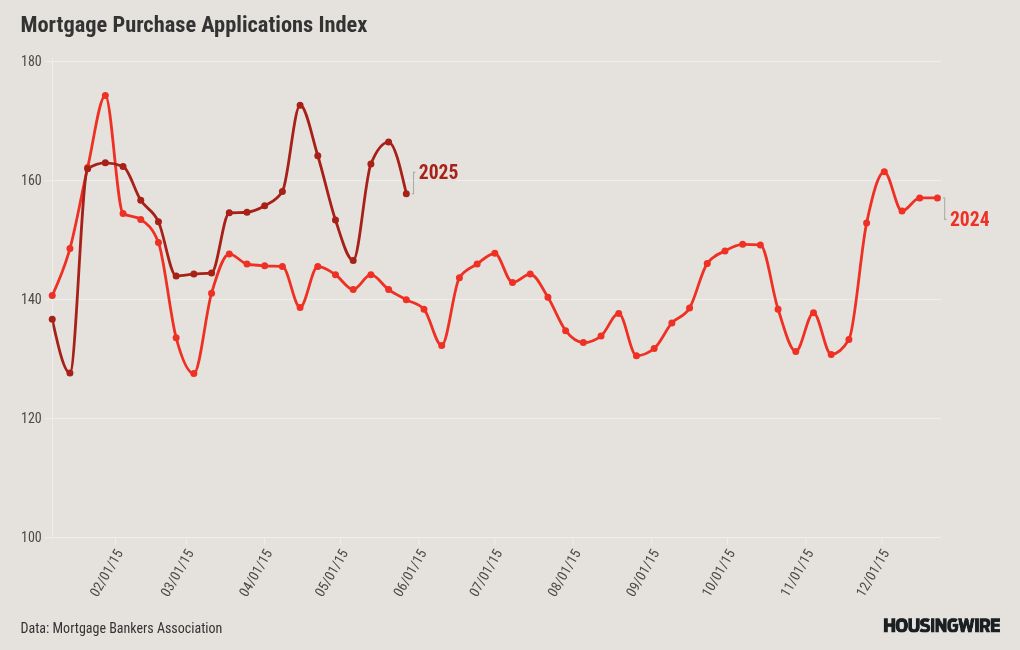

On an unadjusted basis, the index decreased 5% compared with the previous week.

The refinance index also decreased 5% from the previous week and was 27% higher than the same week one year ago. The refinance share of mortgage activity increased to 36.6% of total applications from 36.4% the previous week.

The adjustable-rate mortgage (ARM) share of activity decreased to 7.1% of total applications. By product, the FHA share of total applications continued to tick up, increasing to 17.9% from 17.4% the week prior. The VA share of total applications decreased to 12.6% from 13.4% and the USDA share remained unchanged at 0.5%.

The seasonally adjusted purchase index decreased 5% from one week earlier. The unadjusted purchase index decreased 6% compared with the previous week but was 13% higher than the same week one year ago.

“Mortgage rates jumped to their highest level since February last week, with investors concerned about rising inflation and the impact of increasing deficits and debt,” said Mike Fratantoni, MBA’s SVP and chief economist. “Higher rates, including the 30-year fixed rate increasing to 6.92%, led to a slowdown across the board. However, purchase applications are up 13% from one year ago.”

Across the board, average contract interest rates increased. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 6.92% from 6.86% and 30-year fixed-rate mortgages with jumbo loan balances increased to 6.94% from 6.85%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to 6.60% from 6.59% and 15-year fixed-rate mortgage rates increased to 6.21% from 6.12%.

The average contract interest rate for 5/1 ARMs increased to 6.16% from 6.09%