President Joe Biden and top administration officials are urging borrowers to sign up for an income-driven repayment program that will allow them to receive fast-tracked student loan forgiveness.

Biden’s new SAVE plan is an IDR option that can provide affordable monthly payments tied to a person’s income and family size. Borrowers enrolled in SAVE can become eligible for student loan forgiveness after 20 or 25 years in repayment, depending on whether or not they have student debt from a graduate degree program.

But last week, the Department of Education announced that it would be implementing a provision of SAVE early, allowing certain undergraduate borrowers with low original balances to receive loan forgiveness in as little as 10 years. That benefit was not set to go into effect until next July, but will now start benefiting borrowers as soon as next month.

Here’s what to know.

Fast-Track Student Loan Forgiveness Under SAVE

Under the new student loan forgiveness rule for SAVE that the Biden administration is enacting sooner than expected, borrowers with fairly small original balances can get fast-tracked for student debt cancellation.

“Beginning in February 2024, the SAVE Plan will give borrowers who originally borrowed $12,000 or less forgiveness after as few as 10 years,” says updated Education Department guidance. Undergraduate borrowers with original balances of between $12,000 and $21,000 can get loan forgiveness in under 20 years.

Normally, only time spent in an IDR plan like SAVE can “count” toward a borrower’s student loan forgiveness term. But under a separate, related initiative called the IDR Account Adjustment, Direct loan borrowers can automatically receive “credit” toward their IDR term for nearly any past period of repayment (not just under an IDR plan), as well as certain periods of deferment and forbearance. The Covid-19 forbearance period also counts. Thus, even borrowers who have not been in an IDR plan can still potentially qualify for the fast-tracked student loan forgiveness feature. But they must enroll in SAVE now to be eligible.

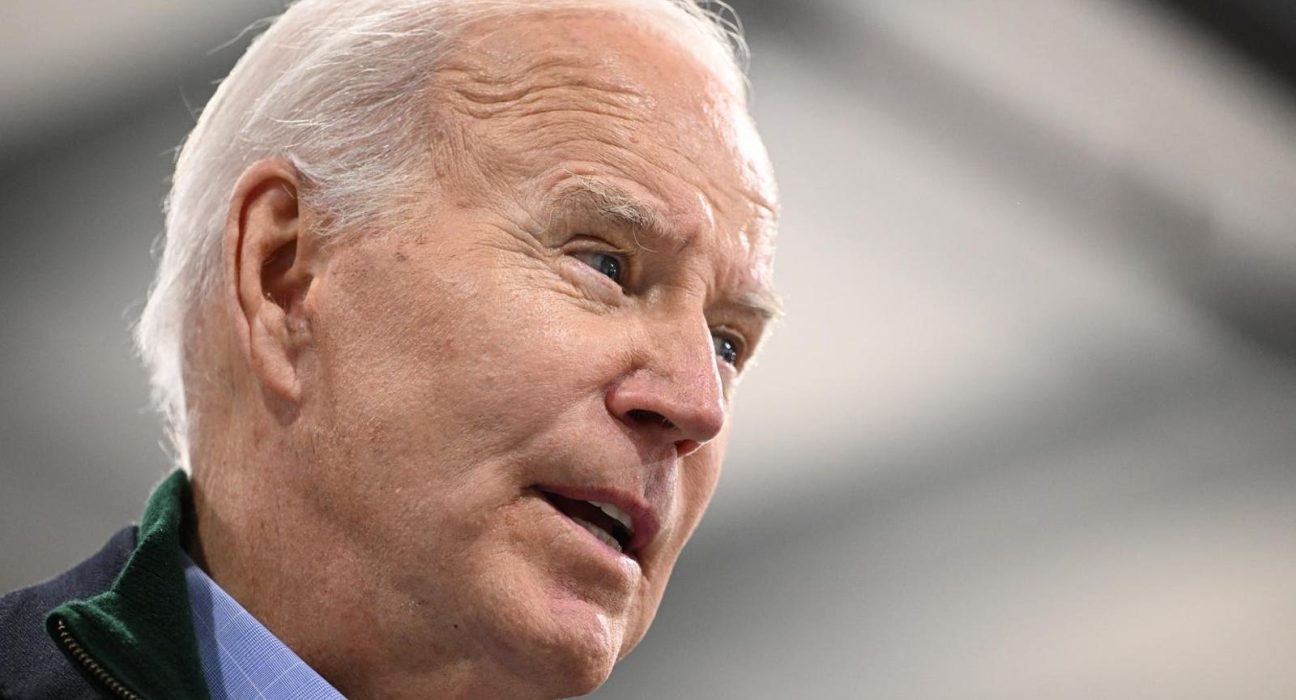

“I encourage all borrowers who may be eligible for early debt cancellation to sign up for the SAVE plan at StudentAid.gov,” said President Biden on X on Tuesday. “Already, 6.9 million borrowers are enrolled in the plan, and 3.9 million have a $0 monthly payment.”

How To Qualify For Early Student Loan Forgiveness

To qualify for the accelerated student loan forgiveness benefits of SAVE, borrowers must meet several eligibility criteria:

- Only Direct federal student loans qualify for SAVE. Borrowers with non-Direct federal student loans, like Perkins loans or FFEL-program loans, may need to consider Direct loan consolidation in order to be eligible. “If some of your loans are not eligible for the SAVE Plan, then we encourage you to consolidate all of your loans into a Direct Consolidation Loan so that you can access the SAVE Plan,” says Education Department guidance. Direct loan consolidation for these borrowers may have the added benefit of allowing them to qualify for the IDR Account Adjustment.

- To qualify for student loan forgiveness on a 10 year term, borrowers must have had an original balance of $12,000 or less. “It does not matter if your outstanding balance is higher than what you originally borrowed,” clarified the Office of Federal Student Aid in a statement on X. For each additional $1,000 in the original loan amount, the loan forgiveness term increases by one year up to a 20-year maximum for undergraduate borrowers, or 25-year maximum for graduate school borrowers.

- Even though the IDR Account Adjustment can provide retroactive “credit” toward IDR loan forgiveness (even for borrowers not currently enrolled in an IDR plan), borrowers must specifically enroll in SAVE in order to qualify for accelerated forgiveness. As an initial step, it may make sense to first determine what your monthly payments would look like under SAVE by using the Education Department’s online loan simulator.

Other SAVE Loan Forgiveness Benefits Go Into Effect This Summer

The Biden administration has been implementing SAVE in stages. The plan was first unveiled last fall as borrowers returned to repayment following the end of the student loan pause. At that time, the SAVE plan included a higher poverty limit (allowing more income to be “exempt” and, therefore, lowering monthly payments), and a generous interest subsidy that periodically cancels any accrued interest that exceeds a borrower’s monthly payment amount. Under the program, a single borrower with a family size of 1 and an income of $30,000 (or a borrower with a family size of 4 and an income of $60,000) would have a $0 monthly payment under SAVE, and effectively no long-term interest accrual.

Starting this July, additional features will go into effect. This will include a new repayment formula that will reduce the monthly payments for undergraduate borrowers by as much as 50%, and allowances for certain deferment and forbearance periods to count toward student loan forgiveness.

The accelerated student loan forgiveness timeline was set to go into effect next July as well. But following last week’s announcement, that feature will now be available for borrowers starting in February.

Further Student Loan Forgiveness Reading

Watch Your Email, Student Loan Forgiveness Approvals Should Continue This Month

6 Student Loan Forgiveness Updates To Watch As 2024 Kicks Off

Student Loan Forgiveness ‘Buyback’ Option Provides New Path To Relief