(Bloomberg) — Investors are becoming more optimistic about Alphabet Inc.’s artificial intelligence strategy, after a run of glitches and misfires that sent its shares tumbling.

Most Read from Bloomberg

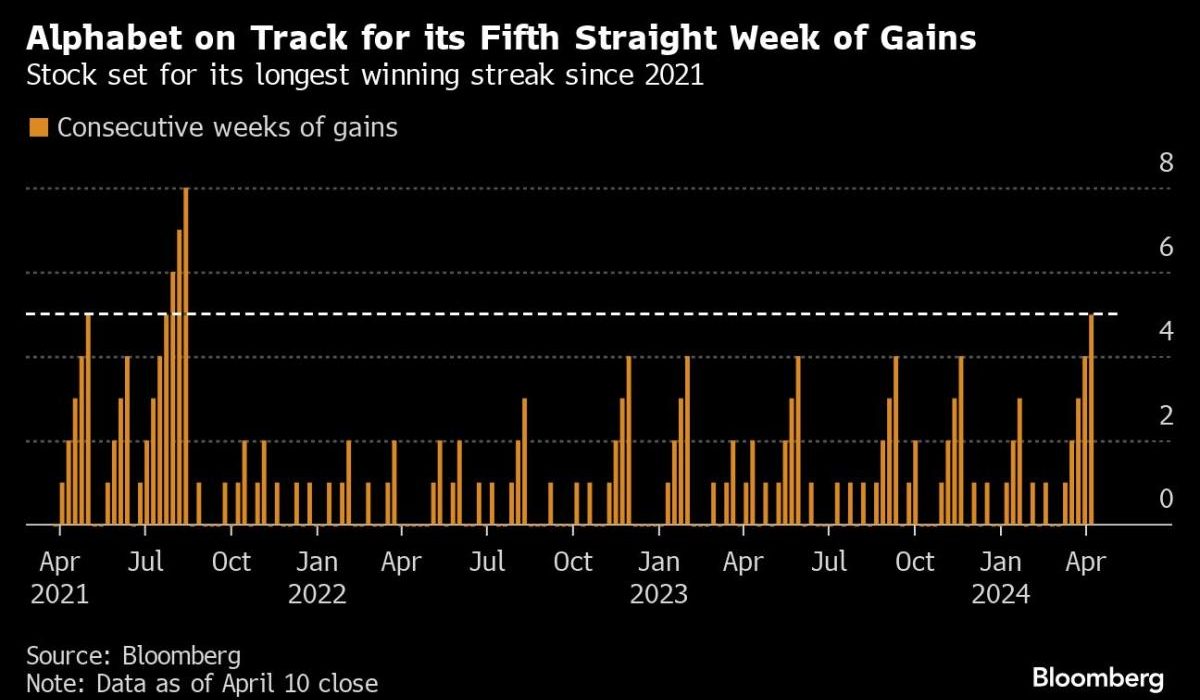

The stock is heading back toward what would be a record $2 trillion market value — a milestone surpassed only by Microsoft Corp., Apple Inc. and Nvidia Corp. in the United States. It has rallied back from last month’s low, when the shares dropped on concerns the company was falling behind in AI.

Using this week’s cloud event to show that its AI model is enterprise-ready despite recent stumbles in its consumer-facing tools, focus is now turning to this month’s earnings and a developer’s conference in May. While Alphabet’s path to AI monetization is still seen as cloudy, the stock’s relatively cheap valuation has kept it attractive to many on Wall Street.

“While the headlines haven’t been favorable, Google’s role in generative AI products will present massive growth opportunities for the stock,” said Sylvia Jablonski, chief executive officer at Defiance ETFs. Alphabet is also set to benefit from making its own generative AI tools that can power more precise ads and increase revenues from ad spend, she added.

Alphabet’s misfiring Gemini product had been viewed as a major setback for a firm known for its technological prowess, with the company in February pausing an image generation feature that drew criticism over inaccurate historical depictions of race.

The company’s cloud computing conference in Las Vegas this week offered investors some reassurance, as the firm showed how Gemini can be used to create advertisements, prevent cybersecurity threats and spin up short videos and podcasts. Google also showed a new chip designed to handle AI workloads.

News that Apple Inc. is considering using Google’s Gemini technology to power AI services added more fuel to the rebound. Up to the last close, shares are up 12% this year.

“Google’s hardware advances, Gemini progress, and AI driven app demos should help sentiment on AI capabilities,” Bank of Amercia Corp. analyst Justin Post wrote in a note Tuesday. “We see Cloud as positive driver for stock given AI credibility, faster growth, improving margins.”

The stock trades at 21 times forward earnings, below Microsoft’s 33 times, and about the same as the S&P 500 Index. Alphabet shares rose 0.7% on Thursday.

Read more: Alphabet’s AI Missteps Are Opportunity For One Fund Manager

Still, not all are convinced by the discount, despite “plenty of people that are making the argument that it’s so cheap right now,” said Michael Lippert, vice president and portfolio manager at the Baron Opportunity Fund.

Given the competitive search space, Alphabet “should be investing every single dollar at a higher ROI (return on investment) into their own businesses,” he said.

For now, the company’s updates have at least offered investors some encouragement. JP Morgan Chase & Co. analyst Doug Anmuth noting this week that he expected Gemini integration to result in more than 20% revenue growth for Google Cloud.

Tech Chart of the Day

Top Tech Stories

-

OpenAI Chief Executive Officer Sam Altman has been working to build a global coalition among government and industry leaders to support boosting the supply of chips, energy and data center capacity needed to develop artificial intelligence technology.

-

SpaceX’s prized Starlink satellite business is still burning through more cash than it brings in.

-

Adobe Inc. has begun to procure videos to build its artificial intelligence text-to-video generator, trying to catch up to competitors after OpenAI demonstrated a similar technology.

-

French chip materials company Soitec is considering building a factory in the US, as customers including Taiwan Semiconductor Manufacturing Co. win government incentives for significant expansions from Arizona to Texas.

-

Amazon.com Inc. Chief Executive Officer Andy Jassy said his company’s cloud infrastructure will become an essential part of the generative artificial intelligence boom.

Earnings Due Thursday

–With assistance from Jeran Wittenstein.

(Updates stock move in paragraph nine.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.