KANSAS CITY, Mo. — Jackson County property owners have until Sunday, Dec. 31, to pay their property tax bills.

After Sunday, those who haven’t paid their property taxes will be charged a late fee.

Chris Goode, the owner of Ruby Jean’s Juicery, which has multiple locations across the metro area, says he has run out of time.

“It seems so real and so heavy today because this is the last business day of the year,” he said.

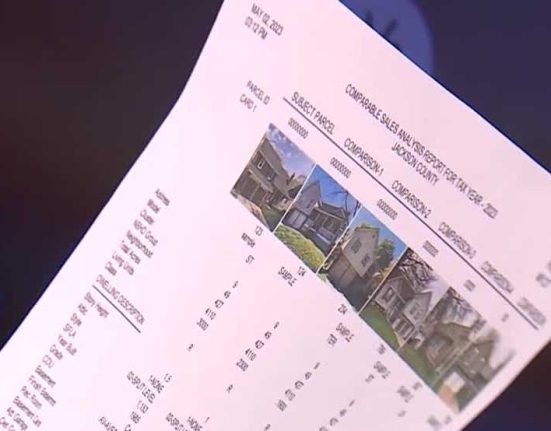

Last year, the taxes on the Ruby Jean’s Juicery building at 3000 Troost were just over $3,300. This year they’re estimated to be $25,000.

“You know, encountering a property tax increase of 657%, it’s like you climb this mountain and you get there and you’re like, ‘Oh!’ There’s an entirely new mountain,'” Goode said.

It’s a mountain he worries he might not be able to climb.

“It just, it’s hard to swallow,” he said. “Honestly, it’s not hard to swallow, it’s really impossible to swallow.”

He worries that climbing taxes will someday drive him out of business.

“Because you think if we got up to $25,000 on this run, what’s the next time look like?” he said.

It begs the question: When you put on the squeeze on small business, what happens when you get every last drop?

“I see our city going like this,” Goode said while pointing upwards. “And I just don’t want myself, Ruby Jean’s and other small businesses to be left here,” he gestured downwards.

The business means a lot to Goode and its patrons. It brings health to the east side in a location Goode fought for because he grew up there.

“The day I closed on this property, you know, I sent it to my family, like, ‘Hey, you know, we bought the bread store,’” he said. “And today it’s like, damn, how could it even shake out like that?”

—