Netflix said Thursday in a letter to investors that starting next year, it will no longer reveal exactly how many subscribers it has. Telling investors about company metrics — besides profits and losses and other financial information — is something a lot of companies do.

When a company is in its infancy, there’s a decent chance it’s not yet turning a profit. So, instead of focusing on just how much money it might be losing, company leaders may point investors to some other metric that tells them, “Hey, we matter.”

“In the beginning, it’s all about getting mindshare. It’s all about land grab,” said Santosh Rao at Manhattan Venture Partners. “You need to show that, ‘Hey, we’re growing, we’re here, we are a sizable company,’” he said.

And in the place of profit margins, subscriber numbers or retail foot traffic or time spent on an app can show investors that a company could make more money in the future.

It’s sort of like how parents talk about their kids when they’re really little, said Sarah Kunst, managing director of Cleo Capital.

“When a kid is born, you say this baby is 5 days old, and then it turns to 5 months old,” said Kunst. But at some point, she says, those early measures evolve.

For instance, it would be weird if my parents started bragging about how I’m turning 405 months old tomorrow (I think I’m doing that math right).

“And so in general, as something is around longer, how we measure this changes,” she said.

In Netflix’s case, subscriber numbers aren’t the company’s whole story anymore, said Matteo Arena, a professor of finance at Marquette University.

“There might be other ways to increase the revenue and profits outside just simply increasing subscribers,” Arena said. Like selling ads on its cheaper subscription tiers, for example. It’s also a sign that the company is profitable now and more mature, he said.

“Reaching maturity for a company is almost another word for slower growth,” said Arena.

That is kind of inevitable for a company that grew really fast for years. At some point, that level of growth is unsustainable. But now, said Steve Kaplan, a professor at the University of Chicago, Netflix has the luxury of telling investors to focus on their bottom line.

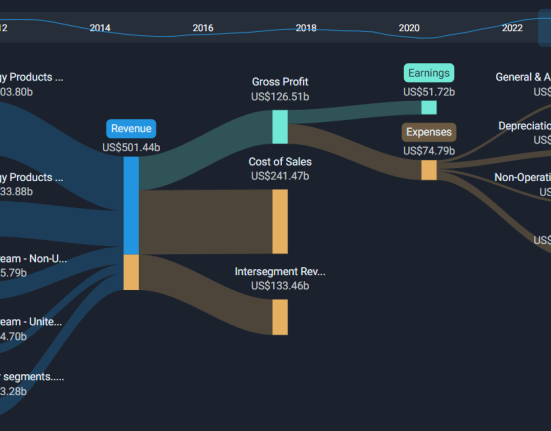

“Look at our revenues, look at our cash flows, and judge us on that. And, you know, if we’re growing those, then good things are happening,” Kaplan said.

And subscriber numbers are probably doing fine.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.