Thrill-seeking investors are turning to single-stock exchange-traded funds, a relatively new product that aims to amplify the return of one stock using borrowed money or derivative contracts.

Premium benefits

35+ Premium articles every day

Specially curated Newsletters every day

Access to 15+ Print edition articles every day

Subscriber only webinar by specialist journalists

E Paper, Archives, select The Wall Street Journal & The Economist articles

Access to Subscriber only specials : Infographics I Podcasts

Unlock 35+ well researched

premium articles every day

Access to global insights with

100+ exclusive articles from

international publications

Get complimentary access to

3+ investment based apps

TRENDLYNE

Get One Month GuruQ plan at Rs 1

FINOLOGY

Free finology subscription for 1 month.

SMALLCASE

20% off on all smallcases

5+ subscriber only newsletters

specially curated by the experts

Free access to e-paper and

WhatsApp updates

Thrill-seeking investors are turning to single-stock exchange-traded funds, a relatively new product that aims to amplify the return of one stock using borrowed money or derivative contracts.

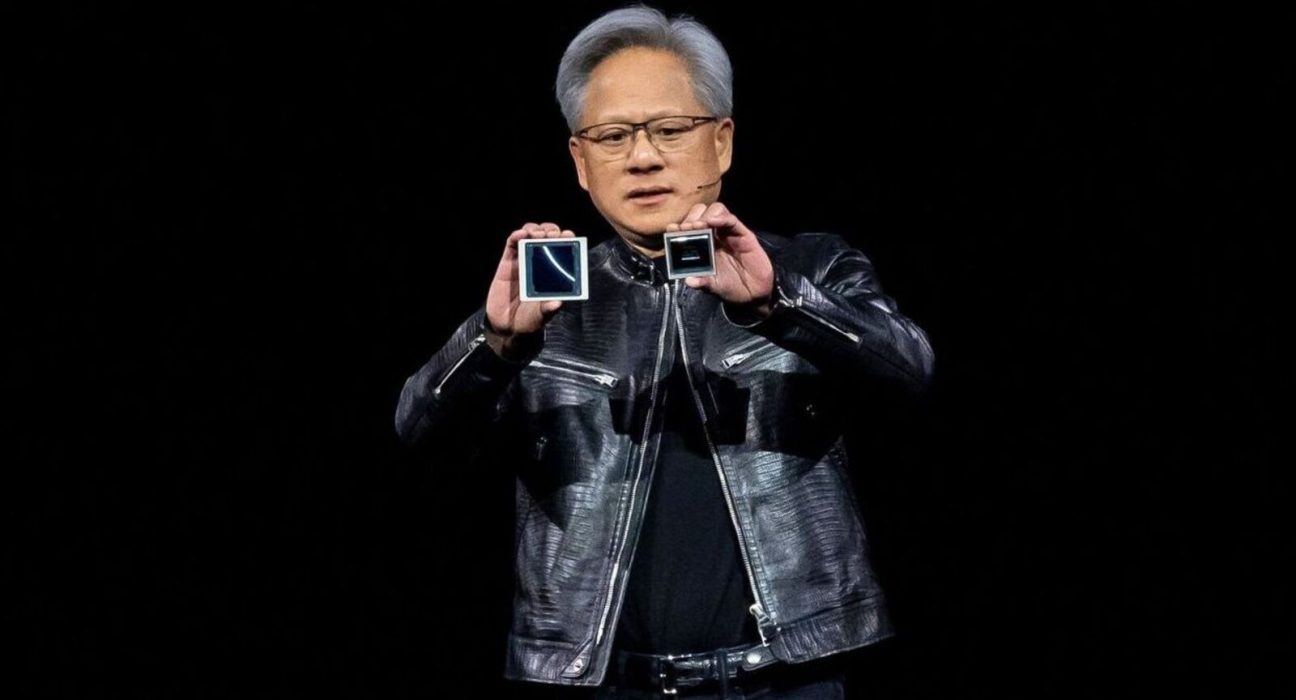

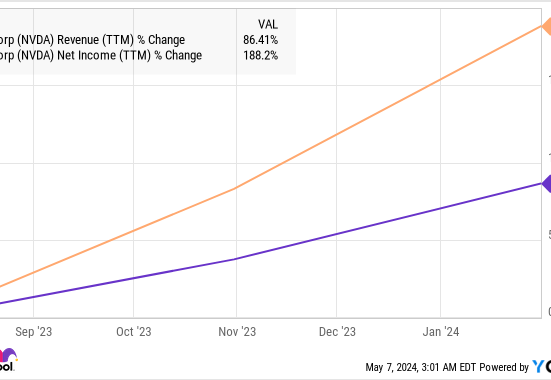

For example, investors who aren’t satisfied with Nvidia’s 80% advance year-to-date can turn to the T-Rex 2X Long Nvidia Daily Target ETF, which aims to double the daily return of the graphics-chip maker. The fund, which is available through most major brokerage accounts, is up 191%. Similar ETFs let investors make leveraged or inverse bets on volatile stocks such as Tesla and cryptocurrency exchange Coinbase Global.

First approved by the Securities and Exchange Commission in 2022, single-stock ETFs were initially slow to catch on. But they are surging in popularity this year, with assets more than doubling to $7.1 billion in the first quarter. The biggest single-stock ETF, a 2x long Nvidia fund from GraniteShares, has posted more than $1 billion in inflows in 2024 and is approaching $2 billion in total assets.

Proponents of the funds say they are a tool that allows regular investors to employ strategies long used by Wall Street. Critics need to point no further than the first-quarter performance of the T-Rex 2x Inverse Nvidia Daily Target ETF: negative 77%.

“This is speculative investing like nothing else,” said Todd Rosenbluth, head of research at data provider VettaFi.

The asset managers that offer single-stock funds say they are meant to be used as short-term trading vehicles and aren’t appropriate for investors who don’t plan to actively manage their portfolios. The funds produce their promised result daily, meaning that compounding effects can lead to very different returns than an investor might expect over the long term.

Investors have been able to get leveraged exposure to indexes such as the Nasdaq-100 through ETFs for more than a decade. Single-stock funds don’t offer the same diversification and carry added risk.

Jeremy Vreeland, a 46-year-old individual investor in central Virginia, quit his job as a mechanic in 2021 to trade stocks and options. He pays his bills with income earned from selling options, and uses a smaller portion of what he calls his “risk capital” to day trade.

A longtime Tesla investor, Vreeland began trading single-stock ETFs with his Robinhood and Webull accounts this year to make short-term bets on both Tesla and Nvidia, sometimes opening and closing a position within an hour.

“I want to take advantage of high volatility situations. Any time I can trade leverage, automatically my potential return on investment is much higher,” Vreeland said.

Single-stock ETFs have made a strategy like Vreeland’s, which previously would have required borrowing money in a margin account, cheaper and easier to implement.

GraniteShares Chief Executive Will Rhind estimates about half of his single-stock ETF investors are individuals. Other investors include hedge funds that use momentum trading strategies and those looking for an arbitrage opportunity between options, futures, ETFs and the underlying stock.

Rhind said the growing inflows and trading volumes this year are “vindication” that there is demand for single-stock leveraged products.

“Fundamentally we’re trying to democratize margin investing and access to margin. For a lot of investors these make sense because it’s much cheaper than using a margin account,” Rhind said.

The biggest GraniteShares ETFs currently charge a 1.15% annual fee on assets. That is high compared with vanilla ETFs, though an investor using the funds on short-term bets would pay very little in fees, which are computed annually.

This year’s single-stock ETF flows, totaling $4.2 billion, are significant, said Elisabeth Kashner, director of ETF fund research and analytics at FactSet, who chalked their growing popularity up to investors chasing returns.

“These funds are the sharpest knife in the drawer, and it’s important people fully understand what they’re getting into,” Kashner said. “My worry is that some people look at the name, hit the buy button and then could be in for quite a surprise.”

So far, the interest has been contained to funds tied to Nvidia, Tesla, Coinbase and Advanced Micro Devices, the only stocks with single-stock ETFs that have eclipsed $100 million in assets. Yet fund managers have rushed to launch new offerings, hoping to identify the market’s next Nvidia. There were almost 60 single-stock ETFs in the U.S. market at the end of the first quarter, up from about 25 a year earlier.

Matthew Tuttle, CEO of Tuttle Capital Management who partnered with fund manager Rex Shares on the T-REX single-stock funds, says he has been pleasantly surprised by the growth this year.

“I think this is going to become its own little ecosystem,” Tuttle said. “I know there’s a lot of criticism of it. To me, it’s a tool.”

Write to Jack Pitcher at jack.pitcher@wsj.com