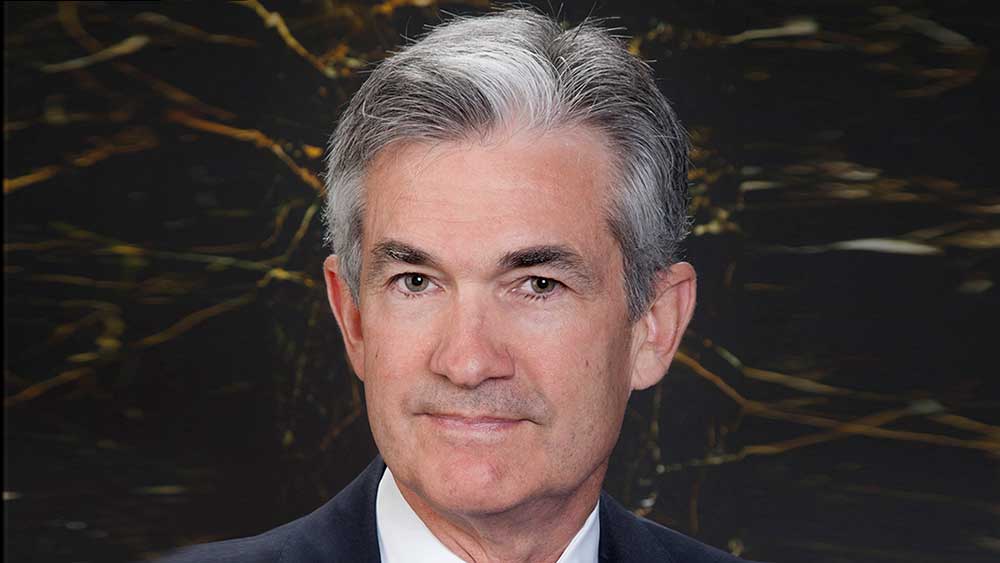

Federal Reserve Chair Jerome Powell’s implicit message to Wall Street on Wednesday was that the S&P 500 rally hasn’t yet gone on far enough and long enough to become a focus of monetary policy. Investors took the hint, propelling the S&P 500 to a record high.

X

‘Buoyant Risk Assets’

About 20 minutes into Powell’s news conference, he was asked whether the easing in financial conditions since last fall was counterproductive for the Fed as it tries to bring inflation down to 2%.

The question was crucial, because it wasn’t just hot inflation data in January and February that had Wall Street thinking the Fed might reel in rate-cut expectations. As Deutsche Bank fixed income strategist Matthew Raskin wrote ahead of the Fed meeting, “Recent inflation data and financial conditions — particularly buoyant risk assets — could support expectations of fewer cuts this year than was thought appropriate in December.”

Yet Powell’s answer downplayed the economic relevance of financial conditions indexes — including the Fed’s own index launched last year. As Powell has often said, monetary policy affects the economy only indirectly, through changes in financial conditions.

Fed Financial Conditions Index

The Fed’s own gauge shows that financial conditions are now easier than they’ve been since early 2022 — before the Fed began raising its benchmark interest rate more than five percentage points.

The latest reading for the Fed gauge is -0.38, with negative readings indicating the extent to which the current setting of monetary policy will be a tailwind to GDP growth over the coming year. The stock market is by far the biggest reason for the negative reading, accounting for 85% of the tailwind. And this may understate the tailwind, since the latest available data is from Jan. 31, and the S&P 500 has climbed 8% since then.

As authors of the Fed’s financial conditions index admit, the gauge isn’t comprehensive. “For example, lending standards and terms may evolve differently from the lending rates included in the index,” they wrote.

Still, Powell could have said that the easing in financial conditions would be important to watch and might alter the Fed rate-cut trajectory if conditions kept easing. That seems to be a popular view among Fed committee members, according to minutes of the December and January meetings.

“Many participants remarked that an easing in financial conditions beyond what is appropriate could make it more difficult for the Committee to reach its inflation goal,” the December minutes indicated.

With the S&P 500 stretching into record territory by the January meeting, “several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate, which could add undue momentum to aggregate demand and cause progress on inflation to stall.”

Powell: Labor Demand Cooling

Yet Powell’s answer to the question about easing financial conditions was to say that, despite the data, financial conditions aren’t easy, and therefore not a worry. Powell essentially made it certain that financial conditions would ease further in response to the updated Fed outlook and his dovish comments.

“We do think that financial conditions are weighing on economic activity,” Powell said. He pointed to an array of labor market indicators showing “demand cooling off a little bit” including job openings, quits, and the hiring rate, as well as unspecified “surveys” of labor demand.

Powell may be right. The latest National Federation of Independent Business survey of small businesses showed the percentage of firms planning to hire was just 12% higher than the share planning to cut jobs in February, the lowest since May 2020.

On the other hand, job openings were a touch higher in January, the latest data available, than they were in October, before financial conditions eased and the S&P 500 kicked off its 27% rally.

Fed Rate-Cut Odds

After yesterday’s Fed meeting, markets were pricing in 70% odds of a rate cut by June 12, up from 60% a week ago. For all of 2024, markets are pricing in a year-end federal funds rate of 4.58%. That implies 74% odds of at least three quarter-point rate cuts.

While markets have responded favorably to Powell’s comments and the outlook for three rate cuts, the Fed is pretty divided below the surface.

The Fed’s so-called dot-plot shows that 10 policymakers expect at least three rate cuts, while nine expect two or fewer. Powell appears to be the glue holding together a flimsy majority.

The upshot is that it won’t take much for the Fed rate-cut outlook to change. Another hot inflation reading before the June meeting could shift the outlook, if the labor market doesn’t show clearer signs of a slowdown.

Powell And The S&P 500

When Powell talks about the Fed’s role in shaping financial conditions, he often throws in “broadly.” He doesn’t want to be seen as trying to rein in the S&P 500, particularly when the Fed doesn’t appear to see a stock market bubble.

The January meeting minutes noted that “equities appeared priced for continued economic resilience.” Outside of surging large-cap tech stocks, “broader measures of equity valuations were more subdued.”

Still, some on Wall Street think the Fed should factor the AI stock boom into its monetary policy stance. That didn’t happen during the dot-com boom. Three rate cuts in 1998 propelled the S&P 500 to a 25% six-month gain, pushing it closer to bubble territory.

Powell “has to be concerned about irrational exuberance and fueling it” with rate cuts, strategist Ed Yardeni told IBD in February, using former Fed Chair Alan Greenspan’s catchphrase from early in the dot-com boom.

After Wednesday’s Fed meeting, Yardeni wrote that “Powell & Co. were more dovish today than we (and stock investors) expected.”

Yardeni expects no more than two Fed rate cuts this year and possibly none at all.

Powell’s comments downplaying financial conditions gave yesterday’s stock market rally a second wind. That pushed the S&P 500 to a 0.9% gain. The rally continued Thursday, lifting the S&P 500 within 2.5% of Yardeni’s 5400 year-end target.

Be sure to read IBD’s The Big Picture column after each trading day to get the latest on the prevailing stock market trend and what it means for your trading decisions.

YOU MIGHT ALSO LIKE:

Join IBD Live Each Morning For Stock Tips Before The Open

How To Make Money In Stocks In 3 Simple Steps

AI News: Artificial Intelligence Trends and Top AI Stocks To Watch