A HOMEOWNER said he has been stuck with $180,000 left to pay on his mortgage despite his older age.

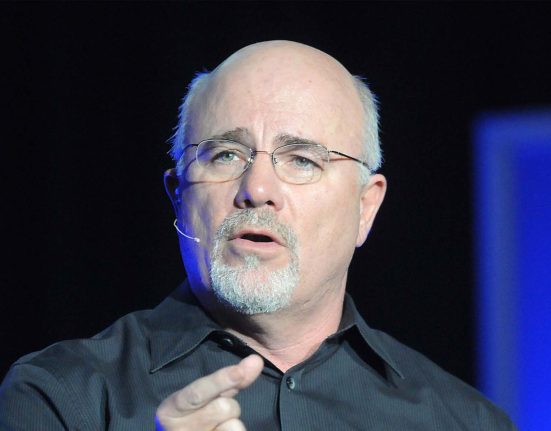

David Turoff, 73, explained why he had no regrets about retiring with a mountain of debt.

Turoff, from Placerville, California, around 40 miles east of Sacramento, said he had to make a change on his paid-off home years ago.

The retiring veterinarian explained he had to refinance his two-bedroom home during the 2008 financial crisis, according to The New York Times.

He decided to take out cash to keep his veterinarian practice afloat during the recession.

“I’m glad I did it,” Turoff said.

“[But] it was definitely a risk.”

There are other people like him, roughly about 31% of homeowners in their 80s still have mortgages, according to the NYT.

Despite having bought their homes years before, many have been put in a difficult financial situation due to changing economic factors.

These have included rising interest rates and house prices.

Other less obvious factors have also increased for homeowners like property taxes and insurance rates.

The changing housing market and rising associated costs have affected other seniors, The U.S. Sun has previously reported.

A couple from Lebanon, New Hampshire, around 50 miles northwest of Concord, explained why they felt trapped in their paid-off home.

Susan Apel and Keith Irwin purchased their property 24 years ago but had been priced out of the housing market for a smaller home.

The couple explained that their house no longer worked for them as Apel had difficulties using the stairs and Irwin struggled with yard work.

As they had paid off their mortgage before retiring, the couple hoped to use the equity to sell up and purchase a smaller place.

Senior housing troubles

Due to the changes in the housing market, there are a slew of reasons why older homeowners are unable to downsize today.

From 1989 to 2022, homeowners aged 65 to 79 with mortgages climbed to 41% from 24%, according to the Harvard Joint Center for Housing Studies.

The amount they owed also went up from $21,000 to $110,000, adjusted for inflation.

Median home equity has also gone from $80,000 in just three years, to $250,000 in 2022.

The Center for Retirement Research at Boston College recently reduced its estimate of the proportion of American households at risk of being unable to maintain their standard of living after retirement.

It dropped from 47% in 2019 to 39 % in 2022 – 8% in three years.

In 2022, only 64,500 older applicants received reverse mortgages through the US Department of Housing and Urban Development.

Cash-out refinancing by homeowners over age 65 dropped to 600,000 in 2022 from 941,000 in 2021.

The couple estimated their home would now be worth $700,000.

They said they were looking for a small condo but struggled as one-floor homes were being purchased quickly and more four-level townhouses were being built.

Apel and Irwin also explained how the post-pandemic move by people from cities to smaller towns like theirs had impacted their house hunt.

The older couple said one of the properties they had come across was on the market for $950,000.

Even younger homeowners have complained about the effects mortgages were having on their house hunts.

A mother said she was unable to upgrade and move into a bigger home after she suffered from the “lock-in effect.”