(Bloomberg) — Edgar Allen’s High Ground Investment Management is preparing to start its second hedge fund, which will be run by former Adelphi Capital partner Henry Guest.

Most Read from Bloomberg

Guest, who joined Allen’s London-based firm last week, will focus on a concentrated portfolio of growth companies in the health-care and technology sectors in Europe, the firm said. The new fund, expected to kick off in the fourth quarter, will complement Allen’s own value-biased hedge fund he started in 2019.

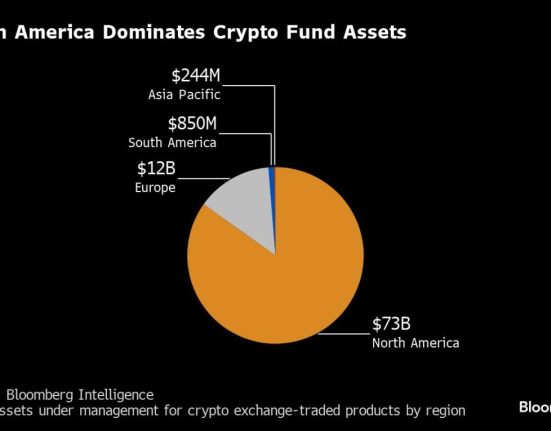

“It’s my strong conviction that Europe is underappreciated by global investors,” Guest said in an interview. “Europe’s position in health care especially, but also in foundational technology, is underappreciated. I wish to capitalize on that mispricing.”

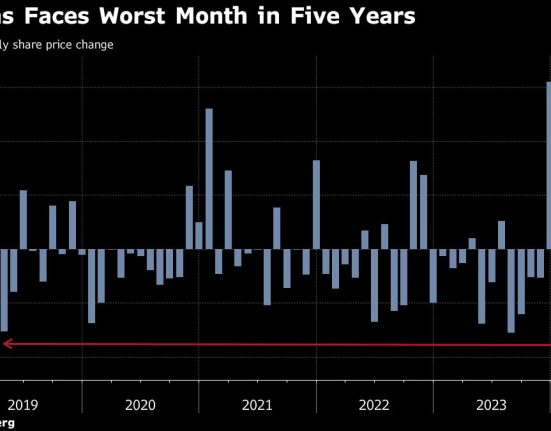

The hiring of Guest marks a milestone in the expansion of High Ground, which has been a rare bright spot among hedge funds that specialize in stock picking. The strategy otherwise has seen investor exodus, particularly in Europe, following years of mediocre returns amid a booming stock market globally.

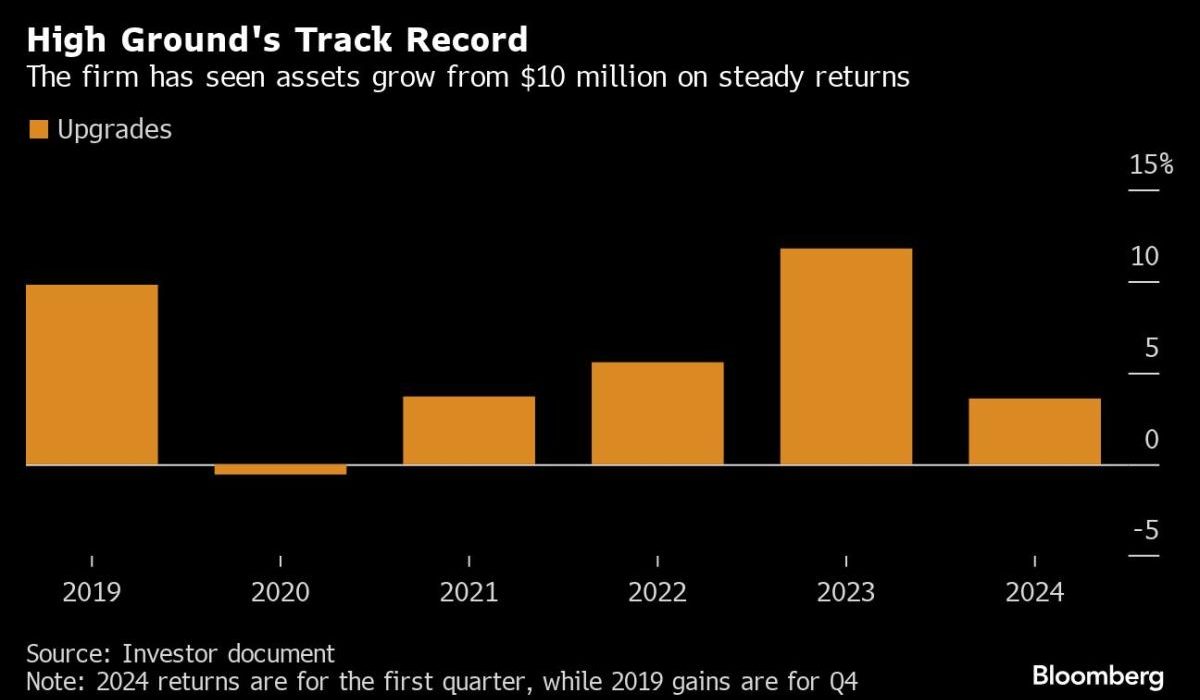

High Ground has grown to manage $625 million after starting with just $10 million in 2019.

Guest’s move also signals an increasingly popular model where traders are joining existing platforms to run their own hedge funds rather than launching their own brand-new investment firms. That’s against a backdrop of a tough capital-raising environment, which has resulted in more than 3,000 hedge funds shutting down over the last five years, with closings exceeding launches, according to data from Hedge Fund Research Inc.

Allen was previously a partner at activist billionaire investor Christopher Hohn’s TCI Fund Management before moving to Naya Capital Management. Then he started his own hedge fund in 2019, which last year made about 12% and was up 3.6% in the first quarter of 2024, according to his investor letter.

Guest spent 18 years at London-based stock-focused hedge fund Adelphi, with 15 of those as a partner. Besides running his fund, he will also bolster High Ground’s research in the health-care, luxury and technology sectors.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.