Key Takeaways:

- Boeing has been plagued by a series of high-profile crises involving the 737 Max.

- Existing 737 Max 9s can still fly, but the FAA is restricting Boeing’s production.

- Investors shouldn’t expect Boeing’s problems to influence travel trends much.

- BA shares have taken a hit, but 737 Max issues won’t necessarily hurt airline stocks.

Boeing Co. (ticker: BA) has a distinguished aerospace history that stretches over 100 years. For much of that run, Boeing has been the gold standard for aviation. However, recent high-profile defects in Boeing airplanes have stirred up doubts and intense scrutiny of the aerospace and defense company.

A Boeing 737 Max 9’s fuselage door plug blew off mid-flight on an Alaska Airlines plane on Jan. 5. Fortunately, none of the passengers were sitting next to the door when it was ripped from the aircraft, according to the National Transportation Safety Board. The plane made an emergency landing and everyone got off the plane safely, though the incident was harrowing by many accounts.

A preliminary investigation revealed that four bolts that were supposed to hold the door plug in place were missing, after the part was recovered from a Portland, Oregon, man’s backyard.

The incident resulted in the Federal Aviation Administration’s grounding of 171 737 Max 9 planes on Jan. 6. Most of those planes resumed flying in late January, though an FAA probe of production processes at Boeing and supplier Spirit AeroSystems Holdings Inc. (SPR) continues.

A lot of people have questions about what will happen next. The focus is rightfully on passengers and their safety. However, some people are invested in Boeing stock or hold shares of other airline companies. The following is an examination of how the fallout from the Boeing 737 Max crisis will affect shareholders:

Boeing has had issues with its 737 Max airplanes for several years now. A Lion Air 737 Max 8 crash in Indonesia in 2018 and an Ethiopian Airlines Max 8 crash in 2019 both resulted in the deaths of all passengers and crew on board.

The Ethiopian Airlines crash prompted many countries to ground the 737 Max. Boeing temporarily suspended production for several months and ran several flight tests before the FAA lifted its grounding order in November 2020.

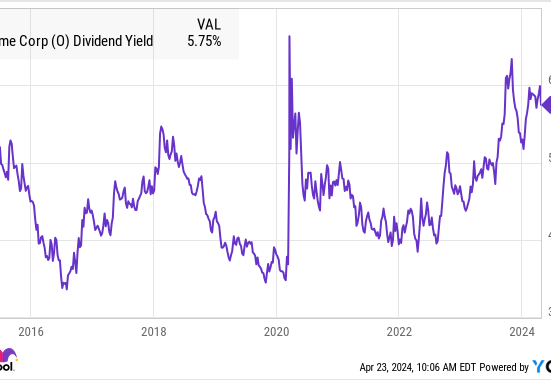

Before this grounding, Boeing stock had reached an all-time high of $430.35 per share on March 1, 2019. The stock hasn’t reclaimed that height since, and it closed the trading day at a share price of $209.20 on Feb. 9. As of mid-day trading on Feb. 12, shares are still losing altitude.

Boeing was regularly profitable before the incidents in 2018 and 2019, but the corporation reported a $2.9 billion net loss in the second quarter of 2019. It was the company’s largest quarterly loss. Revenue declined by 35% year over year in that quarter. Boeing withdrew its 2019 financial guidance, and former CEO Dennis Muilenburg stated the company was “focused on our enduring values of safety, quality and integrity in all that we do, as we work to safely return the 737 Max to service.”

Muilenburg was fired from Boeing roughly a year after making those statements. Even with new leadership, Boeing finds itself in the same problem with a different model of its 737 Max airplanes.

Chad D. Cummings, an attorney and certified public accountant based in Naples, Florida, discusses some of the context that led Boeing to its current state: “About 25 years ago, Boeing embarked upon what was known as the Yellowstone program, which envisioned so-called clean-sheet replacement aircraft to replace the 737 (the original version which entered service in 1968), 777 (originally 1994) and 747 (first flew in 1969). The tandem development of these new aircraft was intended to emulate the success, both operational and financial, of the combined 757/767 development program decades earlier.”

The goal of the Yellowstone clean-sheet project was partially realized in the form of the 787, which first flew in 2009, Cummings says. However, following the development of the 787 and near the end of the 2010s, “Boeing pivoted and adopted a new strategic long-term commercial aircraft plan which was intended to save both time and minimize the capital investment,” he says.

Could the desire for incremental improvements, plus a strong focus on the bottom line, have contributed to the Boeing 737 Max crisis? It appears that way to critics, but Cummings brings up an additional point: “Many of the old guard of engineers and designers, some of whom had successfully delivered the original 737, 747, 757, 767 and the original 777, retired from Boeing, leaving a dearth of institutional knowledge in their wake which is not easily recreated.”

While existing 737 Max 9s can still fly, the FAA is restricting Boeing’s production of the aircraft. “We will not agree to any request from Boeing for an expansion in production or approve additional production lines for the 737 Max until we are satisfied that the quality control issues uncovered during this process are resolved,” FAA Administrator Mike Whitaker stated in a Jan. 24 press release.

It will take a lot of effort to regain trust, but the decision to lift the grounding order can make any declines less severe than they were in 2019.

While most 737 Max planes travel to and from their destinations without any issues, high-profile accidents and the perception that Boeing cut costs at the risk of safety have hurt the brand. So, ironically, an intense focus on the bottom line may have hurt the company’s financials and stock price.

Boeing faces an unpleasant choice that could result in further losses for the stock. Either trim its outsourcing and bring more work in-house, increasing costs, or keep things as they are and incur the risk of future accidents.

Boeing CEO Dave Calhoun did damage control by mentioning that the door failure took place due to a quality issue rather than an issue with the plane’s overall design. It’s still unacceptable, critics say, but this particular case does not yet indicate a structural flaw with the plane’s design.

Some investors may wonder how a loss of trust in a formerly reliable aerospace company may affect air travel. Declining air travel means less consumer spending, which can trickle into many sectors.

However, 2019 data from the International Civil Aviation Organization suggests that investors who have exposure to the broader stock market don’t have much to worry about. In a report titled, “The World of Air Transport in 2019,” the total number of passengers carried on scheduled services increased by 3.6% from 2018 to 2019. The number of departures also rose by 1.7% to 38.3 million in 2019, the same year that Boeing Max planes were grounded as a result of the Ethiopian Airlines crash.

While the travel industry experienced decelerating growth rates in 2019, growth was still respectable. Plus, it’s important to remember that other factors can significantly influence changes in air travel growth rates each year.

Investors shouldn’t expect the Boeing 737 Max crisis to impact travel trends in a meaningful way. Some passengers may lean toward Airbus flights or another model rather than the Boeing 737 Max, however.

Many factors influence airline stocks other than the performance of individual planes. Investors in the broader market focus on interest rates, GDP growth rates, economic indicators and industry-specific metrics.

Investors in airline stocks overall shouldn’t be overly concerned about the fallout from the Boeing 737 Max 9 incident. Airlines can buy planes from different aerospace companies, though a big shift could affect them in the short term. Alaska Air Group Inc.’s (ALK) stock has recovered most of its losses since the latest incident, however.

Boeing competitors, such as Airbus SE (OTC: EADSY), could gain more value if Boeing’s production remains stalled for a long period of time.

Boeing’s 737 Max crisis may impact Boeing’s stock price but not necessarily those of airline stocks, or the stock market as a whole, in the long run. Long-term stock investors can navigate the dips and wait patiently for their equities to recover.

Boeing will try to demonstrate to investors that quality issues are a thing of the past. Until the company makes that commitment clear and meaningfully acts upon it, its share price will likely face continued pressure.