A pair of property tax measures on which Unicameral debate began last week would have slashed gross school and combined tax rates in Scottsbluff-Gering and Scotts Bluff County by one-third or more had they been in place for last fall’s “budget season.”

It also would have meant simpler and more direct state property tax relief by “frontloading” funds from a four-year-old K-12 income tax credit as extra state school aid, a Star-Herald analysis has found.

Finally, Legislative Bills 388 and 1331 would have added to net 2023-24 tax relief for many property owners who have claimed existing K-12 and community college property tax credits on their income tax returns.

State senators are expected Tuesday to resume first-round discussion of LB 388, which would raise state sales taxes by 1 cent, erase a few sales-tax exemptions and boost some excise taxes to help pay for the late-developing property tax plan.

People are also reading…

They’re also expected to take up LB 1331, which would implement the school-aid changes, before time runs out at week’s end for bills to clear initial debate during the 2024 session.

The Star-Herald analysis applies the twin bills’ conditions to 2023-24 taxable values, tax requests and tax bills affecting three similarly valued homes in Scottsbluff, Gering and Terrytown and three rural agricultural operations across the county. The newspaper began tracking the annual assembly of their tax bills last fall as local budgets were set.

Gering school Superintendent Nicole Regan and her Scottsbluff counterpart, Andrew Dick, declined comment Monday on the property tax bills.

State Sen. Brian Hardin of Gering said he can’t support the package, though he appreciates efforts by Gov. Jim Pillen and Omaha Sen. Lou Ann Linehan, chairwoman of the Revenue Committee, “to create a win-win” for schools and taxpayers.

District 48 state Sen. Brian Hardin discusses legislative developments at a Scottsbluff town hall meeting last year.

However, “the incremental tradeoff of a 1% sales tax (increase) for the lowered property tax rate seems to tracking a negative rut in the road,” Hardin told the Star-Herald Monday.

He prefers the petition drive led by fellow Panhandle Sen. Steve Erdman of Bayard to abolish property, income and current state and local sales taxes with state and perhaps local “consumption taxes” while retaining excise taxes.

“Yearly, we nibble around the edges of our tax policy in Nebraska. We’ve done that for 60 years,” Hardin said. “It’s time to embrace the courage it takes to reform our taxation approach.”

The Unicameral plan builds upon a 2023 school-aid reform package that imposed a first-ever lid on school district property tax requests and reintroduced per-student “foundation aid” to the complicated state-aid formula for the first time since 1990.

The $650 million plan also responds to, but falls short of, Pillen’s January call for an extra $1 billion in state funding to drive down statewide school tax requests by 40%. Pillen nonetheless endorsed the plan put forward last week by the tax-setting Revenue Committee.

LB 388 and 1331’s key proposals directly affecting property taxes would:

- Double last year’s foundation aid for K-12 schools from $1,500 to $3,000 per student. Extra “equalization aid” would remain possible for districts with especially high costs of teaching students who meet federal poverty standards or for whom English isn’t their first language.

- Add a new “allocated property tax funds” state aid category, based on the size of a district’s property tax request the previous year compared with all schools statewide. It would replace the state income tax credit that senators approved in 2020 and equaled 30% of a property owner’s K-12 tax bill in 2023-24.

- Keep other parts of the K-12 aid formula that return 2.23% of district patrons’ state income taxes and award extra money if a district brings in more “net option” students than it loses to other districts.

- Essentially retain last year’s new cap on tax requests with minor adjustments. It limits their growth to 3% plus smaller percentages based on enrollment growth, students in poverty and English-as-a-second-language speakers. Taxes to repay bonds aren’t included.

- Add similar caps on tax requests by cities, villages and counties, limiting their annual growth to the previous year’s year-end inflation rate or 3% plus “real growth” in new construction and property improvements, whichever is greater.

The Star-Herald’s analysis applies all of those factors and eliminates a state income tax credit for 30% of a property owner’s community college property taxes, a credit that will disappear for the 2024-25 fiscal year as the state takes over almost all community college funding.

Scottsbluff-Gering scenarios

Had LBs 388 and 1331 been in place for last fall’s budget season, total 2023-24 state aid would have grown by 14.1% in Mitchell, nearly 20% in both Scottsbluff and Gering and leapt by 45.5% in Morrill. The four districts figure into one or more of the Star-Herald’s sample projections.

That extra aid, coupled with an 80.1% drop in community college tax rates, would have driven down combined property tax rates by 34.8% in Scottsbluff, 33.4% in Gering and 34.5% in Terrytown. Community colleges will still be allowed to collect up to 2 cents per $100 of taxable value for capital construction projects.

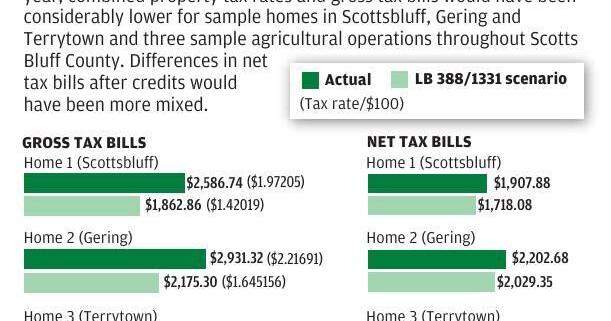

Instead of ranging from $1.97 to $2.23 per $100 as in real life, combined tax rates for Scottsbluff, Gering and Terrytown would have been $1.42, $1.65 and $1.68 respectively in the three cities under the Unicameral package.

School tax rates (including any bonds) for the four districts above would have plunged to 58.2 cents per $100 in Mitchell, 70.2 cents in Scottsbluff, 79.2 cents in Morrill and 81.3 cents in Gering.

Translating those figures into saved property tax dollars depends on whether taxpayers claimed the K-12 and community college tax credits on their 2023 income taxes this winter. Large percentages of Nebraskans have failed to do so the past few years, state officials have said.

All property owners automatically get a direct discount on their annual December property tax bills through the Property Tax Credit Fund, the oldest of the three credits.

In Scottsbluff, Gering and Terrytown, the Star-Herald’s new-for-2023 “tax tracker” coverage followed the assembly of 2023-24 property tax bills for one three-bedroom home apiece of similar size and taxable value in each of the three cities.

Home 1, in Scottsbluff’s Westmoor neighborhood, saved 5.6% on its $2,586.74 gross tax bill with the direct Property Tax Credit Fund discount.

Under the Legislature’s proposed changes, however, Home 1’s 2023-24 tax bill before credits would have been $1,862.86 — a drop of nearly 28%. Adding the automatic discount would have left its final net tax bill 33.6% lower, at $1,718.08.

Both Home 2, in Gering’s Legion Park neighborhood, and Home 3 in northwest Terrytown saved 5% with the direct tax credit fund. LB 388’s and 1331’s changes would have boosted their owners’ savings to 30.8% for the Gering home and 29.8% for the Terrytown one, compared with 24.9% and 24.7% respectively if they claimed the twin education income tax credits this winter.

The Star-Herald’s three sample agricultural operations, introduced in a Dec. 1 story, feature a mostly open-range ranch southeast of Lyman and farms with mixed irrigated land, dryland and grassland northwest of Mitchell and southwest and southeast of Melbeta. All three have multiple parcels.

All three enjoyed somewhat larger direct tax discounts — ranging from 6.8% to 8.7% — from the Property Tax Credit Fund. State law grants larger discounts for agland from that fund than for other land types.

Ag 1, the Lyman-area operation, got a 7.7% 2023 Property Tax Credit Fund tax break off its gross tax bill of $22,744.46. Claiming the two income tax credits this winter would have lowered its net tax bill by 29.9%, compared with 30.7% had the two bills now before the Legislature been in effect for 2023-24.

The two irrigated farm operations, however, would have fared even better under LBs 388 and 1331. Ag 2, the one near Mitchell, would have wound up with a $19,084.78 net tax bill, 34% less than its 2023 gross bill of $28,916.07. Taking the two education tax credits would have yielded just a 26.5% combined tax break.

The Melbeta-area operation, Ag 3, had the highest 2023-24 gross tax bill at $33,265.19. But its net bill had the Legislature’s proposals been in effect would have been 36.2% less, totaling $21,230.02.

If Ag 3’s owners claimed all three current credits, their actual total tax break would have been 29.5%.