The pressure to reprice loans in the key home mortgage and local government debt sectors will likely cloud Chinese banks’ revenue outlook in 2024.

Chinese regulators have urged banks to ease the burden on real estate buyers as part of attempts to support a recovery in the sector, which makes up nearly a quarter of the economy. Pressure is also building on lenders’ exposure to local government financing vehicles (LGFVs), which provide funds to town councils or provincial governments.

“The major risks faced by commercial banks in China are pressure for revenue growth, and how the impact of related interest rate reductions [as a result of repricing existing mortgage loans] will reflect on financial performance from the fourth quarter of 2023,” said Calvin Zeng, China banking and capital markets sector leader at Deloitte.

The National Administration of Financial Regulation (NAFR), the umbrella regulator for the financial sector, allowed banks to cut rates on existing mortgages in September. The People’s Bank of China maintained an easing bias for most of 2023 as part of efforts to support the economy. China’s gross domestic product growth may stay close to the 5.0% target for 2023, but a prolonged housing market downturn and weak consumption continue to drag on the world’s second-biggest economy. GDP grew 5.2% in the January-to-September period, compared with 3.0% in full year 2022.

Helping hand

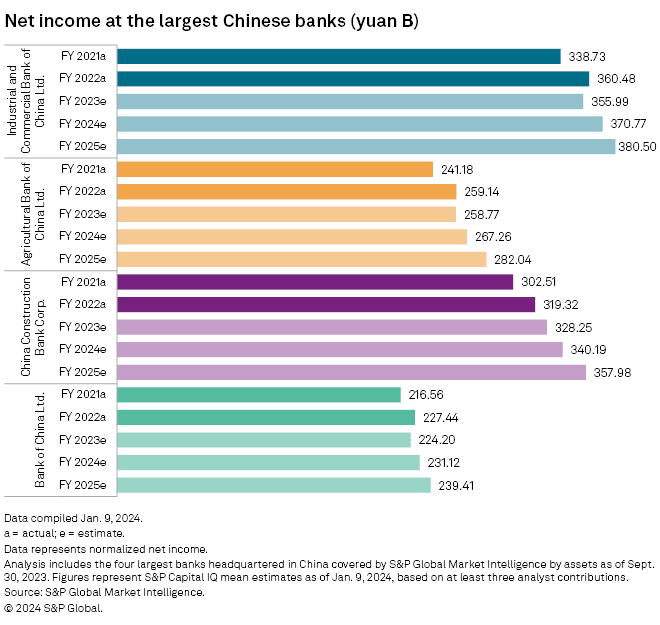

Large banks, especially the four mega lenders — Industrial and Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd. — are expected to help authorities support the economy, especially the real estate sector, by, among other things, implementing mortgage rate cuts, for example.

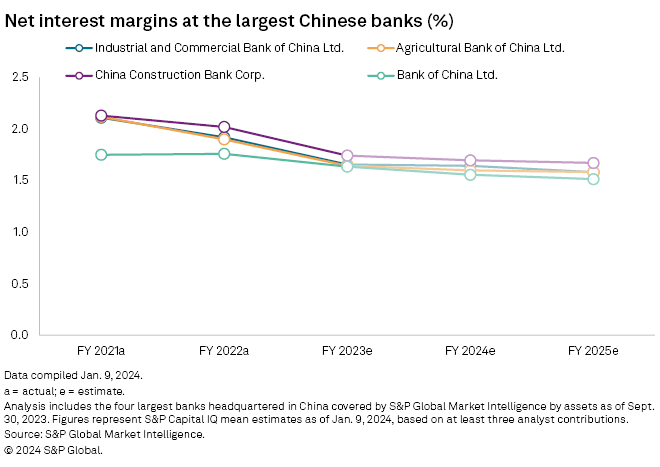

Chinese banks’ net interest margins (NIMs) have been squeezed as a result of lower loan interest rates and stagnant deposit costs, and they are likely to stay pressured as a result. Among them, all of the big four banks are facing further NIM decline in 2024 and 2025, according to S&P Global Market Intelligence data, after severe drops in 2023.

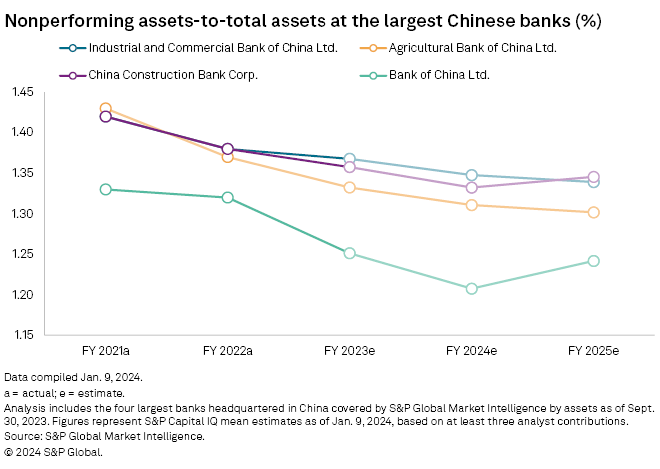

Banks’ asset quality has remained stable through most of 2023 but could come under pressure, especially if the country’s housing market deteriorates further. S&P Global data showed that the nonperforming loan ratio, a key indicator of loan quality, of ICBC and AgriBank may stay flat while that of Construction Bank and Bank of China could head higher into 2025.

Credit risk

“The credit risk exposure related to the real estate industry may continue to expand even if more proactive policy and regulation are promulgated,” said Zeng, who added that some developers may still fail. “It is an inevitable choice for those defaulting real estate companies to seek credit restoration through debt restructuring in the coming one year.”

The LGFV sector will also possibly require help, with financiers to local governments themselves facing financial strain. LGFVs depend on government land sales as a key source of income, which has been greatly reduced amid the downturn in the real estate sector.

“Large scale … local government debt restructuring could take place in 2024 and 2025,” Ning Zhang, senior China economist at UBS, told S&P Global Market Intelligence on Jan. 4. Banks “will likely … accept lower interest rates and extended maturities to keep these loans from nonperforming,” Zhang added.

Local government debt

The net increase in aggregate local government debts was 5.57 trillion yuan in the first 11 months of 2023, according to Ministry of Finance data, to 40.64 trillion yuan. However, the total volume of debt remained below the 2023 statutory ceiling of 42.17 trillion yuan that the 14th National People’s Congress approved in March 2023.

Although LGFVs’ credit risk is unlikely to materialize in the near-to-medium term, loan repricing to a lower interest rate could weigh on the NIMs of the big four banks, with the exact impact still “highly uncertain,” said Frank Zheng, equity research analyst at UBS.

“Rate cuts, early repayment of mortgages, loan repricing and strong deposit growth are also putting pressure on NIMs,” said Ryan Tsang, managing director and analytical manager at S&P Global Ratings. “Such factors will weigh on the banks’ profitability over the next couple of years,” but problem loans “will trend down gradually” despite continuing stresses in the property and LGFV sectors, Tsang said.

“The banks’ performance will be polarized as these pressures will hit different banks differently,” Tsang said, adding that larger national banks will perform better than some of the smaller regional lenders, especially those operating in regions with weaker economies.

“Chinese banks are well aware of the property and LGFV risks, but they also have to answer central and local (governments’) calls on the policy front,” according to a Dec. 11 Ratings note. Large banks seem well prepared for this balance act and should be able to serve their mandates while protecting their credit profiles and limiting systemic risks.