LINCOLN — A state legislative committee began working Tuesday to craft a proposal to reduce property taxes statewide by another $1 billion, as called for by Gov. Jim Pillen.

The Revenue Committee didn’t vote out any bill on the issue, but its chair, State Sen. Lou Ann Linehan, floated the idea of raising the state sales tax by 1-cent and using the $531 million generated to increase state aid to K-12 schools.

She said she’s considering a plan to reduce the current cap on the property tax levy allowed to schools from $1.05 to something lower, which would focus the tax relief toward districts that have had the highest tax levies in the state.

“It’s just an idea,” Linehan said, after the nearly three-hour discussion behind closed doors.

“There’s a lot of unknowns here,” she added.

More discussions are scheduled this week by the eight-member committee, which crafts state tax proposals. With 25 days left in the 60-day session, there’s some urgency to get a tax bill out for floor debate.

Sales tax hike still considered

But the idea that a 1-cent hike in state sales taxes — raising it from 5.5 cents to 6.5 cents — is still being considered is a development, particularly in light of harsh opposition to a tax increase from business-related groups including the Nebraska Chamber of Commerce, Americans for Prosperity and the Platte Institute.

But Pillen, a hog producer, has stuck to his guns, saying he wants a total 40% reduction in local property taxes, even if state lawmakers need to keep meeting “until Christmas.”

To get to 40% would mean an additional $1 billion reduction on top of a $1 billion drop that has been approved in recent years by the Legislature.

The Pillen administration has proposed several ideas to get there, including the sales tax increase and the elimination of several sales tax exemptions on things like farm repair parts, candy and pop and legal/accounting bills, plus a harder “cap” on spending increases by schools and other local governments.

Once, during the executive session, Linehan told the committee that she didn’t see how they could come up with $1 billion in new revenue to shift the cost off property.

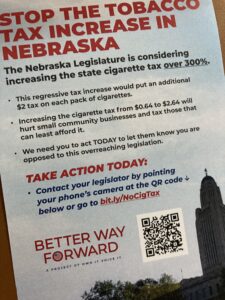

That appeared to be a recognition of the opposition that has been mounted against a proposed $2-a-pack increase in cigarette taxes, a new tax on vaping products and new taxes on veterinary services for pets and storage unit rentals.

The tobacco industry, in particular, has beefed up its lobbying presence at the State Capitol and sought to increase public opposition.

Compromises offered

Linehan did tell the committee that the tobacco lobby would settle for a lower tax increase, eventually raising the per-pack state tax by $1.50, and that representatives of the vaping industry are also willing to compromise.

But every compromise would leave less new revenue to reach the goal of $1 billion in property tax relief.

Linehan said her idea about lowering the property tax levies of school districts would give the public a clear idea of how revenue from a sales tax increase would be used.

“Nobody is going to support a sales tax increase if they don’t know what they’re getting for it,” she said.

Two advocates for rural schools — Dave Welsch, a school board member from Milford, and Jack Moles of the Nebraska Rural Community Schools Association — said Linehan’s proposal sounds somewhat like the so-called “Nebraska Plan” that they have been promoting in recent years.

‘Nebraska Plan’ again introduced

Under the Nebraska Plan, introduced as Legislative Bill 1150, the valuation of agricultural and residential property would be lowered in calculating a school district’s state aid, which would increase their “needs” under the formula and result in more state aid for many districts.

Both the Nebraska Plan and Linehan’s idea would seek to narrow the gaps among the property tax levies of the state’s 244 school districts. Last year, they varied from a low of 34 cents at the rural Humphrey schools to $1.05 at Lincoln and Millard schools.

Welsch, a farmer, has long argued that it’s unfair for him to pay property taxes on a local school levy of 92 cents while the levy for a neighbor in an adjacent school district is half that.

The Legislature’s Education Committee took testimony Tuesday on the latest version of the Nebraska Plan but took no action on LB 1150 after the public hearing.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX