Hong Kong’s benchmark index, which was in the 15,000-point range in July 1997 when the city returned to Chinese sovereignty, surged above 30,000 in 2007 and 2018. Last Friday, it closed at 16,353.

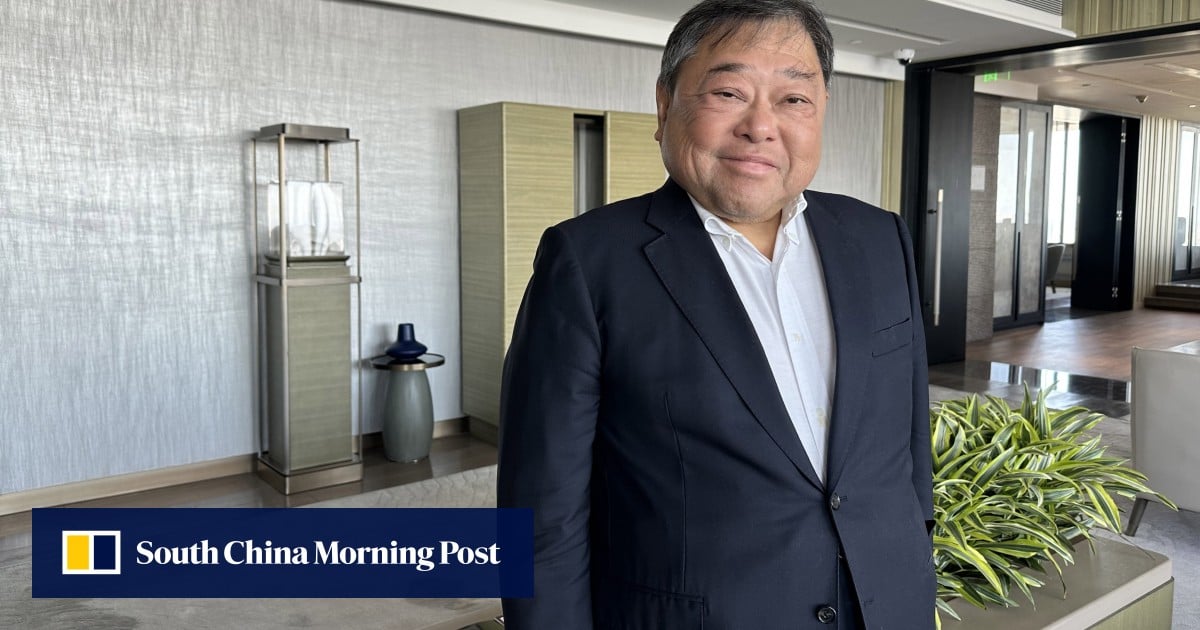

“Every market has its cycle. Hong Kong’s stock market had gone up to 30,000. But he just took today’s low point [for comparison],” Chiu said in Beijing as the Chinese People’s Political Consultative Conference (CPPCC) concluded its annual session.

“It’s an unfair statement.”

Roach had compared the Hang Seng Index with the United States’ S&P 500 index, saying the former was up only about 5 per cent in the past two decades while the latter had surged more than fourfold.

His gloomy outlook triggered rebuttals from local political and business heavyweights, including Regina Ip Lau Suk-yee, convenor of the key decision-making Executive Council, and Laura Cha Shih May-lung, chairwoman of Hong Kong Exchanges and Clearing.

Why I am making ‘good trouble’ for Hong Kong, the city I love

Why I am making ‘good trouble’ for Hong Kong, the city I love

One of the major debates centred on Roach’s argument that Hong Kong’s development would be trapped by the mainland Chinese economy, which he said had “hit a wall” due to a combination of structural problems, cyclical pressures in the property market and local government financing vehicles.

Chiu, whose company had a hotel and property development portfolio in Hong Kong, the mainland, Malaysia and the United Kingdom, struck an optimistic note and said China’s recently announced 5 per cent annual growth target was “remarkable”.

“The growth rates over the years were already an economic miracle. You can’t expect China to continue to move at that pace,” he said.

China’s full-year gross domestic product growth averaged 9 per cent from 1992 until 2023, reaching a peak of 14.3 per cent in 1992 and a record low of 2.2 per cent in 2020 amid the Covid-19 pandemic.

Chiu said he expected Beijing’s vision in technology advancement, delivered by state leaders during the “two sessions” gatherings, would be a promising driving force for its economy in the year ahead, although he said the mainland’s overbuilt property market was still worrying.

“When I went to Heilongjiang, [there were] miles and miles of empty units. Frankly speaking, houses that were overbuilt are going to take a long time to digest, could be a decade,” he said.

“No matter what Beijing wants to do, it is not easy.”

For the year ahead, Chiu, whose conglomerate is a medium-sized developer in Hong Kong, said potential interest rate cuts by the US Federal Reserve and the recent lifting of extra stamp duties locally would give a timely lift to the city’s stagnant property market, which supplies 14,000 new private homes annually.

“Transaction numbers will go up by 20 to 30 per cent in a year. Price won’t go up that much, 5 per cent at most [over the same period],” he estimated.

“Digestion will be better because worldwide interest rates will come down by July or August – that’s the pattern in every US presidential election year. This will definitely help Hong Kong.”

Hong Kong is fast-tracking domestic security legislation, as required under Article 23 of the city’s mini-constitution, while China’s annual political gathering takes place.

Roach weighed in on X, formerly known as Twitter, on Sunday, saying the swift scrutiny underscored his concerns that the city “had lost political autonomy”.

In defence of the Article 23 bill, Chiu said: “Beijing always intends to keep Hong Kong a very free city, in terms of travel and people’s way of life.

“The quicker we complete the legislation, the quicker Hong Kong can focus back on business, where our strength lies.”

Hong Kong lawmakers raise concerns at scope of Article 23 interference offence

Hong Kong lawmakers raise concerns at scope of Article 23 interference offence

The bill proposes life imprisonment for treason and increased sentences for crimes such as sedition, sparking concerns in the international community over an erosion of freedoms and a potential chilling effect.

Amid such concerns and a shrinking workforce, Chiu said attracting talent, in particular non-mainland Chinese, had become ever important for Chief Executive John Lee Ka-chiu’s administration.

He called for targeted visa policies and a relaxation of relevant admission schemes.

“I am not saying that [officials] did nothing to lure talent. The problem with Hong Kong now is that foreigners don’t want to come,” he said.

“Getting more international is always the key to Hong Kong’s success.”