The last day of the fiscal year is June 30, which means some bills are coming due.

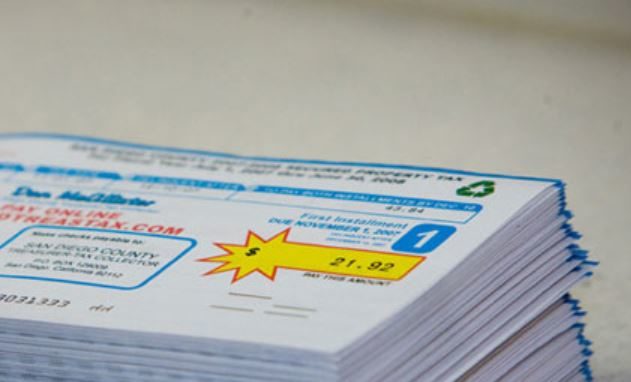

San Diego County Treasurer-Tax Collector Dan McAllister Friday reminded property owners who are already delinquent in paying their property taxes that the next deadline to pay is Monday, July 1.

Unpaid first or second installment bills, which were due November 2023 and February 2024, are now past due and have incurred a 10% penalty, plus a $10 fee for the second installment.

After July 1, 2024, bills go into default and incur heavier penalties.

“I want to spread the word as far as possible, and you’re going to hear this same message from me over the next 10 days: There is still time to avoid additional penalties if the bills are paid by July 1,” McAllister said.

“In May, we sent 41,245 delinquent notices to property owners who did not pay all their 2023-2024 property taxes, reminding them of the deadline.

“Unpaid bills will go into default and receive an additional $33 redemption fee plus penalties that can add up to 18% a year — that’s hefty.”

Because the normal June 30th deadline falls on a Sunday, taxpayers get an additional day to pay, a statement from McAllister said. After July 1, those unpaid bills will go into default and receive additional penalties of 1.5% each month.

“Property taxes fund essential county and city services,” McAllister said. “Public health, public schools and many more critical services are funded by these tax dollars.”

Taxpayers can pay by:

-Going online to sdttc.com and paying before midnight, July 1;

-Mailing a payment that is postmarked before or on July 1;

-Calling the County Treasurer-Tax Collector’s office at (855) 829-3773; or

-Going in person to one of the three branch offices in Chula Vista, Santee, or San Marcos before 5 p.m., July 1.

The total remaining taxes due in the county is $180 million, an increase of $7 million over last year. However, the Treasurer-Tax Collector’s office has collected 98.96% of first installments and 98.19% of second installments, bringing the total overall paid taxes to 98.58%.

City News Service contributed to this report.