Assessing whether a target-date fund (TDF) series is performing as expected can be a difficult undertaking. Each TDF series features multiple vintages, each with its own asset allocation. And each TDF provider can take a different approach to glide-path construction, sub-asset allocation, implementation, rebalancing methodology, and benchmarking. Furthermore, the investment time horizon of a TDF is measured not in months or years but in decades. This means that there is simply no single metric that can definitively answer the question, Is my TDF doing its job?

For this reason, to adequately gauge TDF success and compare providers, a mosaic of different metrics is needed to see the full performance story. These can include long-term success metrics, such as risk-adjusted returns and retirement readiness outcomes, and peer-relative returns as well as benchmark-relative returns and tracking error. While many of these metrics are straightforward, interpreting benchmark-relative returns and tracking error can be more challenging than it may seem on the surface. The results need to be paired with an understanding of how the TDF provider approaches rebalancing methodology as well as benchmark selection and implementation. Because there is no industry standard, there can be considerable differences across providers, resulting in different trade-offs.

In this article, we present considerations for assessing TDF benchmark-relative returns and tracking error and an overview of Vanguard’s methodology and rationale for our rebalancing approach, benchmark selection, and implementation. We also highlight several enhancements to our methodology that are focused on improving investor outcomes and increasing the usefulness of benchmark-relative returns as a performance measurement tool.

Assessing TDF benchmark-relative returns and tracking error

Benchmark-relative returns, or excess returns, are simply the difference (positive or negative) between the performance of a fund and its benchmark, while tracking error is the annualized standard deviation of this difference. While both are commonly used to evaluate index funds, assessing and comparing TDF providers using these two metrics requires an understanding of not only the performance and attribution data but also the methodology associated with rebalancing and benchmark selection and implementation.

Before taking a deeper dive into this methodology, there are certain foundational considerations to keep in mind:

-

Index-based TDFs are not index funds. While index-based TDFs are constructed with index funds, they themselves are not index funds and, thus, are not managed like index funds. Most index-based TDFs maintain strategic allocations to varying asset classes that gradually adjust over time as they roll down their glide path to an eventual landing point. Therefore, if one asset class, such as stocks, significantly underperforms another asset class (bonds), and if cash flows are not sufficient to rebalance back to desired weights, the manager needs to sell the outperforming bonds and purchase the underperforming stocks to realign the portfolio back to target weights. Large market swings can result in more substantial trading between asset classes and typically coincide with increased transaction costs. To keep transaction costs reasonable in volatile markets, TDF providers tend to have higher tolerances for excess return and tracking error than most index funds.

-

Separating out the noise is key. It is important to distinguish the return drivers tied to the actual portfolio management of a TDF from the return drivers that fall outside of portfolio management control, namely, those attributed to accounting and pricing policies. For example, fair-value pricing can be a large driver of benchmark-relative results over short-term periods. Fair-value pricing refers to the adjustments to the price of securities as of 4 p.m., Eastern time, when Vanguard strikes fund NAVs to account for after-hours movement in those securities’ prices. While this can lead to large positive or negative short-term dislocations, particularly during periods of heightened market volatility, these differences are artificial and temporary.

With these foundational considerations as a baseline, we can then move on to rebalancing methodology. Currently, there is no standard or consistent rebalancing methodology or benchmarking across the TDF industry. Each TDF manager defines their own rebalancing policy for their funds and the associated benchmarks. We find that having a deeper understanding of a provider’s approach can make benchmark-relative returns and tracking error more useful performance measurement tools.

Selecting a TDF rebalancing approach

The primary function of portfolio rebalancing is to keep portfolio risk in alignment with the fund’s target risk exposure. Without rebalancing, portfolio allocations will drift from their intended target as the returns of its assets diverge. As highlighted in previous Vanguard researchOpens in a new tab, there are numerous rebalancing strategies that can be implemented, but we find that two approaches are common in the TDF industry, each with its own set of trade-offs:

-

Calendar-based rebalancing: Portfolios are rebalanced at predetermined time intervals, such as monthly or quarterly. This approach is easy to implement and, when aligned with the rebalancing methodology of the benchmark, can lead to lower tracking error. However, it may require large trades to be made on a regular cadence, which may result in higher transaction costs. Additionally, for monthly or quarterly calendar-based approaches, the actual TDF asset allocation may differ significantly from the target asset allocation in between rebalance periods when market volatility is high.

-

Threshold-based rebalancing: Portfolios are rebalanced if the portfolio’s asset allocation has drifted from its target asset allocation by a predetermined tolerance threshold, for example, a threshold of 1% or 2%. Portfolio allocations are then rebalanced to a set destination, which can be the midpoint between the threshold and the target, fully back to target, or another point in between. This approach requires greater monitoring compared with a calendar-based approach, but it can also limit the extent to which the portfolio drifts from the target asset allocation. In addition, a threshold-based rebalancing approach has the potential to have lower transaction costs, as portfolios are rebalanced only when they breach the tolerance threshold rather than on a predefined date such as month-end.

Given the different rebalancing approaches that could be implemented, which approach is best suited for a TDF?

Vanguard’s approach to TDF rebalancing

The goal of Vanguard’s TDF rebalancing policy is to provide our investors with the best long-term investment outcomes. Therefore, our approach seeks to strike a balance between transaction costs, which are a drag on absolute performance and erode returns, and alignment with the funds’ strategic asset allocation. To accomplish this goal, our research consistently indicates that a threshold-based approach produces better long-term performance results than a calendar-based approach while maintaining close alignment to the strategic asset allocation.

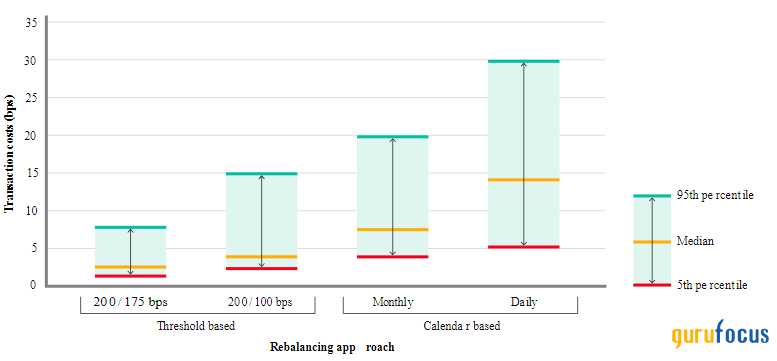

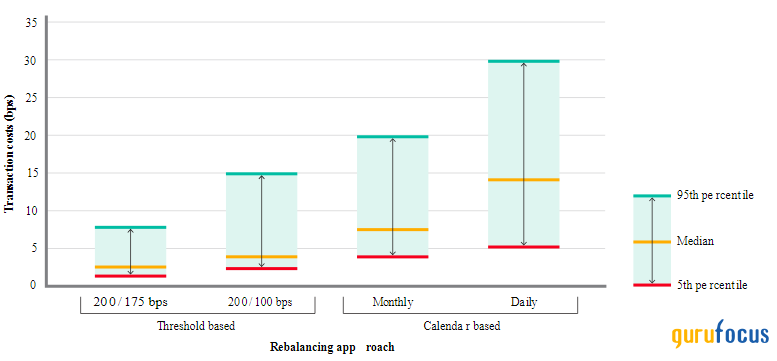

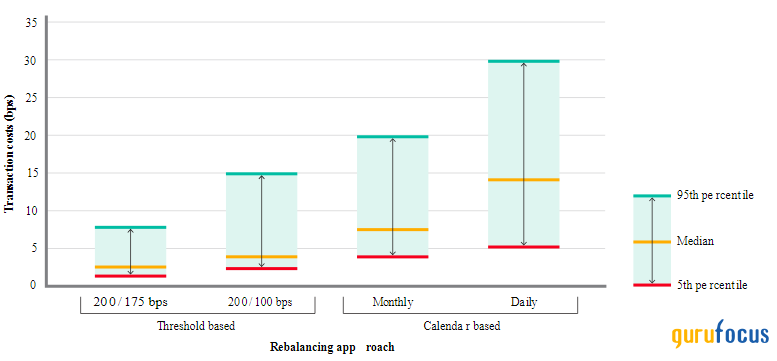

Figure 1. Estimated annual transaction cost ranges across various rebalancing approaches

Notes: Based on a hypothetical 60% global equity and 40% global fixed income portfolio using the actual historical returns of the underlying indexes for the 10 years ending March 2023. The back test uses a daily return series under each rebalancing approach, assuming no cash flows or use of futures. Equities allocation based on performance of CRSP US Total Market Index (36%) and FTSE Global All Cap ex US Index (24%). Bond allocation based on Bloomberg U.S. Aggregate Index (28%) and Bloomberg Global Aggregate ex-USD (12%). Transaction costs are a function of the underlying market regime and transaction size. Transaction costs also account for simultaneous rebalancing across all target-date vintages.

Source: Vanguard.

Minimizing transaction costs: Over the long term, different rebalancing approaches tend to produce similar returns before costs. But once transaction costs are factored in, a threshold-based approach consistently leads to better long-term outcomes. Figure 1 highlights a subset of commonly used threshold-based and calendar-based approaches and the estimated annual transaction cost impact of each approach. Transaction cost estimates include explicit costs (commissions and ticket charges) and implicit costs due to market impact for normal and stressed environments. As shown, all else being equal, a threshold-based approach typically has lower associated transaction costs, which results in greater absolute returns.

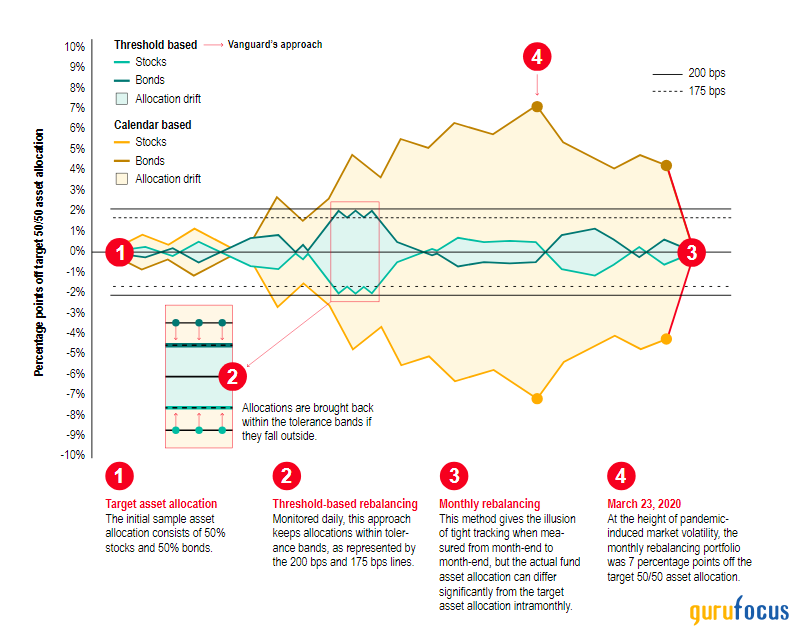

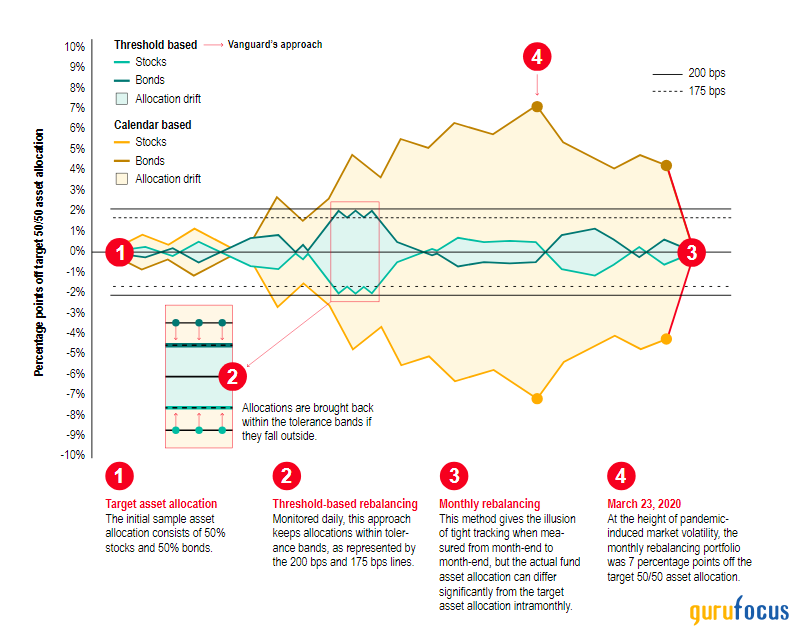

Strategic asset allocation alignment: A TDF’s glide path and associated strategic asset allocation are intended to provide age-appropriate levels of risk throughout an investor’s life cycle. We believe that an appropriate TDF rebalancing policy should aim to maintain close alignment to the strategic asset allocationwhile accounting for transaction costseach day, as that is the investment experience and risk-return profile the TDF holder expects. During normal market environments, both calendar-based and threshold-based approaches should stay reasonably close to the strategic asset allocation, but during periods of heightened market volatility, the two approaches can have significantly different outcomes. Figure 2 illustrates a hypothetical 50% stock and 50% bond portfolio and the associated strategic asset allocation drift using a monthly calendar-based approach and a 200 bps (threshold)/175 bps (destination) threshold-based approach during the COVID-driven market volatility experienced in March 2020.

Figure 2. Calendar-based versus threshold-based rebalancing methods in March 2020

Notes: This chart is for illustrative purposes only and is not indicative of any specific investment. Bond returns are represented by the Bloomberg US Aggregate Float Adjusted Index (70% allocation) and the Bloomberg Global Aggregate ex-USD Float-Adjusted RIC Capped USD Hedged lndex (30%). Stock returns are represented by the performance of the CRSP US Total Market Index (60% allocation) and the FTSE Global All Cap ex US Index (40%). Past performance is not a guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Vanguard.

As shown, under a monthly calendar-based approach, the portfolio could have drifted by a deviation of 7% away from the strategic asset allocation, whereas under the threshold-based approach, the same portfolio never drifted more than +/ 2% away.

Overall, while a threshold-based approach requires additional monitoring from the portfolio managers of the strategy, the ability to effectively balance transaction costs and close alignment to the strategic asset allocation makes it the more suitable choice for a TDF that may lead to better long-term outcomes for investors.

TDF benchmark selection and implementation

Beyond the rebalancing approach, the final piece of the puzzle involves understanding the TDF provider’s benchmark selection, construction, and implementation. As previously stated, there is no industry standard, and selection and construction of a custom benchmark varies across TDF products. Some providers construct composite benchmarks that represent each underlying asset class (the strategic glide path), while others construct benchmarks with only broad asset classes represented. In addition, outside of composite or custom benchmarks, certain providers utilize broad-market indices, such as the S&P 500 Index or the Bloomberg US Aggregate Index, as their primary benchmark.

Vanguard Target Retirement Funds utilize a composite benchmarkOpens in a new tab that is a weighted representation of the strategic glide path and underlying asset allocation for each TDF vintage. For example, Target Retirement Funds designed for investors in the early phases of their careers typically have an asset allocation of 90% stocks and 10% bonds. Within those broad asset classes, the funds maintain allocations of 60% U.S. stocks and 40% non-U.S. stocks and 70% U.S. bonds and 30% non-U.S. bonds. The composite benchmark then represents each of these allocations at a weight that corresponds to the strategic glide path. By including each component of the strategic asset allocation in the composite benchmarks, we can provide a clear representation of theoretical target investment experience for a TDF investor.

While the selection of the appropriate composite benchmark is based on the theoretical strategic asset allocation, when it comes to implementation, practical considerations should also be layered in to provide an accurate and measurable representation of the investment process. As it is not possible to invest in a frictionless theoretical composite benchmark, all TDFs must incur some level of transaction costs to invest contributions and to rebalance portfolios back to target allocations.

To provide a more useful performance measurement tool, Vanguard aligns the rebalancing policies of the TDFs and their composite benchmarks. That is, both the Target Retirement Funds and their corresponding composite benchmarks rebalance using the same threshold-based approach. We find that this implementation method allows investors and other observers to evaluate the efficacy of the funds’ portfolio management teams, as well as utilize benchmark-relative returns and tracking error as part of the overall performance mosaic.

Conclusion

To see the full TDF performance story, a mosaic of different metrics is required. Benchmark-relative returns and tracking error are an important part of this mosaic, but utilizing these metrics also requires an understanding of the TDF provider’s approach to rebalancing methodology, benchmark selection, and implementation.

The policies that we have put in place for Vanguard Target Retirement Funds are designed to help us emphasize investor outcomes by reducing costs and delivering the expected asset allocation experience, thereby increasing the investor’s chance of achieving retirement success. At Vanguard, we are committed to improving outcomes for clients, whether through lower costs, investments in portfolio management capabilities, innovative approaches to rebalancing, or other enhancements. Investors should not only expect that Vanguard will continually improve our products but also demand it.

Notes:

-

For more information about Vanguard funds, visit vanguard.com or call 800-662-2739 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.

-

Investments in Target Retirement Funds are subject to the risks of their underlying funds. The year in the fund name refers to the approximate year (the target date) when an investor in the fund would retire and leave the workforce. The fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. An investment in a Target Retirement Fund is not guaranteed at any time, including on or after the target date.

-

Vanguard is responsible only for selecting the underlying funds and periodically rebalancing the holdings of target-date investments. The asset allocations Vanguard has selected for the Target Retirement Funds are based on our investment experience and are geared to the average investor. Regularly check the asset mix of the option you choose to ensure it is appropriate for your current situation.

-

All investing is subject to risk, including the possible loss of the money you invest. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Diversification does not ensure a profit or protect against a loss.

-

Investments in bonds are subject to interest rate, credit, and inflation risk. Investments in stocks or bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk.

This article first appeared on GuruFocus.