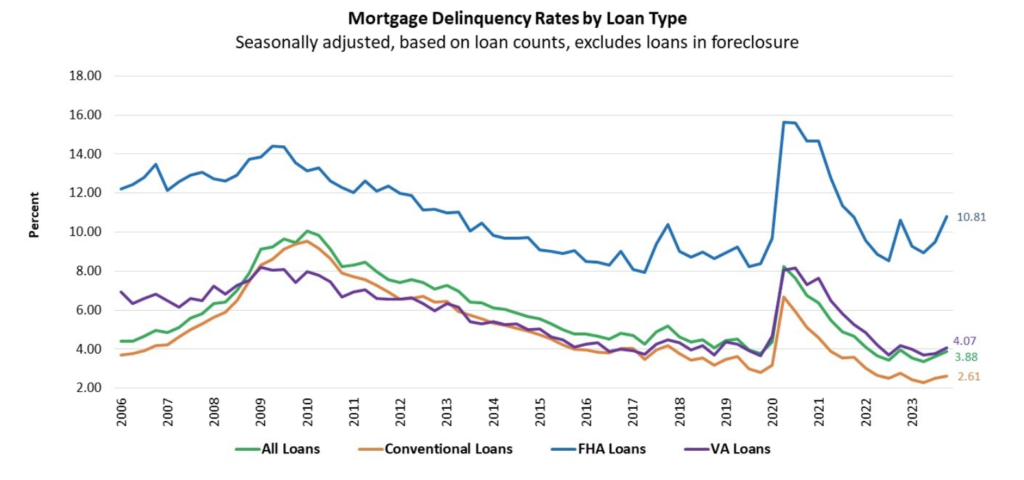

The national mortgage delinquency rate was 3.88% as of the end of the fourth quarter, up 26 basis points compared with the third quarter but down 8 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

Of particular note, FHA delinquencies were up 131 basis points.

The percentage of loans on which foreclosure actions were started in the fourth quarter remained unchanged at 0.14%.

“Mortgage delinquencies increased across all product types for the second consecutive quarter,” says Marina Walsh, CMB, vice president of industry analysis. “While the overall delinquency rate is still very low compared to the historical average, the pace of new loans entering delinquency picked up and some loans moved into later stages of delinquency. The resumption of student loan payments, robust personal spending, and rising balances on credit cards and other forms of consumer debt, paired with declining savings rates, are likely behind some borrowers falling behind at the end of 2023.”

“The labor market is still quite resilient with the unemployment rate – strongly correlated with mortgage performance – remaining at 3.7 percent in January,” Walsh adds. “Any weakening in employment conditions would likely lead to more borrowers falling behind on their payments in the coming quarters.”

By stage, the 30-day delinquency rate increased 7 basis points to 2.10%, the 60-day delinquency rate increased 11 basis points to 0.73%, and the 90-day delinquency bucket increased 7 basis points to 1.05%.

By loan type, the total delinquency rate for conventional loans increased 11 basis points to 2.61% over the previous quarter. The FHA delinquency rate increased 131 basis points to 10.81%, the highest level since the third quarter of 2021. The VA delinquency rate increased by 31 basis points to 4.07%.

The historical average for the seasonally adjusted mortgage delinquency rate from 1979 through 2023 is 5.25%.