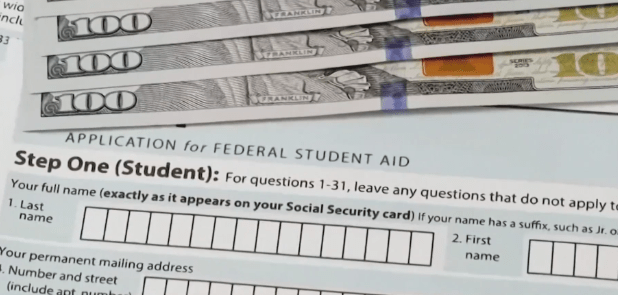

STATESBORO, Ga. (WSAV) – College freshmen become some of the youngest debtholders in the country. According to federal student aid, the average student loan debt in Georgia is $40,000, and it can take a long time to pay back.

“I’m not really sure like how much I’m going to owe by the end of this,” said Mason Horne, a freshman at Georgia Southern.

On average undergraduates will spend 10 years of their life paying for their education.

“It’s a little stressful knowing that I’m only a freshman and I’ll have to pay that back in four years,” said Maggie Wilson, GSU freshman.

On top of that, trying to make student loan payments using an entry-level salary can be a challenge.

“I always recommend seeing which [payment plan] fits you the most,” said Blake Mercer, associate director of student aid at GSU. “Life after graduation there can be some uncertainty. you could have a period of where you have no job.”

Mercer says recently there’s a new challenge. Since the white house’s federal loan pause ended in October, several COVID graduates are missing payments.

“There are some students who had been graduated since 2020 and never had to make a student loan payment so it was a new shock to them,” said Mercer. “The thing about federal loans is they’re going to find you… They will make sure they get their cut.”

Missing payments could lead to delinquency which leads to a default status – meaning they can take from your wages or affect your taxes.

“You never want to default on your loan,” said Mercer.

He says it’s typical for people to have lots of questions. His best recommendation is to know your lender.

“The federal lenders are so willing to work with students now,” said Mercer.

His highest recommendation was the federal SAVE Plan. It works with your income and even accounts for dependents you might care for. After all, the highest average debt belongs to people aged 25-50.

“They really are making a system that’s trying to help students out,” said Mercer.

The SAVE Plan covers some of the interest on payments, and it could even forgive your debt entirely after ten years if you never borrowed over $12,000.

“If there’s help out there, why not use it if you need it,” said Mercer.

There are no income requirements for the SAVE Plan, and it doesn’t matter how long ago you took out loans.

Mercer says his department will also help past graduates find a plan if they need help.