-

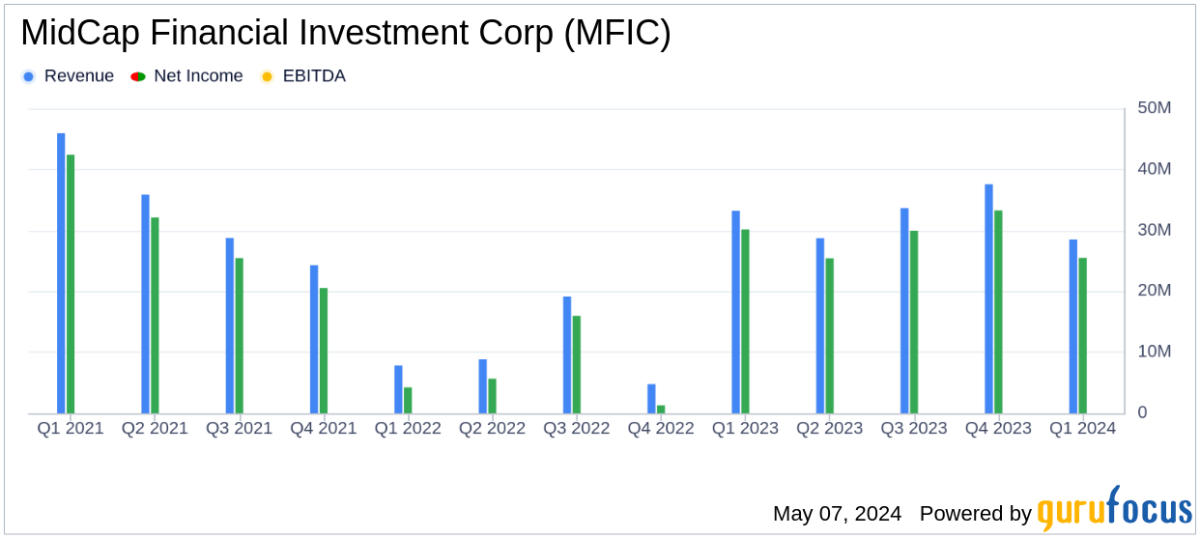

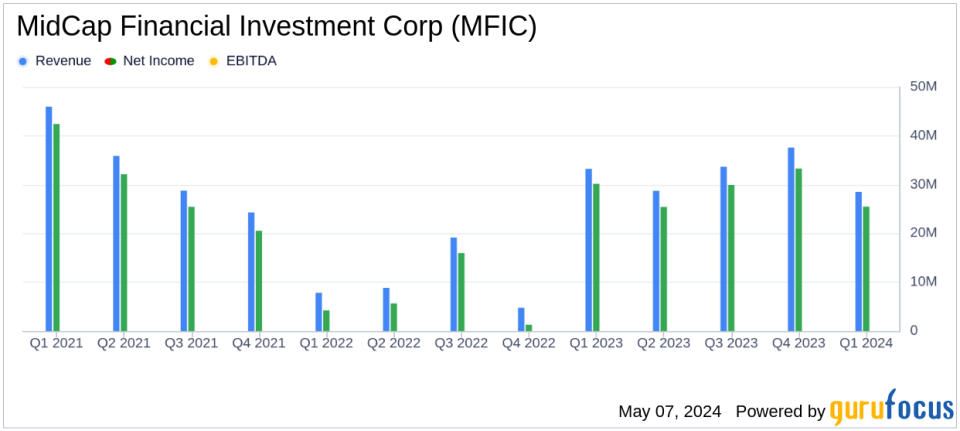

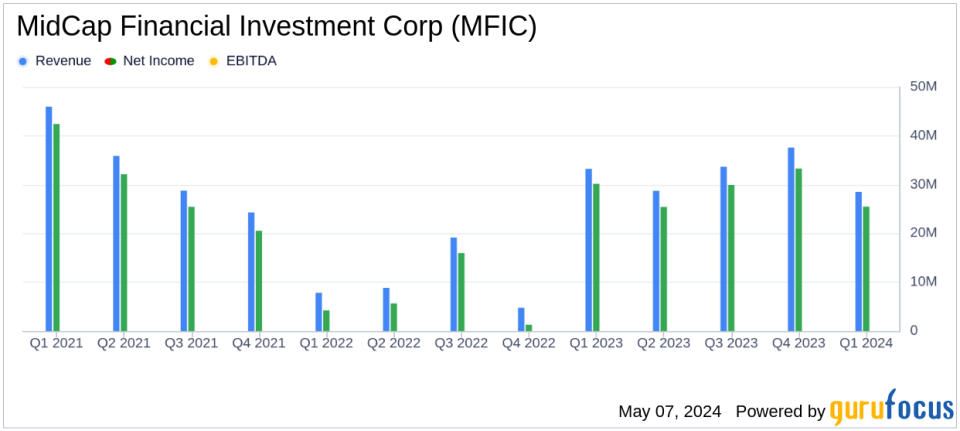

Earnings Per Share: Reported at $0.39 for Q1 2024, falling short of estimates of $0.43.

-

Net Investment Income: Reached $28.5 million, slightly above the estimated $28.45 million.

-

Revenue: Total investment income stood at $68.33 million, missing the estimated revenue of $69.36 million.

-

Dividend: Declared a quarterly dividend of $0.38 per share, payable on June 27, 2024.

-

Net Asset Value (NAV): Slightly increased to $15.42 per share as of March 31, 2024, from $15.41 as of December 31, 2023.

-

Portfolio Activity: Net investment activity resulted in a positive change, with $15.9 million in new investments after repayments.

-

Leverage and Liquidity: Reported a debt-to-equity ratio of 1.40x, showing a slight reduction from previous quarters.

On May 7, 2024, MidCap Financial Investment Corp (NASDAQ:MFIC) disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a net investment income of $0.44 per share, closely aligning with the analyst estimates of $0.43 per share. This performance reflects a slight decrease from the previous quarter’s $0.46 per share. The net asset value (NAV) per share as of March 31, 2024, was $15.42, showing a marginal increase from $15.41 at the end of December 2023.

MidCap Financial Investment Corp, managed by Apollo Investment Management, primarily focuses on first lien senior secured loans to U.S. middle-market companies. The company’s strategic approach includes a diversified investment portfolio predominantly in the middle market sector, which is evident from its stable credit performance and portfolio de-risking activities noted during the quarter.

Financial Highlights and Portfolio Activity

The company’s total assets slightly decreased to $2.45 billion from $2.50 billion in the previous quarter. Its investment portfolio was valued at $2.35 billion. The debt-to-equity ratio stood at 1.40x, slightly lower than the previous quarter’s 1.45x, indicating a conservative leverage position. During the quarter, MFIC made new investments totaling $152.8 million and reported net investment activity of $15.9 million after repayments.

CEO Tanner Powell highlighted the solid results and the strategic benefits of the company’s diversified investment approach. Powell also discussed the anticipated advantages of the proposed mergers with Apollo Senior Floating Rate Fund Inc. and Apollo Tactical Income Fund Inc., aimed at creating a more scaled business development company focused on middle market direct lending.

Operational and Market Challenges

Despite a stable financial performance, MFIC faced challenges typical of the asset management industry, such as market volatility and competitive pressures in middle-market lending. The slight decrease in net investment income per share year-over-year from $0.45 to $0.44 illustrates these challenges. Furthermore, the company did not repurchase any shares during the quarter, maintaining a cautious approach in capital return strategies.

Liquidity and Capital Resources

As of March 31, 2024, MFIC’s liquidity position included $49.6 million in cash and cash equivalents. The company’s debt obligations totaled $1.412 billion, with various notes maturing between 2025 and 2028. The available remaining capacity under its multi-currency revolving credit facility was $1.063 billion, subject to borrowing base compliance.

Looking Ahead

MidCap Financial Investment Corp’s near-term outlook is cautiously optimistic, with strategic mergers on the horizon expected to enhance its market position and financial robustness. The company’s adherence to a prudent investment strategy and its focus on first lien secured loans should continue to support its objective of generating current income while managing investment risks effectively.

Investors and stakeholders are encouraged to participate in the upcoming conference call scheduled for May 8, 2024, to discuss these results and future strategies in more detail.

For further information and detailed financial data, stakeholders are advised to review the supplemental information package available on the company’s website, which provides additional transparency into MFIC’s financial results and operational strategies.

Explore the complete 8-K earnings release (here) from MidCap Financial Investment Corp for further details.

This article first appeared on GuruFocus.