Exchange-traded funds are poised to build on their 2023 successes in 2024. Excellent performance across the board and resurgent flows overshadowed some important and emerging trends from 2023:

- ETF providers continued to slash fees. Schwab moved first, dropping fees on all its passive bond ETFs to 0.03%, a move that competitors soon copied.

- Vanguard Total Bond Market ETF BND became the first bond ETF to cross $100 billion in assets.

- The success of JPMorgan Equity Premium Income ETF JEPI fueled a renaissance in options-based ETFs.

- Active ETFs continued to gain steam.

- There were more mutual-fund-to-ETF conversions.

- Fidelity and others filed for a Vanguard-like ETF share class.

- Still no spot bitcoin ETF.

Those were just a few of the notable stories from 2023, and 2024 is a new year that’s sure to be filled with surprises. Each member of Morningstar’s North America passive strategies team weighed possible outcomes, and we offer predictions for what ETF investors can expect in the year to come.

In order from most likely to least likely, here are those predictions.

Prediction 1: Active ETFs Become the Preferred Choice for Alpha-Seeking ETF Investors

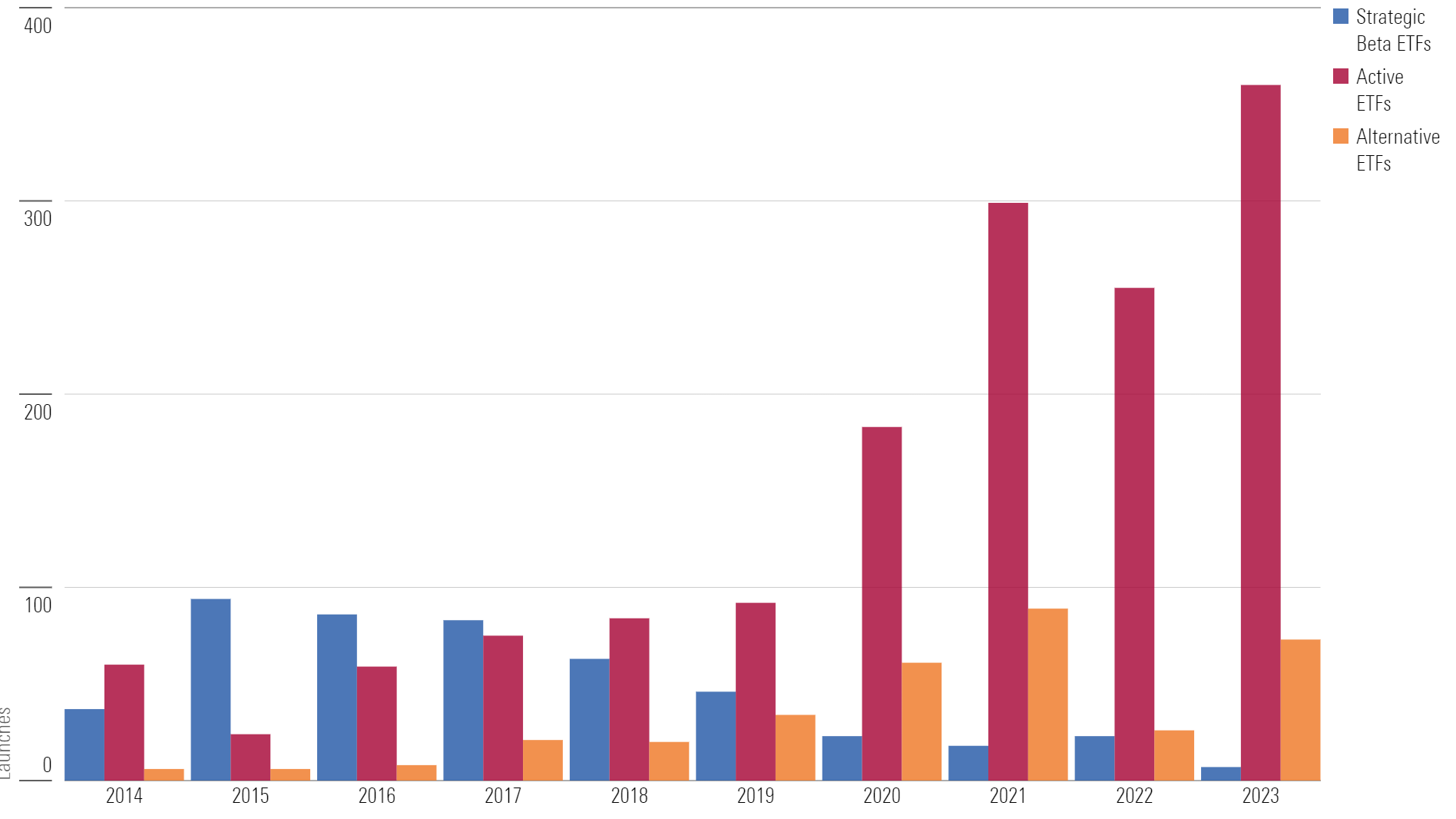

Strategic-beta ETF launches hit the brakes in recent years. In the United States, 26 closures outstripped seven launches in 2023—a testament to the market’s saturation and the maturity of these alpha-seeking ETFs. Burgeoning strategies like actively managed ETFs, covered-call ETFs, and defined-outcome ETFs helped displace strategic-beta ETFs from the limelight.

Fewer ETF issuers are incentivized to launch new and innovative funds in the now-mature strategic-beta ETF market. Downward fee pressure is pushing smaller providers out of the space, while higher-priced active or alternative ETFs provide new and potentially lucrative opportunities for emerging ETF issuers. This trend will continue in 2024, further reducing the number of strategic-beta ETF launches and possibly increasing the number of closures. New money will also be drawn to active and alternative ETFs as alpha-seeking investors are increasingly choosing to allocate to these funds instead. This is not to demerit some strategic-beta ETFs, but as the industry evolves, it is clear there are better business opportunities for ETF issuers.

—Mo’ath Almahasneh

Prediction 2: ETF Closures Will Increase

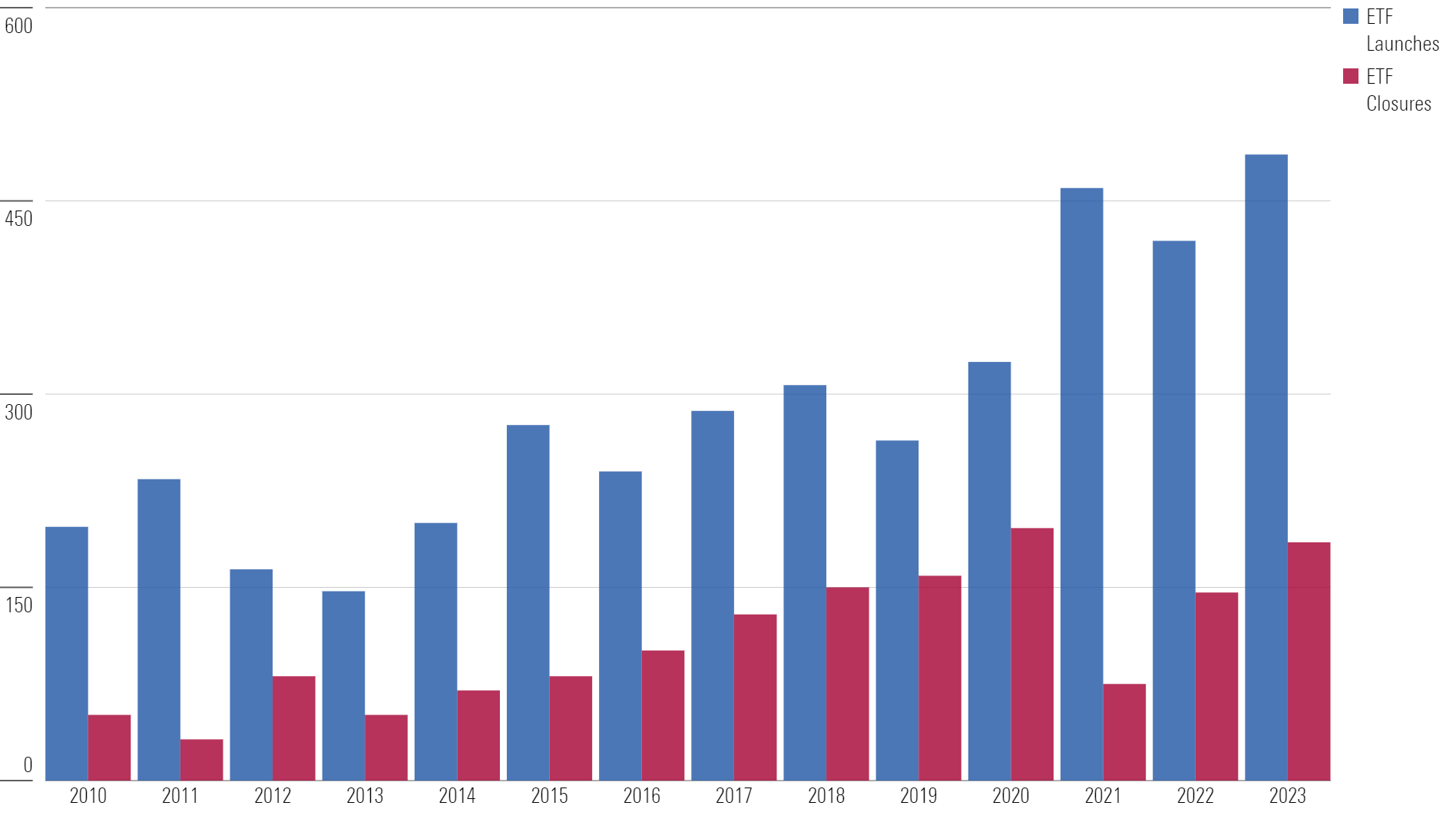

ETF providers brought more than 400 new ETFs to market in each of the past three years, and new launches in 2023 have surpassed 500. Many of these new ETFs are novel. They include leveraged and inverse single-stock ETFs, cryptocurrency, and artificial intelligence thematic ETFs, and various options-based strategies designed to provide income or downside protection, among others.

That adds up to a lengthy list of 3,300-plus ETFs currently available to U.S. investors. While interesting, few have gained much traction. More than 1,200 ETFs have less than $50 million in assets, and almost 500 of those have been around for three years or longer. Said another way, they’re prime candidates to close shop. At a certain point, the costs of providing these ETFs outweigh the revenue they generate. Sooner or later, they’ll have to wave the white flag.

—Daniel Sotiroff

Prediction 3: Bond ETF Launches and Flows Accelerate, Led by Active ETFs

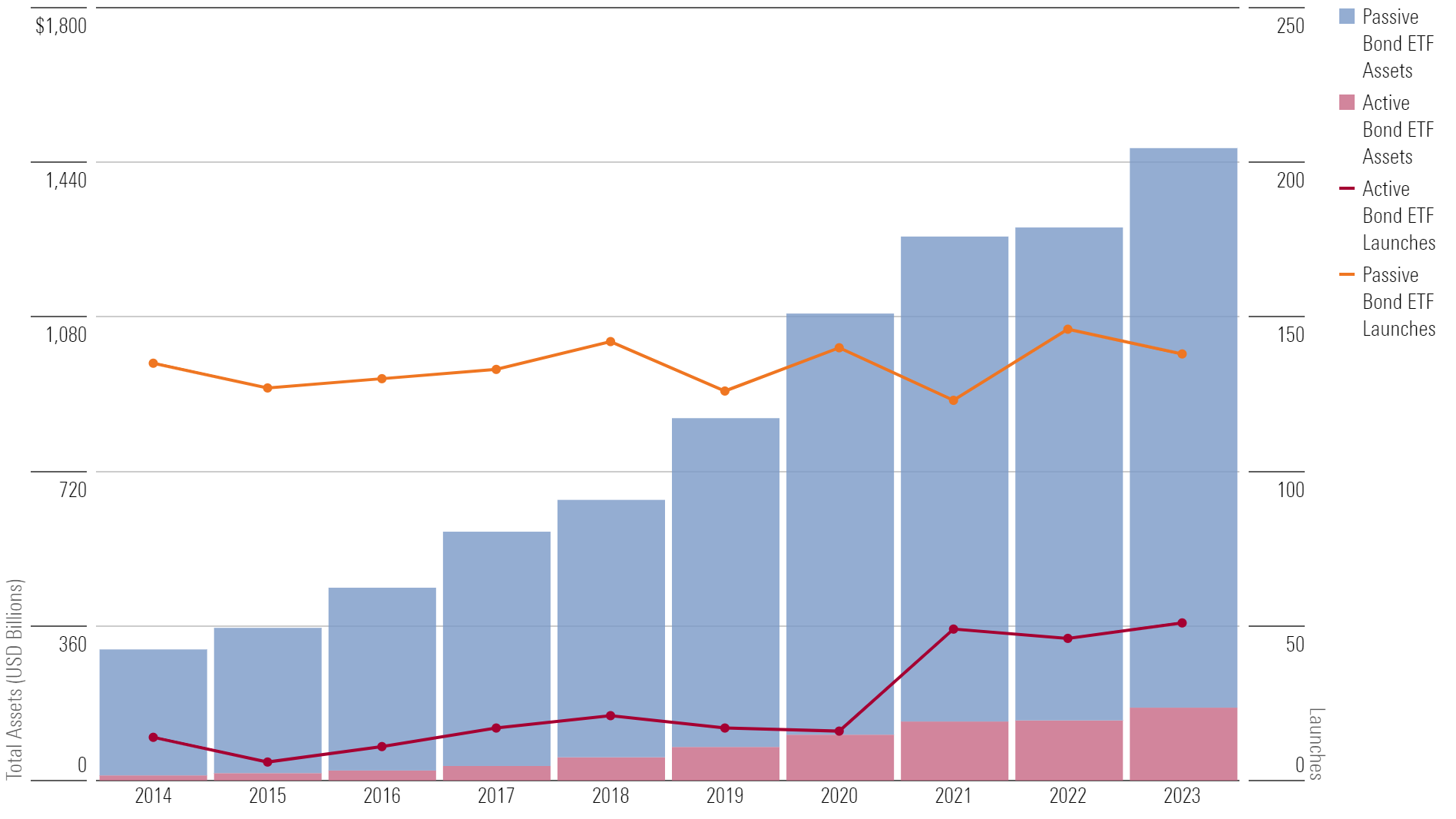

The market for U.S. taxable-bond ETFs is roughly 4 times smaller than the U.S. equity ETF market by assets. It’s also 3 times smaller by number of funds. Major players will attempt to bridge this gap as both investor demand for bond ETFs and the efficiency in operating these funds continues to improve.

The 2019 adoption of the ETF Rule allowed for widespread use of custom baskets—a tool that provides ETF portfolio managers with a degree of flexibility when trading. They’re instrumental in keeping a bond ETF’s share price in sync with the value of the bonds in its portfolio. Combined with continuous refinement and improved liquidity on electronic trading platforms, bond ETFs will become less of an operational headache for asset managers. Investors have also grown more comfortable with the ETF wrapper as bond ETFs skated through the worst of 2020′s coronavirus-driven shock. Those ETFs proved critical to overall market function, providing both price discovery and liquidity in those challenging weeks.

Intensifying competition among actively managed bond ETFs should continue in 2024. BlackRock leads the charge, but Vanguard is hot on its heels. In 2023, Vanguard launched ETF versions for two of its active core bond mutual funds, after adding to its municipal-bond ETF lineup earlier in the year. Capital Group also began expanding its bond ETF suite in late 2022.

—Lan Anh Tran

Prediction 4: Alternative ETFs Will Pick Up Steam

ETFs are oversaturated with stock and bond strategies, a fact that should compel providers to set up shop where their footprint is small: alternatives. Remove buffer and crypto ETFs from the alternatives category group, and you will find just 22 ETFs, representing 3% of the market. Hedge-fund-esque categories like multistrategy, systematic trend, and market-neutral are mutual fund terrain ripe for an ETF takeover.

The market is more ready for hedge-fund-like ETFs now than it was when launches from iShares and J.P. Morgan fizzled in the 2010s. Investors have caught on to the benefits of the ETF and to the fact that it’s merely a wrapper. Before investors could disentangle the strategy from its packaging, a hedge fund strategy in an ETF seemed an awkward combination. That’s no longer the case.

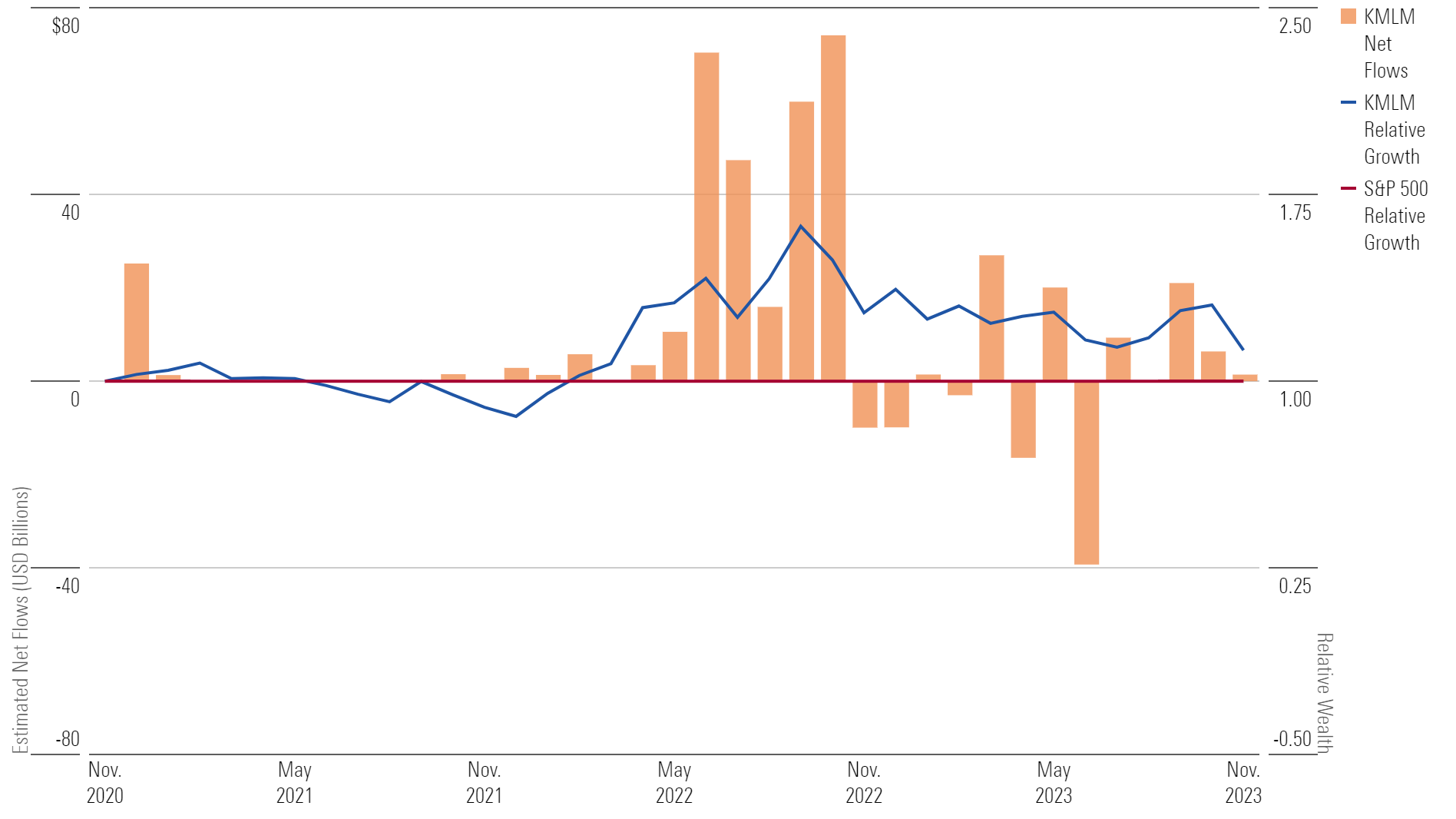

Squint, and you’ll find evidence that alternative ETFs are near a breakout. IMGP DBi Managed Futures Strategy ETF DBMF has grown over $750 million in roughly four years on the market; fellow trend-follower KFA Mount Lucas Strategy KMLM totaled over $275 million after three.

A booming 2024 stock market could throw cold water on my prediction because alternatives tend to draw attention during downswings. But even if it takes longer than a year, I expect hedge-fund-like strategies to adopt the ETF structure in due time.

—Ryan Jackson

Prediction 5: Covered-Call ETFs Will Lose Steam

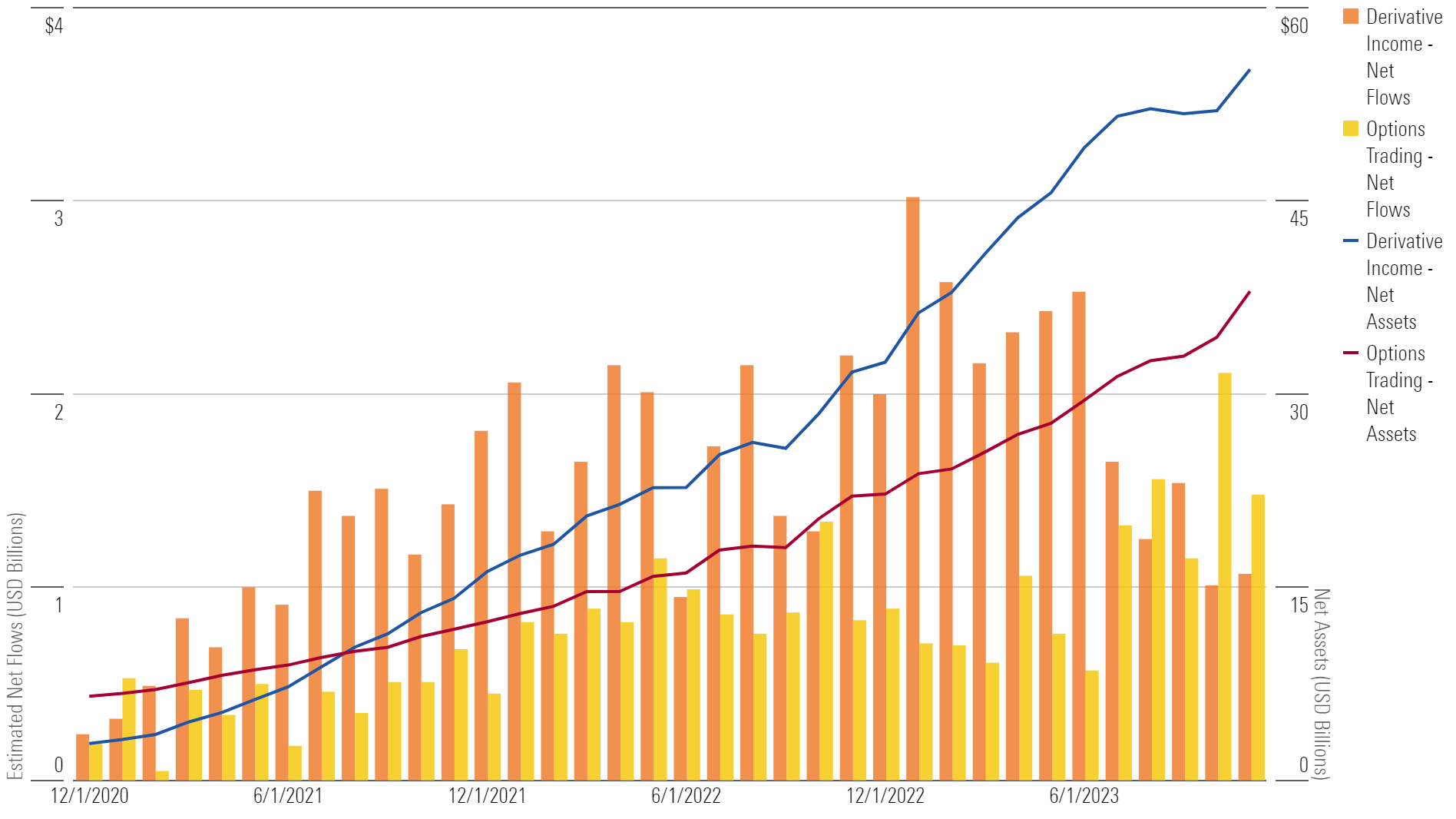

Covered-call and defined-outcome strategies have been among the hottest ETF trends since 2021, as shown in the below chart. I expect this trend to slow significantly or even reverse in 2024.

The chart shows a robust growth trend in these options-based ETFs. So, why do I expect the trend to slow? A hot year for stocks left covered-call ETF investors in the cold in 2023. Selling call options comes with the benefit of added yield and a small buffer in down markets. But the trade-off is upside. Investors don’t participate in rallies once the underlying investment surpasses the call’s strike price.

Opportunity cost plays a big role in performance for options-based ETFs. JPMorgan Equity Premium Income ETF JEPI is one of the hottest names in ETFs, yet its 7.72% year-to-date return through November fell nearly 11 percentage points short of the Morningstar US Market Index. Likewise, Global X Nasdaq 100 Covered Call ETF QYLD enjoyed a 19.48% return over the same period, but that paled in comparison to the 46.96% return by the Nasdaq-100 Index.

Options-based ETF investors will also be hit with a hefty tax bill. JEPI investors may be surprised to find their 8.5% yield in 2023 is taxed as ordinary income, which can drag on compounding returns over the long run.

Morningstar’s 2024 Outlook cites the potential for a wide range of outcomes in 2024. This doesn’t bode well for covered-call strategies, which place a ceiling on upside and provide limited downside protection. Investors are becoming wiser to the higher costs and unique caveats of this risk profile.

—Bryan Armour

Prediction 6: ETF Fees Reverse Trend and Increase

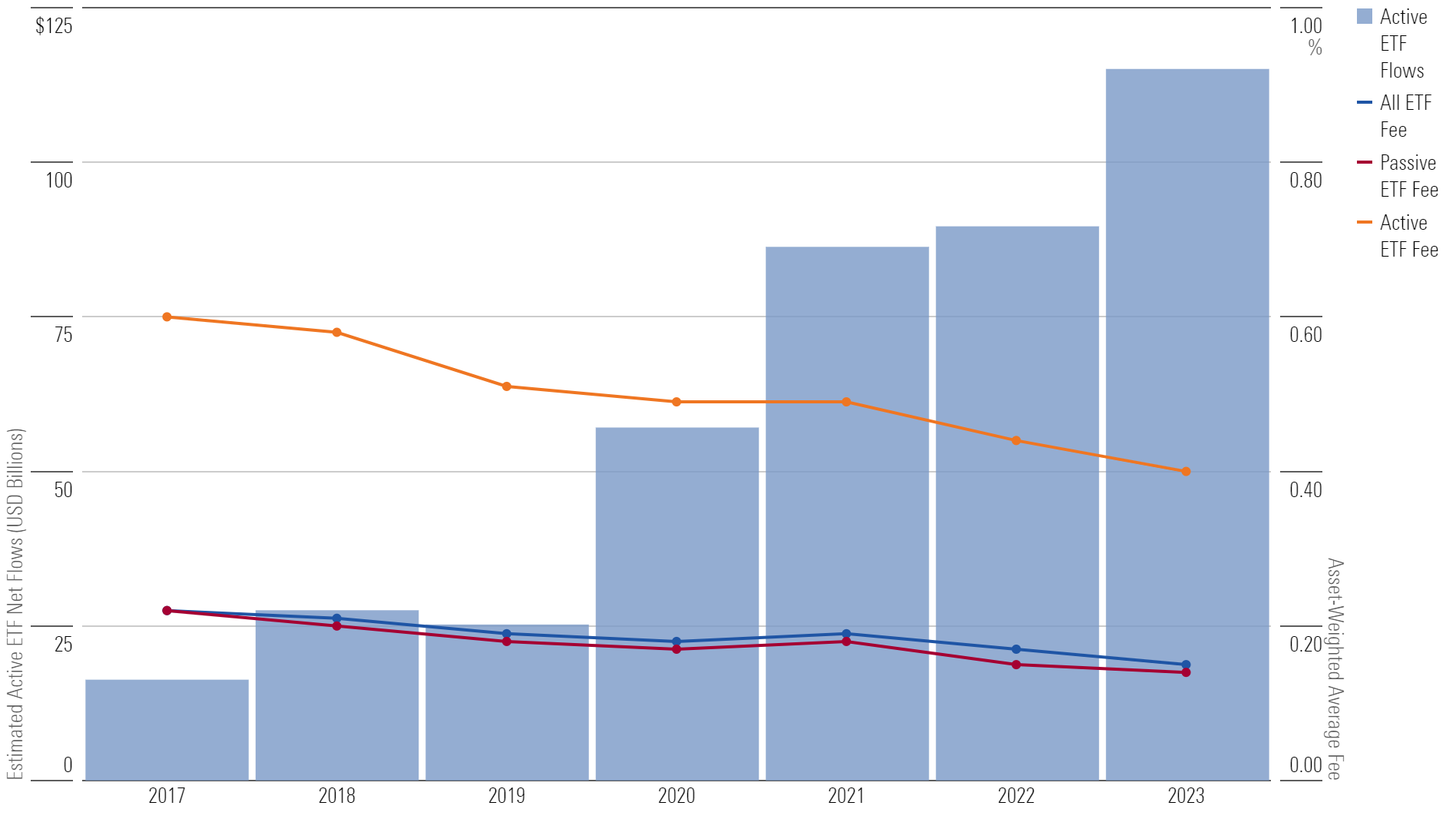

As the ETF landscape evolves beyond cheap and index-tracking funds, the average fee of all ETFs may tick up as a result. While any increase would be small, it would reverse a yearslong trend that saw ETF fees fall 56% since their 2009 peak. The asset-weighted average fee for all U.S. ETFs currently measures just 0.15%, with only about one in 10 ETFs charging a fee below that. Investors have made their preferences clear, parking 61% of total ETF assets in low-cost, usually index-tracking funds that keep the asset-weighted average fee low. However, new money is increasingly looking elsewhere.

Actively managed and alternative ETFs are growing faster than traditional passively managed ETFs, despite their usually higher fees. More than one in three ETFs don’t track an index. While these funds only account for 6.4% of ETF assets right now, that figure is increasing steadily. Alternatives are a smaller piece of the pie, but their interest is also growing. The asset-weighted average fee for alternative ETFs is 0.93%, while it measures 0.40% for active ETFs. Both are considerably higher than the 0.14% average for nonalternative passive ETFs. If their popularity continues to swell, it may cause the whole group’s average fee to rise.

—Zachary Evens

ETF Investing Takeaways

The future is unknowable, so predicting it is impossible. Speculation is fun, though, and it makes investors take stock of countless possible outcomes.

These predictions are not intended to serve as an ETF doctrine or cause you to suddenly change course. They’re instead intended to highlight some areas, themes, or trends investors should be aware of going into 2024.

What plays out may rhyme with our predictions, but exact accuracy is unlikely. Take each with a grain of salt, but keep an eye out for topics and themes noted in each. You’ll be surprised by what you might notice.