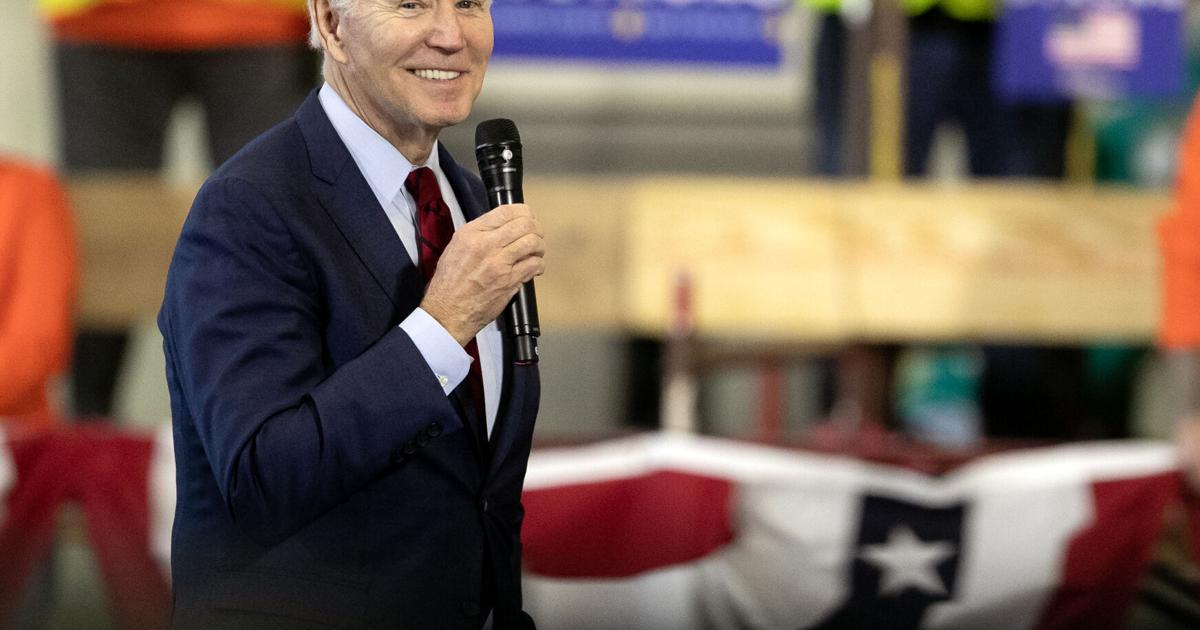

Democratic President Joe Biden will unveil his latest effort to expand student loan relief when he visits Madison on Monday, according to news reports.

Citing unnamed sources, The Wall Street Journal first reported Friday the Biden administration plans to propose reducing or eliminating student outstanding loans for millions of borrowers. The Wall Street Journal story and a similar article in The Washington Post said the announcement would be made in Madison, home to the flagship campus of the Universities of Wisconsin.

The effort would mark Biden’s second attempt at large-scale loan forgiveness after the U.S. Supreme Court last year overturned the administration’s first debt cancellation plan, which proposed eliminating up to $20,000 in student debt for borrowers earning less than $125,000 a year.

People are also reading…

The White House has not yet said where or when Biden will be in Madison, but the visit will be the president’s third to the battleground state this year.

The plan that Biden will detail seeks to expand federal student loan relief to new categories of borrowers through the Higher Education Act, which administration officials believe puts it on a stronger legal footing than the sweeping proposal that was killed by a 6-3 court majority last year, according to The Washington Post.

Many of the specifics that Biden will discuss Monday have long been telegraphed through a negotiated rulemaking process at the Department of Education, which has worked for months to hash out the new categories of borrowers. The president announced immediately after the Supreme Court decision that Education Secretary Miguel Cardona would undertake the process because he would have the power under the Higher Education Act to waive or compromise student loan debt in specific cases.

“This new path is legally sound,” Biden said in June. “It’s going to take longer, but, in my view, it’s the best path that remains to providing for as many borrowers as possible with debt relief.”

Targeted forgiveness

Biden’s latest attempt at cancellation is expected to be smaller and more targeted than his original plan, which would have canceled up to $20,000 in loans for more than 40 million borrowers. Details of the new plan have come into focus in recent months as the Education Department brought its ideas to a panel of outside negotiators with an interest in higher education, ranging from students to loan servicers.

“President Biden’s expected additional executive action will greatly reduce the burden of student loans for millions of Americans,” Senate Majority Leader Chuck Schumer, D-N.Y., said Friday. “There is always more work to be done to alleviate the burden of student loan debt. And we will not stop until crippling student loan debt is a thing of the past.”

Through that process, the agency laid out five categories of borrowers who would be eligible to get some or all of their federal loans canceled. The plan is focused on helping those with the greatest need for relief, including many who might otherwise never repay their loans.

Among those targeted for help are individuals whose unpaid interest has snowballed beyond the size of the original loan. The proposal would reset their balances back to the initial balance by erasing up to $10,000 or $20,000 in interest, depending on a borrower’s income.

Borrowers paying down their student loans for decades would get all remaining debt erased under the department’s plan. Loans used for a borrower’s undergraduate education would be canceled if they had been in repayment for at least 20 years. For other types of federal loans, it’s 25 years.

The plan would automatically cancel loans for those who went to for-profit college programs deemed “low-value.” Borrowers would be eligible for cancellation if, while they attended the program, the average federal student loan payment among graduates was too high compared to their average salary.

Those who are eligible for other types of cancellation but haven’t applied would automatically get relief. It would apply to Public Service Loan Forgiveness and Borrower Defense to Repayment, programs that have been around for years but require infamously difficult paperwork.

Under pressure from advocates, the department also added a category for those facing “hardship.” It would offer cancellation to borrowers considered highly likely to be in default within two years. Additional borrowers would be eligible for relief under a wide-ranging definition of financial hardship.

Rule under review

A series of hearings to craft the rule wrapped up in February, and the draft is now under review. Before it can be finalized, the Education Department will need to issue a formal proposal and open it to a public comment period.

The latest attempt at cancellation joins other targeted initiatives, including those aimed at public service workers and low-income borrowers. Through those efforts, the Biden administration says it has canceled $144 billion in student loans for almost 4 million Americans.

It’s all but certain Biden’s latest attempt will once again be met by pushback from Republicans, who have viewed loan forgiveness as an undue burden on taxpayers.

Some Republican state attorneys general told The Wall Street Journal they will likely bring legal challenges to the program once all the details are known.

“It appears that the proposal will be another attempt to circumvent the Supreme Court’s initial ruling to help the President garner votes in November,” Austin Knudsen, spokesperson for Montana’s attorney general, told the outlet.

Reporting by Wisconsin State Journal reporter Mitchell Schmidt and Associated Press reporters Seung Min Kim and Collin Binkley.

Mapping the 2024 Total Solar Eclipse: States With the Best View

Mapping the 2024 Total Solar Eclipse: States With the Best View

Photo Credit: kdshutterman / Shutterstock

On April 8, 2024, Americans in every state will have the chance to witness either a partial or total solar eclipse. Solar eclipses materialize when the moon passes between the earth and the sun, casting a shadow on the earth’s surface and partially or fully obstructing the sun from view.

Despite the relative frequency of solar eclipses, occurring approximately two to four times a year, the geographic path of totality—the region where viewers can experience the complete blockage of the sun—is small. Consequently, for individuals in any given location, the opportunity to observe a total solar eclipse is an extremely rare event. NASA notes that, on average, this phenomenon occurs roughly once every hundred years. However, some regions may experience total solar eclipses more frequently.

For instance, the most recent total solar eclipse visible in the U.S. took place in 2017, with the path of totality extending from Oregon to South Carolina. Prior to 2017, only two solar eclipses in the 20th century had totality paths that overlapped some portion of the United States. Looking ahead, the next coast-to-coast total solar eclipse won’t occur until 2045.

The 2024 Solar Eclipse Path of Totality

The April 8th solar eclipse path of totality stretches from Texas to Maine

Source: Captain Experiences analysis of NASA data shown on Google Maps. The 2024 totality path is shown in blue; the 2017 totality path is shown in purple.

Compared to the 2017 total solar eclipse, the upcoming 2024 event will boast a wider and more populated path of totality. While the totality path in 2017 averaged 60–70 miles in width, the 2024 eclipse will span approximately 110–120 miles.

Moreover, the path of totality for the 2024 eclipse encompasses a greater number of major U.S. cities compared to that of 2017—notably, several large cities in Texas. As a result, an estimated 31 million Americans will find themselves within the path of totality for the 2024 event, substantially more than the 12 million in 2017. Residents in 15 states—Texas, Oklahoma, Arkansas, Missouri, Tennessee, Illinois, Kentucky, Indiana, Ohio, Michigan, Pennsylvania, New York, Vermont, New Hampshire, and Maine—will have the opportunity to witness the moon completely blocking the sun’s view in 2024.

Largest U.S. Cities in the 2024 Solar Eclipse Totality Path

Texas is home to the top 4 largest cities in the path of totality

Captain Experiences analysis of NASA and Census data

Due to the unique path of the 2024 eclipse, Texas stands out as the state hosting the top four largest cities within the totality path and eight of the top 15. Notably, among the five largest cities in Texas—Houston, San Antonio, Dallas, and Austin—only Houston will not experience the total solar eclipse this year. Similarly, in Ohio, three out of its top four cities fall within the 2024 path of totality, including Columbus, Cleveland, and Toledo. Other major U.S. cities within the totality path are Indianapolis, IN, Buffalo, NY, Rochester, NY, and Little Rock, AR.

Another unique characteristic of the 2024 eclipse is that several large U.S. cities lie in close proximity to, though not directly within, the totality path. Residents in these cities will still have the opportunity to witness a nearly total eclipse. For instance, individuals in Memphis, TN, St. Louis, MO, Louisville, KY, Cincinnati, OH, and Pittsburgh, PA can all expect to experience at least a 95% partial eclipse.

Population Living in the Path of Totality by State

While Texas has the most residents overall living in the path of totality, Ohio has the highest proportion

Captain Experiences analysis of NASA and Census data

In terms of total population within the path of totality, Texas leads with 12.6 million residents, followed by Ohio (7.1 million), Indiana (3.9 million), and New York (3.6 million). However, when considering the states with the highest proportion of residents within the totality path, Ohio, Vermont, Arkansas, and Indiana are this year’s frontrunners. In each of these four states, more than 57% of the population resides in areas where the total eclipse will be visible.

Conversely, only tiny slivers of Michigan and Tennessee fall within the totality path. Fewer than 10,000 residents in Michigan and fewer than 1,000 residents in Tennessee are estimated to live in areas where the total eclipse can be observed.

For Americans living outside of these areas, the April 8th event will still be worth watching—albeit using eclipse safety glasses the entire time. With the exception of Florida, most East Coast residents will be able to observe a partial eclipse with 70%–90% obscuration. Maximum obscuration in Florida ranges from approximately 45%–75%. West of the totality path, obscuration will decrease the further west and north one lives. On the West Coast, maximum obscuration ranges from around 55% in San Diego to 20% in Seattle.

This study was conducted by Captain Experiences. For details about how the analysis was conducted, see the methodology section below.

Methodology

Photo Credit: kdshutterman / Shutterstock

To determine the states with the most people living in the path of totality for the 2024 solar eclipse, researchers—using data from NASA’s Scientific Visualization Studio and from the U.S. Census Bureau’s 2020 TIGER/Line Shapefiles and 2022 American Community Survey 5-Year Estimates—identified the Census tracts in each state that overlap fully or partially with the totality path. Populations for the resulting Census tracts were summed and divided by the state total population. For Census tracts that only partially overlap, populations were reduced based on the percentage of the Census tract’s area outside of the totality path.

To identify the largest places (cities, villages, boroughs, etc.) that fall within the path of totality, researchers identified the Census places that overlap fully or partially with the totality path. Only places with a 10% or more overlap with the totality path were included. Additionally, places with fewer than 1,000 people were filtered out. The approximate start time for each place was calculated by merging the Census places shapefiles with NASA’s umbra 10-second interval shapefiles, and selecting the earliest time that intersected with each place. Times were converted to Central Daylight Time or Eastern Daylight Time depending on the location.

For complete results, see Mapping the 2024 Total Solar Eclipse: States With the Best View on Captain Experiences.