ServiceNow

ServiceNow

NOW

$10.38

1.34%

20%

IBD Stock Analysis

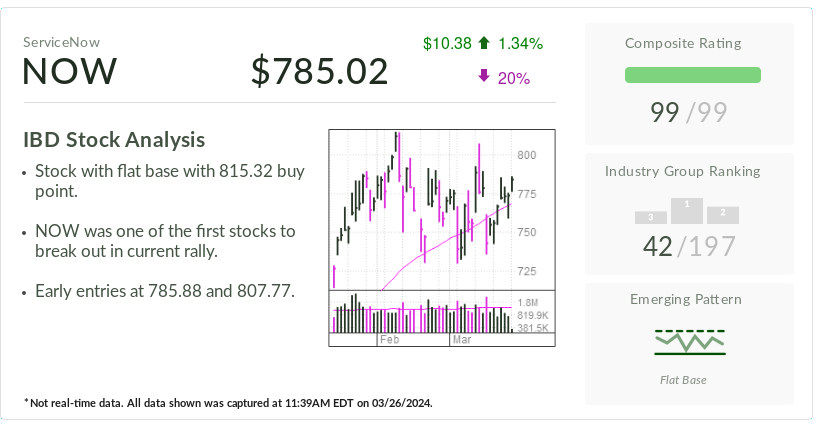

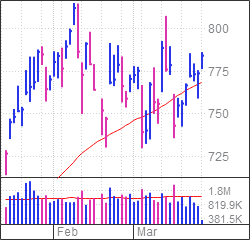

- Stock with flat base with 815.32 buy point.

- NOW was one of the first stocks to break out in current rally.

- Early entries at 785.88 and 807.77.

![]()

Industry Group Ranking

![]()

Emerging Pattern

![]()

Flat Base

* Not real-time data. All data shown was captured at

11:39AM EDT on

03/26/2024.

ServiceNow (NOW) is the IBD Stock Of The Day as the enterprise software maker rides the wave of corporate interest in generative artificial intelligence. ServiceNow stock has advanced 81% over the past 12 months.

X

The company’s software tracks and manages services provided by information-technology departments. Also, its self-service tech portal enables company employees to access administrative and workflow tools.

Further, ServiceNow has expanded from its core business into software for human resources, customer service management and security.

Generative AI Takes Off

Meanwhile, corporate interest in generative AI has jumped since startup OpenAI launched ChatGPT in 2022 with the aid of partner Microsoft (MSFT). Many companies are scrambling to launch generative AI pilot programs.

Generative AI models process “prompts,” such as internet search queries, that describe what a user wants to get. Generative AI technologies create text, images, video and computer programming code on their own.

Also, ServiceNow expects to have an edge in building industry-specific models using customers’ proprietary data.

On the stock market today, ServiceNow rose more than 1% to 786.33. ServiceNow stock has advanced 11% in 2024.

ServiceNow was one of the first stocks to break out in the current market uptrend, which started in November.

The software stock holds a tradition entry point of 815.32 from a flat base. For aggressive investors, 807.77 offers an early entry.

ServiceNow Stock: Customer Conference, Investor Day

ServiceNow is expected to report second-quarter earnings in late April. Investors may want to be cautious ahead of the report. One strategy around earnings would be to use call options.

That approach would let investors cap their possible loss while still letting them participate in any post-earnings upside.

Also, ServiceNow will soon host its annual customer conference in Las Vegas. The ServiceNow Knowledge 2024 conference runs from May 7 to May 9. The software maker will host an investor day during the conference to discuss financial targets.

ServiceNow in mid-March hosted an event in Washington, D.C., to showcase its fast-growing federal government business.

“We walked away with the view that ServiceNow’s record 2023 Fed momentum will carry through 2024, with agencies continuing to invest in their overall IT modernization efforts,” said Jefferies analyst Samad Samana in a report.

“GenAI was the main focus, with ServiceNow showing how GenAI can streamline processes for Fed customers,” he added.

ServiceNow Acquisitions

ServiceNow brought in Bill McDermott, former CEO of SAP (SAP), as its chief executive in late 2019. Under McDermott, ServiceNow has yet to make a big acquisition as some analysts anticipated.

However, McDermott targeted AI in his early days at ServiceNow, acquiring Element AI and Passage AI.

The company continues to make small acquisitions. In early March, ServiceNow said it will acquire Netherlands-based 4Industry. It recently completed the acquisition of Smart Daily Management.

ServiceNow has forged generative AI partnerships with chipmaker Nvidia (NVDA) and startup Hugging Face, an OpenAI rival. Nvidia is the leading supplier of AI chips for training generative AI models.

Hugging Face develops large language models, or LLMs. The more data an LLM is trained upon, the more powerful its capabilities can become.

ServiceNow Stock Technical Ratings

NOW stock has an IBD Relative Strength Rating of 91 out of a best-possible 99, according to IBD Stock Checkup. That means it has outperformed 91% of stocks in the past 12 months.

Further, ServiceNow has a best-possible IBD Composite Rating of 99. The Composite Rating scores a stock’s key growth metrics against all other stocks regardless of industry group.

However, ServiceNow stock has an Accumulation/Distribution Rating of C+, indicating mediocre demand for shares among institutional investors.

ServiceNow Earnings Top Views

The company reported December-quarter earnings and revenue that topped Wall Street targets.

ServiceNow earnings popped 36% to $3.11 per share from the year-earlier period. Revenue rose 26% to $2.44 billion.

Analysts had expected the company to report earnings of $2.78 a share on revenue of $2.4 billion.

For full-year 2024, ServiceNow predicted subscription revenue in a range of $10.55 billion to $10.57 billion vs. estimates of $10.5 billion.

Follow Reinhardt Krause on X, formerly Twitter, @reinhardtk_tech for updates on artificial intelligence, cybersecurity and cloud computing.

YOU MAY ALSO LIKE:

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Learn How To Time The Market With IBD’s ETF Market Strategy

IBD Live: A New Tool For Daily Stock Market Analysis

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader