(Kitco News) – After posting dramatic declines late last week and through the weekend, the cryptocurrency market continued its downward trajectory on Monday.

Bitcoin (BTC) did manage to hold key support around $62k over the weekend, but after bulls managed to push King Crypto close to $67k by 6 am EDT, they ran out of steam and bears regained control of the price action, pushing BTC to a low near $62,380 just after 3 pm EDT.

BTC/USD Chart by TradingView

At the time of writing, Bitcoin trades at $63,514.73, a decrease of 3.44% on the 24-hour chart.

Stocks also trended lower on Monday, with all three major U.S. indices seeing broad-based declines. At the closing bell, the S&P, Dow and Nasdaq finished lower, down 0.62%, 0.65%, and 1.79%, respectively.

ETF flows turn negative, but Hong Kong approvals should provide a boost

The recent dire price action also pushed ETF flows into net negative territory, with digital asset investment products recording $126 million in outflows last week as investors became more hesitant.

Regionally, the United States saw the largest outflows of $145 million, with Canada and Switzerland seeing $6 million and $5.7 million in outflows respectively.

In terms of assets, Bitcoin saw the lion’s share of outflows with $110 million but BTC still retained its positive month-to-date inflows of $555 million. “Short-bitcoin broke its 3-week spell of outflows, with minor inflows of US$1.7m, presumably taking advantage of recent price weakness,” noted James Butterfill, head of research at Coinshares.

On a relative basis, Ethereum was hit the hardest, with $29 million in outflows from ETH funds last week, its fifth consecutive week of outflows.

One development which should give hodlers hope is Monday’s announcement that Hong Kong has approved its first spot bitcoin and ether exchange-traded funds (ETFs).

The move positions Hong Kong to establish itself as the first jurisdiction in Asia to accept the two largest cryptocurrencies as a mainstream investment tool, and at least three offshore Chinese asset managers are set to launch BTC and ETH spot ETFs in the near future.

The Hong Kong Securities and Futures Commission (SFC) said it issues a conditional authorization letter to an ETF application if it generally satisfies its requirements, subject to various conditions, including fee payments, filing of documents, and the Hong Kong Stock Exchange’s (HKEX) listing approval. The regulator did not comment on the details of any virtual asset spot ETFs.

Altcoins slide as momentum stalls

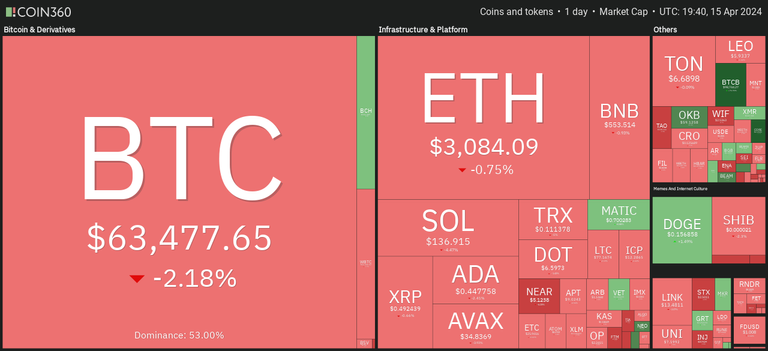

The overwhelming majority of the top 100 altcoins declined in value on Monday as traders pulled back from crypto markets waiting for fresh signals of a renewed uptrend for digital assets.

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360

Core DAO (CORE) led the gainers with an increase of 59.64% on the 24-hour chart, followed by Bitcoin BEP2 (BTCB), which rose 28.84%, and OKB (OKB), which gained 12.37%. Starknet Token (STRK) led the losers with a decline of -8.64%, followed by an 8.09% drop for Bittensor (TAO) and a decline of -7.57% for Ethena (ENA).

The overall cryptocurrency market cap now stands at $2.32 trillion, and Bitcoin’s dominance rate is 53.66%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.