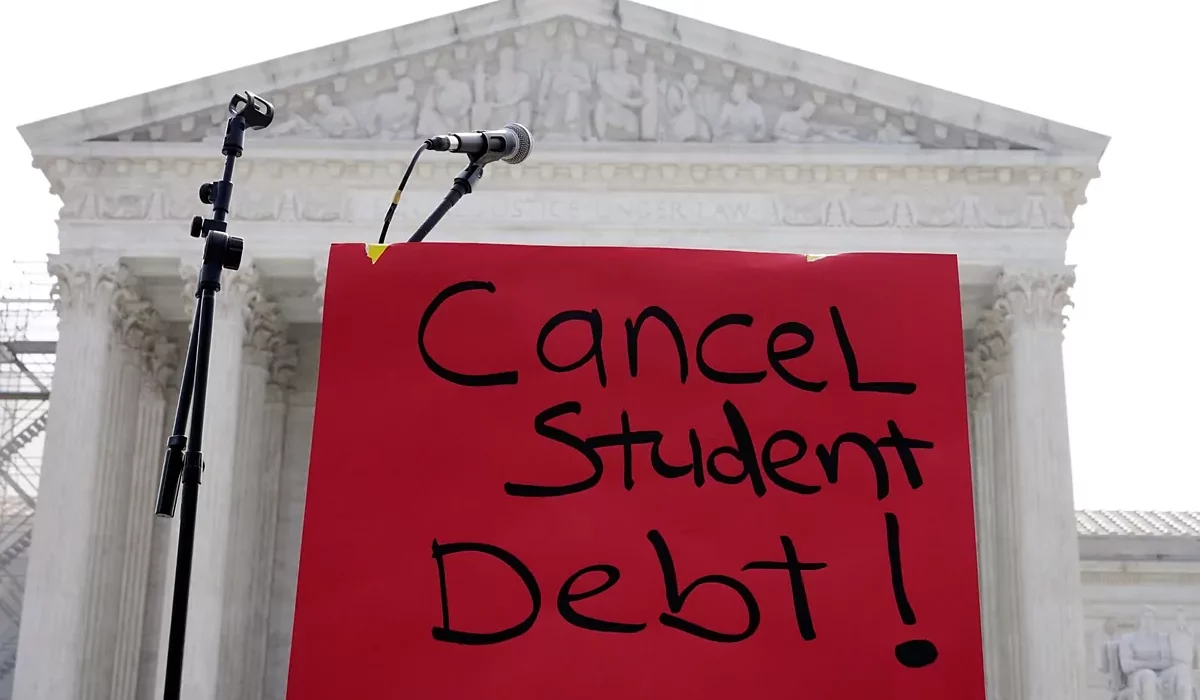

In a surprising move, some student borrowers could be in for a pleasant surprise next month as President Joe Biden announces a plan for debt forgiveness. If you’ve taken out less than $12,000 in loans and have been in repayment for a decade, your remaining loan balance could be “canceled immediately” under the new Saving on a Valuable Education repayment plan (SAVE plan).

President Biden highlights the plan’s focus on assisting community college borrowers, low-income individuals, and those struggling to repay loans. He expresses the administration’s commitment to providing relief quickly, allowing borrowers to move forward with their lives.

The eligibility criteria for the new forgiveness plan are clear. Those who initially borrowed $12,000 or less and have been in repayment for a decade qualify. Additionally, enrollment in the SAVE plan is a requirement for eligibility. The forgiveness process is set to begin in February, offering relief earlier than expected.

The SAVE plan stands out for its unique feature of canceling debt for certain borrowers after a decade in repayment, a significant improvement compared to the older plans that required 20 to 25 years of payments for forgiveness. The Biden administration’s recent announcement brings more good news for eligible borrowers, advancing the debt cancellation timeline by nearly six months, reflecting the administration’s proactive approach to addressing student loan challenges.

6.9 million borrowers are already enrolled

The Department of Education aims to encourage more borrowers to sign up for the SAVE plan, particularly those eligible for immediate forgiveness. Approximately 6.9 million borrowers are already enrolled, with around 3.9 million enjoying monthly payments as low as $0.

President Biden emphasizes the positive impact of the forgiveness plan on community college attendees, low-income borrowers, and those facing repayment challenges. The administration’s commitment to easing the burden of student loan debt aligns with its broader efforts to support individuals pursuing their dreams.

If you meet the criteria-enrollment in the SAVE plan, borrowing $12,000 or less in student loans, and being in repayment for a decade or longer-early forgiveness may be within reach. Experts recommend swift enrollment in the SAVE plan for those not currently signed up, taking advantage of the upcoming relief. The administration’s accelerated timeline ensures eligible borrowers can soon experience the benefits of reduced financial strain and an expedited path to debt-free futures.