Cryptocurrencies were invented in the heat of the 2008-2009 financial crisis to provide an alternative to banks. The inventors of Bitcoin, who went by the pseudonym Satoshi Nakamoto, envisioned a financial system that didn’t depend on “trusted third parties” that they said couldn’t be trusted in the first place. Instead, it would use cryptography and a decentralized ledger called a blockchain to record transactions and provide irrefutable proof of ownership. Crypto evangelists said this would democratize finance and lower the cost of holding and using money.

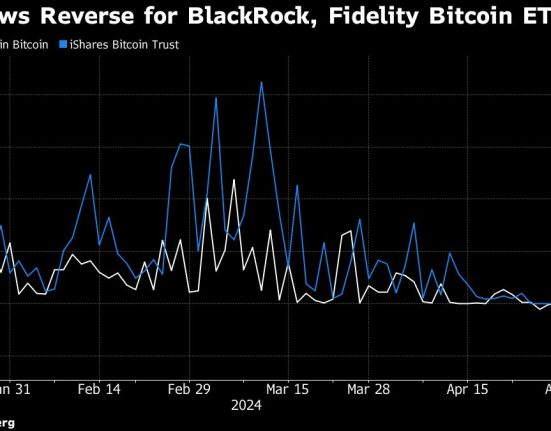

Banks scoffed, calling crypto a cypherpunk pipe dream. But more than 15 years later, many banks and other financial institutions on Wall Street are not only in the cryptocurrency business (see ETFs, Bitcoin) but they’re also beginning to adopt the underlying blockchain technology. JPMorgan Chase & Co., Goldman Sachs Group Inc. and other banks are experimenting with or already offering private blockchain services, a concept that strikes many crypto lovers as oxymoronic. Banks are drawn to blockchain technology for its ability to “tokenize” traditional assets like stocks and Treasury bills, making trading them faster and cheaper. Critics say banks aren’t just adopting but co-opting the technology to generate fees, similar to how financial firms turned low-cost, low-touch exchange traded funds into a healthy business.