(Bloomberg) — A batch of exchange-traded funds investing directly in crypto debuted in Hong Kong on Tuesday, heralding potential competition for US Bitcoin products whose popularity stoked a record rally in the digital asset.

Most Read from Bloomberg

Harvest Global Investments Ltd., the local unit of China Asset Management, and a partnership between HashKey Capital Ltd. and Bosera Asset Management (International) Co. each listed Bitcoin and Ether ETFs in the city.

The level of demand for the funds will provide clues on whether Hong Kong’s push for a tightly regulated digital-asset hub is gaining traction. Officials are hoping the crypto pivot will help to restore the city’s reputation as a modern financial center, a standing that was tarnished by a crackdown on dissent.

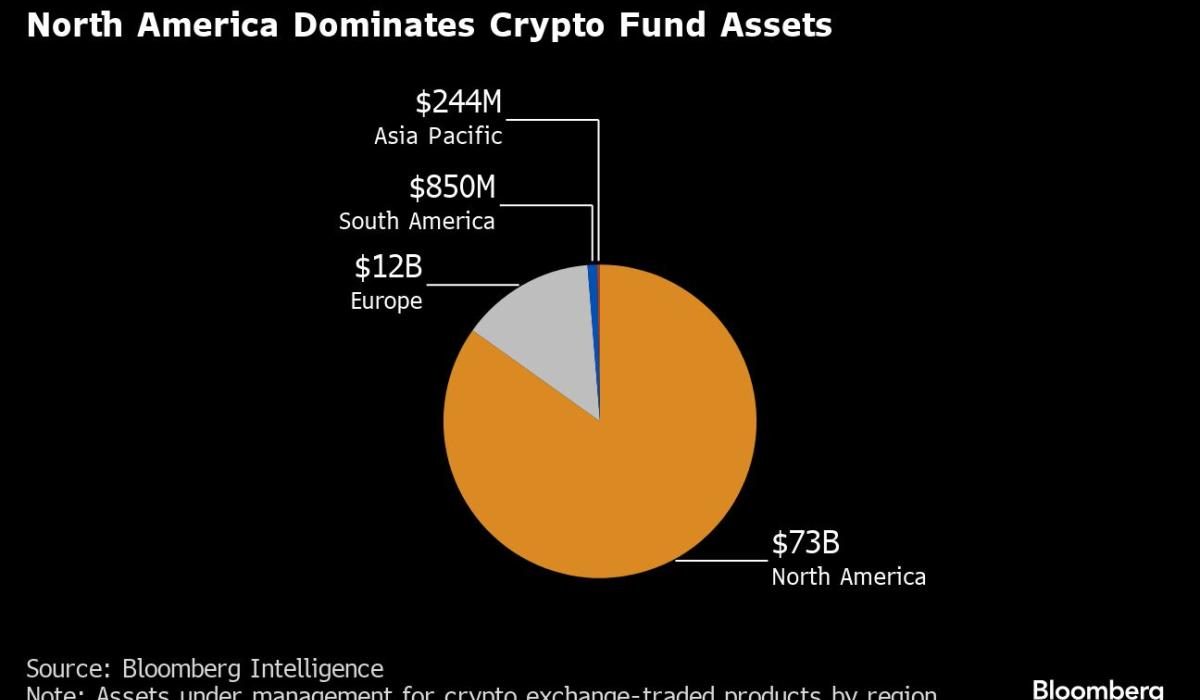

US spot-Bitcoin ETFs from issuers including BlackRock Inc. and Fidelity Investments went live in January and have $53 billion of assets so far in an historic rollout. For Hong Kong, Bloomberg Intelligence’s Rebecca Sin estimates the city’s Bitcoin and Ether funds may amass $1 billion over two years.

West and East

Such a projection is “too small,” Han Tongli, the chief executive officer of Harvest Global, said in an interview. That’s partly because financial products and services in Hong Kong are “accepted by investors both in the West and in the East” whereas the US caters mainly to the former, he said.

Possible sources of inflows for the Hong Kong offerings include Chinese wealth parked in the city, as well as crypto exchanges and market makers active in the Asia Pacific. Crypto trading is banned on mainland China — driving activity underground — and the upcoming fund launches will likely remain beyond the scope of a program giving Chinese investors access to some Hong Kong ETFs.

Hong Kong is adopting an in-kind ETF subscription and redemption mechanism, which allows for the underlying assets to be swapped for fund units and vice versa, whereas the US Bitcoin funds use a cash redemption model.

Harvest Global’s Han said the in-kind approach burnishes the appeal of the city’s products and is among the reasons why the eventual take-up of the Hong Kong ETFs could be as much as three times bigger than for the US funds.

Asian Trading

Others have cautioned that expected demand must be calibrated in line with Hong Kong’s smaller financial sector. The city already allows crypto-futures based ETFs but their total assets of about $164 million are a fraction of the $2.3 billion ProShares Bitcoin Strategy ETF, a derivatives-based product in the US.

Hong Kong may lag behind the US in launching spot-crypto ETFs and have a smaller market for passive funds, but the local products will still be appealing for ease of access, especially for Asian trading hours, Bosera Asset Management (International)’s Head of Products Ethan Li said in an interview.

Chief Executive Officer Doris Lian said Bosera is looking to expand its team and digital-asset product pipeline. “Hong Kong will have a significant place in the global virtual-asset sphere,” she added. “We’re very confident of that.”

Digital assets have revived from a deep rout in 2022: Bitcoin is up about 287% since the start of last year and hit a record of $73,798 in March, while Ether is up 169%. The rallies stalled lately, and Bitcoin has dipped roughly $10,000 from the high.

The largest digital asset climbed 1.7% to $64,000 as of 9:35 a.m. in Hong Kong as trading in the new ETFs got underway. Ether, the second-largest token, added about 1%.

Investors will likely scour incoming data from issuers to gauge net inflows for the Hong Kong vehicles. The equivalent figures for the US funds sometimes led to swings in crypto prices as demand waxed and waned.

(Updates with start of trading from the first paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.