(Bloomberg) — Investors who bought into Turkey’s transformation story are unusually optimistic after the shock departure of central bank Governor Hafize Gaye Erkan, expecting her successor to intensify an orthodox push in the nearly $1 trillion emerging market.

Most Read from Bloomberg

In the past, surprise late-night changes at Turkey’s central bank have fueled periods of financial stress. This time appears different, investors said, thanks largely to the new governor’s credentials — including work as an economist at the New York Federal Reserve, his reputation since he joined the revamped Monetary Policy Committee last year, and the blessing of market-friendly Finance Minister Mehmet Simsek.

“Replacing Erkan, whose credibility got hurt by personal issues, with a former Fed economist will positively impact the lira in the medium term,” said Evren Kirikoglu, founder of Orca Macro. “I see more rate hikes are now possible to maintain the central bank’s credibility, which is also lira-positive.”

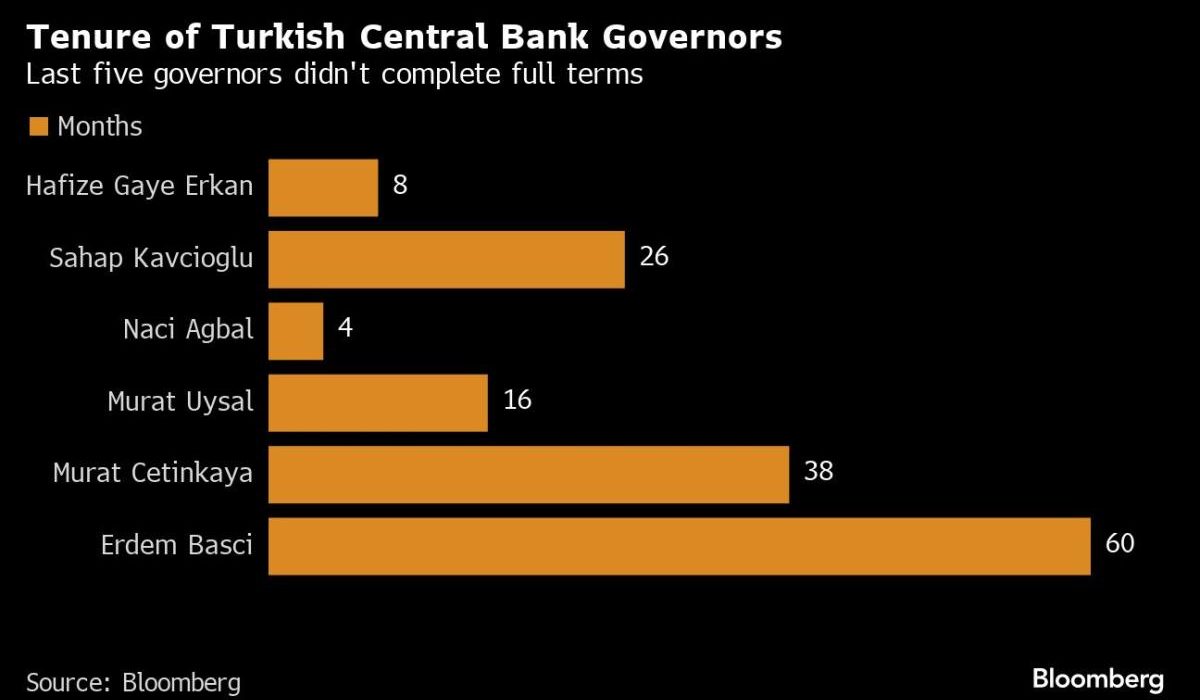

Erkan, Turkey’s first female governor, cited personal reasons and a smear campaign against her in local media for her decision late Friday to step aside after just eight months in the job. Hours later, deputy Fatih Karahan was appointed by President Recep Tayyip Erdogan as the new governor.

In his first public statement on Sunday, Karahan, who holds a PhD from the University of Pennsylvania and also worked as an economist for Amazon.com, looked to reassure investors, saying getting inflation under control was the top priority and that the central bank stood ready to act in case of any deterioration.

The combination of persistent inflation and the arrival of a new governor paves the way for more interest-rate hikes in 2024 — a departure from recent signs from Erkan, who indicated last month the end of tightening, according to Deutsche Bank AG.

“Given our view of stickier inflation pressure in the near-term in combination with the appointment of the new governor, we see room for another 250 basis points or even 500 basis point of front-loaded tightening. The latter is not yet priced in,” strategists including Christian Wietoska said in a note.

Turkey’s swap markets at the close of Friday, and prior to the news, were pricing almost no change in interest rates until May. But the lira weakened nearly 0.6% against the dollar in thinner trading after the announcement.

In 2021, the firing of then-Governor Naci Agbal, also late on a Friday night, triggered a 13% slide in the lira over the following two weeks, along with a jump of about 60% in the cost to insure Turkish government debt against potential default.

“The market is unlikely to view this as a repetition of Agbal’s ouster,” said Batuhan Ozsahin, chief investment officer at Ata Portfoy in Istanbul. “Market players will focus on messages about the continuation of tight monetary policy.”

Since Erkan and Simsek, both former Wall Street Bankers, took their jobs last year, the lira has lost nearly 30% of its value against the dollar. The depreciation came after their decision to abandon a costly intervention policy that had sent Turkish foreign-exchange reserves deeply negative, deterred foreign investors, and in the end, hardly helped to support the currency.

Still, the cost to insure Turkish sovereign debt against default using five-year credit default swaps dropped to below 300 basis points as of the end of last year, from more than 700 basis points in May. The extra yield investors demand to hold the country’s bonds over US Treasuries also plunged by nearly the same amount, according to JPMorgan indexes.

Meanwhile, foreign investors increased their holdings in the local stock market by about $10 billion to more than $32 billion. Foreign holdings of local-currency bonds have also risen, to a modest $2.8 billion from close to zero before Erkan and Simsek became policymakers. That’s still a far cry from a decade ago, when non-residents held more than $70 billion.

2024 Trade

The reluctance of foreign investors to enter the local debt market is due to a series of ad-hoc restrictions on swaps, currency hedges and other derivatives that Erkan’s predecessors imposed and that Turkish authorities have found difficult to unwind. In October, officials told Bloomberg that they’d consider relaxing those limits only after Turkey had a strong interest-rate buffer over the inflation rate.

That didn’t dissuade Deutsche Bank and JPMorgan Chase & Co. from betting on a big turnaround for Turkish lira bonds this year, with Deutsche saying they could be the trade of 2024 in emerging markets.

“In the broader context, neither Erkan’s resignation nor Karahan’s appointment should be seen as a major surprise, considering recent events and Turkey’s history of frequent central bank changes,” said Emre Akcakmak, a senior consultant at East Capital in Dubai. “Simsek is the one in charge of Turkey’s economic management, and policies are expected to remain consistent, irrespective of personnel shifts even when it concerns the central bank governor.”

From here, focus will be on what Karahan does and says, as well as whether the policy pivot that began last year retains Erdogan’s backing.

“Erdogan remains the ultimate decision-maker,” said Wolfango Piccoli, co-head of Teneo Intelligence. “As long as the president stays supportive of the gradual turn to orthodoxy that he endorsed after the 2023 elections, the identity of the governor is almost irrelevant.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.