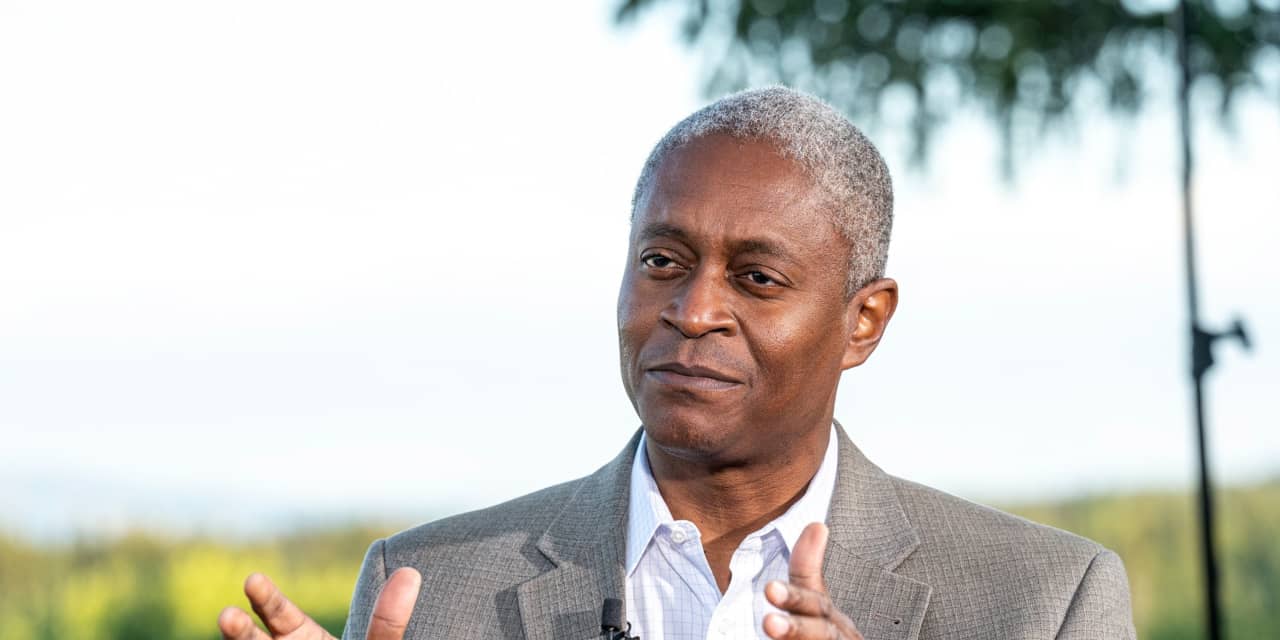

Investors will have to wait awhile for interest-rate cuts, Fed’s Bostic says

Investors will have to wait until at least July for those widely expected interest-rate cuts, according to one Federal Reserve president’s outlook. Atlanta Fed President Raphael Bostic said rate cuts probably wouldn’t be suitable until the third quarter given the current strength of the economy. That’s a quarter earlier than he originally predicted, Bostic said,

The truth about investing: ‘Common sense’ can be the worst advice

In a recent article I offered the opinion that “common sense” is a dangerous trap that’s easy for investors to fall into. Some readers didn’t agree. So let’s explore this idea a bit, then you can make up your own mind. Common sense is a popular topic for authors. I have often recommended ”The Little Book of Common