Torsten Asmus

As the Federal Reserve pauses its rate increases, high-quality bonds are becoming more attractive. The iShares 10+ Year Investment Grade Corporate Bond ETF (NYSEARCA:IGLB) is a passive ETF that aims to mirror the results of an index that comprises investment-grade, U.S. dollar-denominated corporate bonds with over ten years of maturity. This ETF is part of the iShares fund family, which is under the stewardship of BlackRock – a global leader in asset management.

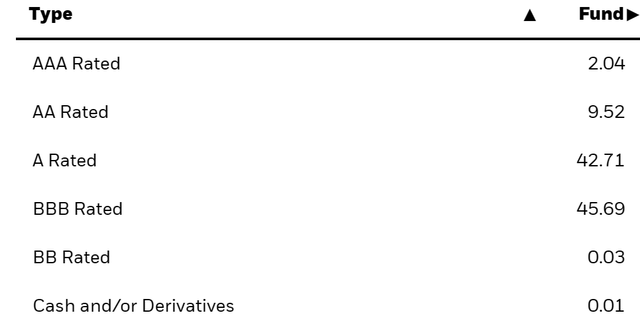

Bonds that fall into the investment-grade category are recognized by credit rating agencies for their low likelihood of default, signifying their high quality. Credit rating agencies, including Standard & Poor’s, Moody’s, and Fitch, assess these bonds. They rate them based on the issuing entity’s financial health, future outlook, and specific features of the bond itself.

Investment grade bonds typically carry ratings from AAA (the highest quality) to BBB- or Baa3 (the lowest investment grade category) depending on the rating agency. Bonds rated BB+ and below by Standard & Poor’s or Ba1 and below by Moody’s are considered non-investment grade or “high-yield” bonds.

Investors tend to favor investment-grade bonds for their lower risk relative to high-yield bonds. These bonds generally offer lower interest rates than those with lower credit ratings, reflecting a lower level of risk. They are a popular choice for conservative investors, such as pension funds and individuals seeking steady income with relative safety of principal.

It’s a good fund given the investment grade credit quality across the board, and duration looks attractive given some of the more recent movements we’ve been seeing in the fixed income space.

Detailed Insights into IGLB’s Holdings

IGLB’s portfolio is composed predominantly of U.S. corporate bonds, particularly those with investment-grade ratings and long-term maturities. Below are the top five individual positions within the ETF’s portfolio:

-

AT&T Inc.: A leading global provider of telecommunications, media, and technology services. AT&T Inc. represents 1.95% of IGLB’s portfolio.

-

Comcast Corporation: One of the largest broadcasting and cable television companies in the world. It constitutes 1.57% of the ETF’s holdings.

-

Oracle Corporation: A multinational computer technology corporation specializing in database software, cloud-engineered systems, and enterprise software products. It makes up 1.48% of IGLB’s portfolio.

-

UnitedHealth Group Inc.: A diversified health and well-being company, UnitedHealth Group Inc. constitutes 1.36% of IGLB’s holdings.

-

Verizon Communications Inc.: A multinational telecommunications conglomerate, Verizon Communications Inc. represents 1.33% of the ETF’s portfolio.

Sector Composition and Weightings

IGLB’s portfolio is spread across various sectors, with a significant concentration in the top five sectors. These include:

-

Communication: Representing a significant portion of the ETF’s holdings, this sector includes companies like AT&T Inc., Comcast Corporation, and Verizon Communications Inc.

-

Technology: This sector includes tech giants like Oracle Corporation and Microsoft Corporation.

-

Healthcare: This includes companies like UnitedHealth Group Inc., which provides healthcare products and insurance services.

-

Financials: This sector includes major financial institutions like JPMorgan Chase & Co and Bank of America Corp.

-

Consumer Discretionary: This sector includes companies that tend to be the most sensitive to economic cycles. Its performance is heavily reliant on the state of the economy and consumer confidence.

Pros and Cons of Investing in IGLB

Like any investment, IGLB comes with its own set of advantages and disadvantages.

Pros:

-

Diversification: IGLB provides exposure to a wide range of investment-grade corporate bonds, offering diversification benefits.

-

Attractive Yield: With a current yield of around 5.51%, IGLB offers an attractive income potential for investors.

-

Lower Interest Rate Risk: Due to its focus on long-term, investment-grade bonds, IGLB mitigates the risk associated with short-term interest rate fluctuations.

Cons:

-

Interest Rate Risk: While IGLB does mitigate some interest rate risk, the long-term nature of its bonds means that the fund is still sensitive to changes in interest rates.

-

Credit Risk: Despite being investment-grade, the bonds in IGLB’s portfolio are still subject to the risk that the issuing companies could default on their debt payments.

Conclusion: To Invest or Not to Invest in IGLB?

The decision to invest in IGLB should be based on an individual investor’s risk tolerance, investment horizon, and income requirements. While IGLB offers an attractive yield and good diversification, it also carries a degree of risk due to the nature of its bond holdings. If you’re a risk-averse investor seeking stable income over the long term, IGLB could be a suitable addition to your portfolio. However, if you’re more risk-tolerant and are looking for higher returns, you might want to consider other investment options.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).