April mortgage rate forecast

Mortgage rates shouldn’t change much in April, as inflation remains stubbornly elevated.

The inflation rate has been falling since October 2022, but progress has felt as maddeningly slow as the driver who doesn’t notice when the light turns green. Inflation’s decline is likely to continue its glacial pace in April. Mortgage rates are influenced by the inflation rate, so if they move much in April, they’re more likely to fall than to rise. Either way, the change probably won’t be by much.

A tentative tone from the Fed

Mortgage rates wandered up and down in March, without consistent direction. That trajectory matched the month’s economic data, which didn’t have a coherent story to tell. The Federal Reserve‘s rate-setting committee kept short-term rates unchanged at the March meeting and set a wishy-washy tone about the future.

“Inflation has eased substantially while the labor market has remained strong, and that is very good news. But inflation is still too high, ongoing progress in bringing it down is not assured, and the path forward is uncertain,” Fed Chair Jerome Powell said at a news conference following the March 20 meeting.

The Fed’s next rate meeting ends May 1. As of the end of March, traders in the interest rate futures market believed the chance of a Fed rate cut at that meeting was less than 10%, according to the CME FedWatch tool. They’re betting on a rate cut at the June 12 meeting. Mortgage rates might remain relatively static until a rate cut appears to be imminent.

More homes on the market, more sales

Lisa Sturtevant, chief economist for Bright MLS, a database of properties for sale in the mid-Atlantic region, said via email that she expects mortgage rates to remain fairly steady in April, “perhaps ending the month a little below where they started at the beginning of the month. But I think it’s going to be movements in inventory, not rates, that drive homebuying activity this spring.”

In her region, there’s been an increase in people listing their homes for sale, she said. “More supply coming onto the market — rather than rate movements — could be the factor that causes buyers to jump into the market this spring.”

She added that the spring homebuying season “could extend into summer as home buyers wait for lower rates and more listings.”

» MORE: Buying a home: 15 steps

What other forecasters say

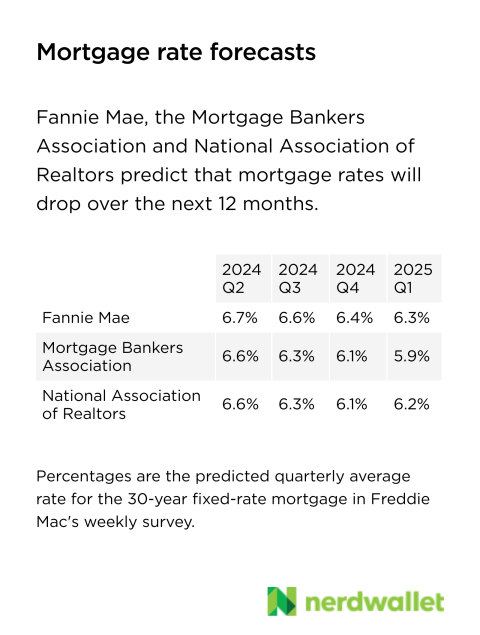

Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors all predict that mortgage rates will fall over the next 12 months. But they don’t expect much of a drop from April through June. In Freddie Mac’s weekly rate survey, the 30-year mortgage averaged 6.75% from January through March, and forecasters predict that it will average a tad lower in the second quarter.

Looking back at March’s prediction

At the beginning of March, I wrote that the month’s “mortgage rates are likely to remain about the same because the economy hasn’t cooled off enough yet to cause them to fall.” The accuracy of that prediction depends on how you look at it.

For the whole month, the average rate on the 30-year mortgage was almost the same in both months: 6.78% in February and 6.82% in March, according to Freddie Mac’s weekly index. From that perspective, the forecast was accurate.

But each of those is the average for the entire month. When you zoom in, rates behaved differently in each month. They went up from the beginning of February to the end, and went down in March. From that perspective, the forecast was inaccurate.

The article April Mortgage Rates Will Be Stuck in Neutral as Inflation Idles originally appeared on NerdWallet.