On November 28 2023, the Financial Conduct Authority (FCA) unveiled its long-awaited Sustainability Disclosure Requirements (SDR) and investment labels regime for investment products.

The SDR policy statement includes a substantial package of measures aimed at improving the trust in, and transparency of, sustainable investment products and at minimising greenwashing.

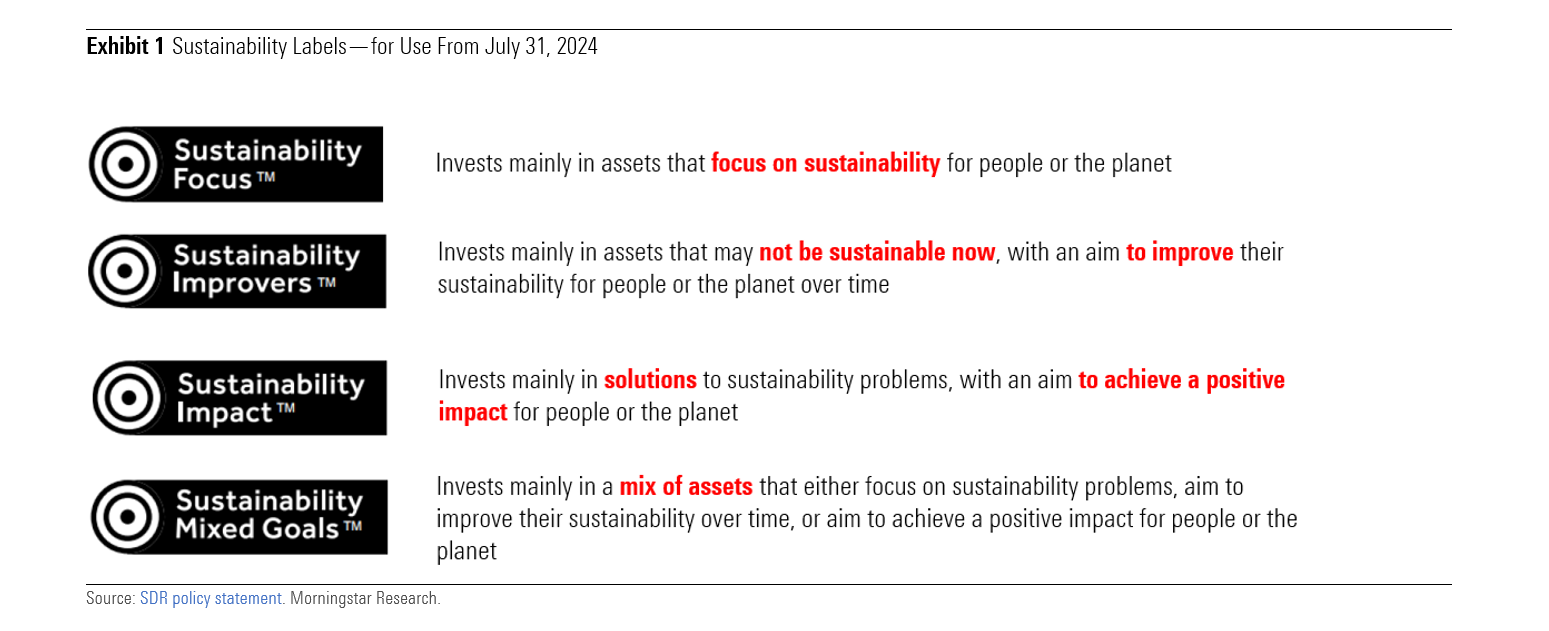

As part of the raft of new measures, the FCA created four sustainability labels to help consumers differentiate between products with different sustainability objectives and investment approaches.

The labels are “Sustainability Focus”; “Sustainability Improvers”; “Sustainability Impact”; and “Sustainability Mixed Goals.” A brief description of each is provided in the table below.

Use of labels is voluntary and asset managers will be allowed to use them from July 31.

Within the next few months, asset managers will be reviewing their product lines to consider which funds would qualify for a label.

About 300 UK Funds May Opt For a Label

Based on conversations we have had with 15 asset managers and our knowledge of the strategies and the firms, we have attempted to predict which funds would opt for a label and which label they would use. The purpose of this exercise is to assess what the market of UK sustainability-labelled funds may look like by the end of the year.

In total, we estimate about 300 funds would opt for one of the four labels, representing just over 8% of funds domiciled in the UK and less than 3% of all funds available for sale in the UK. In terms of assets, these funds would amount to around £110 billion.

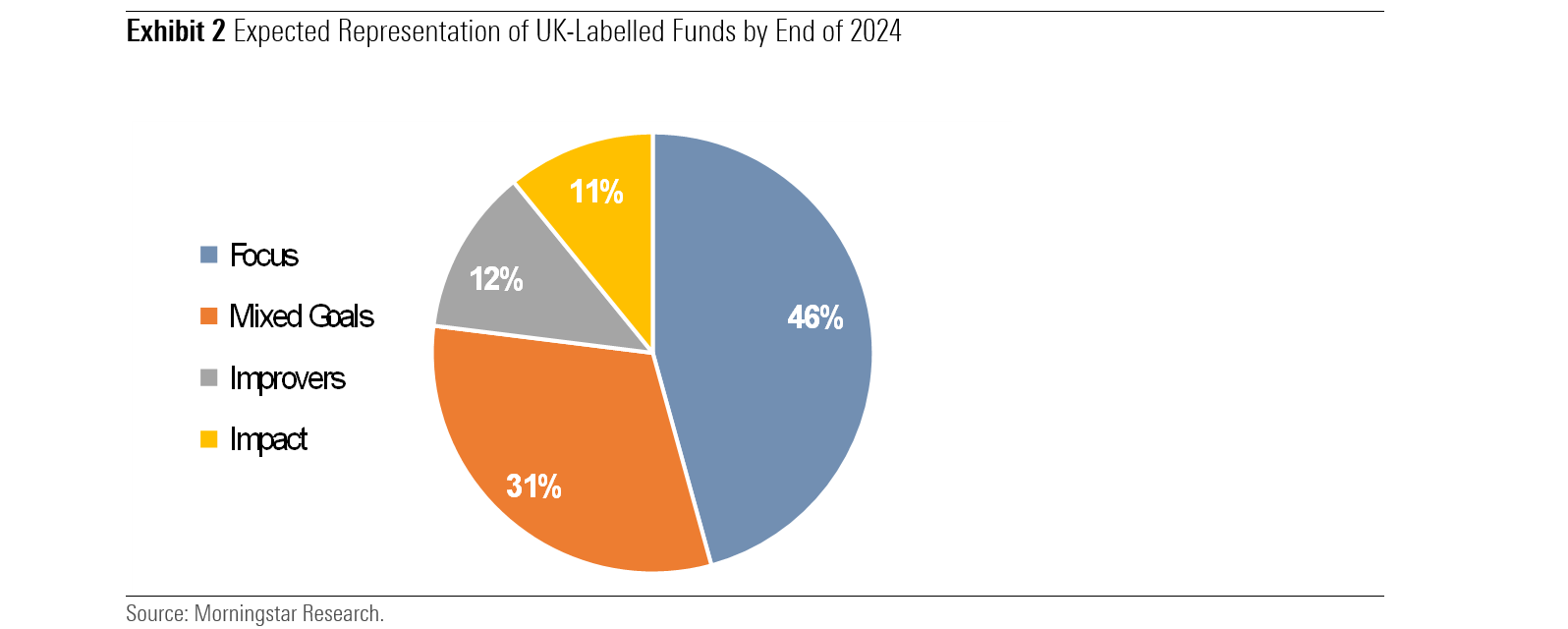

Two Labels Will Dominate

Based on our assessment of these 300 funds, we predict that Focus will be the dominant label, representing almost half (46%) of labeled products, followed by Mixed Goals (31%), Improvers (12%), and Impact (11%).

Of the four labels, it appears asset managers have the best understanding of the Focus label and the type of strategy that will qualify for this label. Managers we spoke to seemed confident that strategies meeting the criteria for Article 9 under the EU Sustainable Finance Disclosure Regulation (SFDR), portfolios with high sustainable investments as defined under SFDR, as well as thematic strategies would meet the requirements for the Focus label.

We expect the Mixed Goals label, which was created mainly to accommodate multi-asset strategies, to be a popular label for portfolio managers who want to keep some flexibility. The requirements of the label should allow managers to create as many allocations to sustainability objectives as they see fit as long as 70% of the overall assets are aligned with the criteria of at least two of the other three labels.

When the FCA unveiled its proposed labels in 2022, the Improvers label was hailed as a great idea, recognising the need to build portfolios for sustainability-oriented investors that reflect the current state of the world: one that houses few companies that are sustainable but many more that are transitioning and aspiring to be sustainable one day.

According to our preliminary analysis, we don’t expect the number of Improvers-labelled funds to be among the largest because managers may prefer to hold a mix of assets that have different sustainability strategies, including an Improvers sleeve.

We predict Improvers funds will represent only around 14% of labeled products, although this proportion may be higher if more funds end up setting improvement key performance indicators at product-level (as opposed to KPIs for individual assets) such as portfolio decarbonisation targets. Managers may also be tempted to test the limit of the label’s requirements by setting low improvement thresholds.

Finally, and perhaps unsurprisingly, we expect only a small number of funds will use the Impact label because of its strict criteria. Managers of Impact-labeled funds will have to demonstrate a theory of change at both the investor level (through engagement, for instance) and asset level.

It will therefore remain a challenge for managers to show evidence of impact in the listed market. Impact will be easier to evidence for strategies focused on bonds with use of proceeds (for example, green and social bonds) as well as those investing in private assets, including direct property and infrastructure, which are more suited in a closed-end investment trust format.

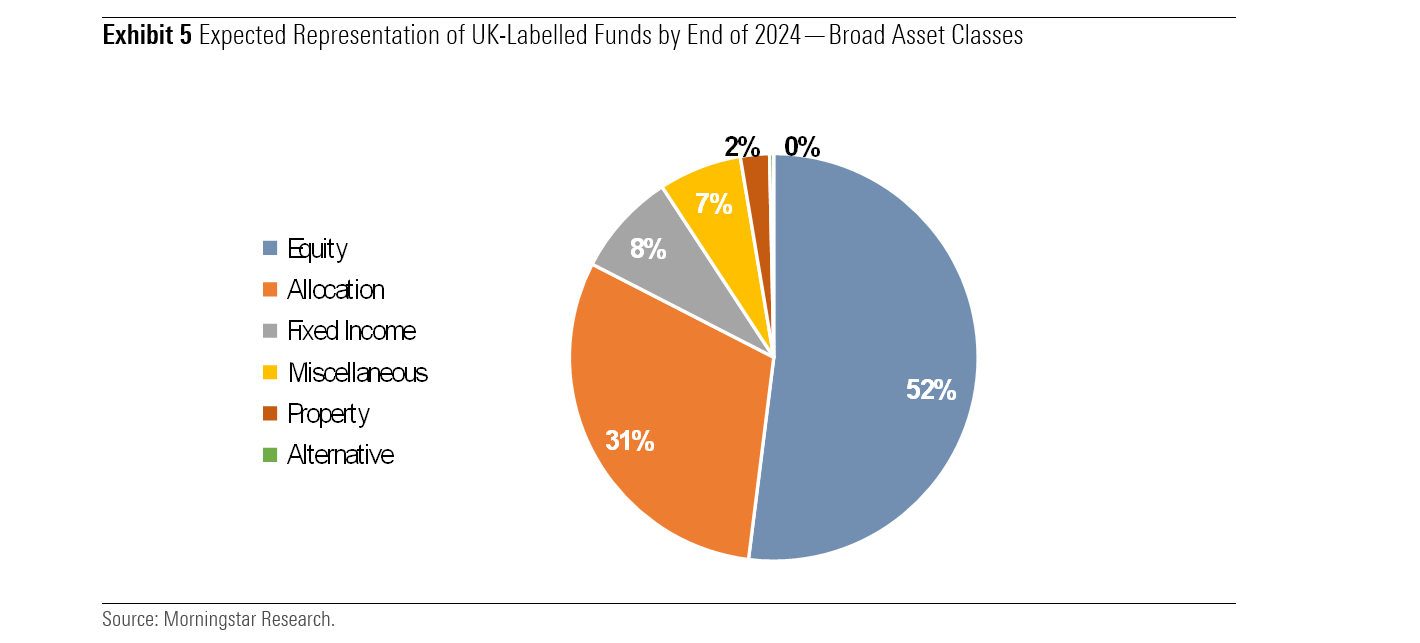

Equity Will Dominate. Fixed Income Will Be Underrepresented

Diving into our universe of approximately 300 UK funds, we found just over half (52%) of the 300 labelled funds would offer exposure to equities, while about 31% would be allocation (multi-asset) funds. Fixed income would account for only around 8% of labe;led funds.

By comparison, the overall UK-domiciled fund market includes 42% of equity funds, 39% of allocation funds, and 11% of fixed-income funds. When considering all funds available for sale in the UK, equity funds represent 48% of the market, allocation funds only 18%, and fixed income 22%.

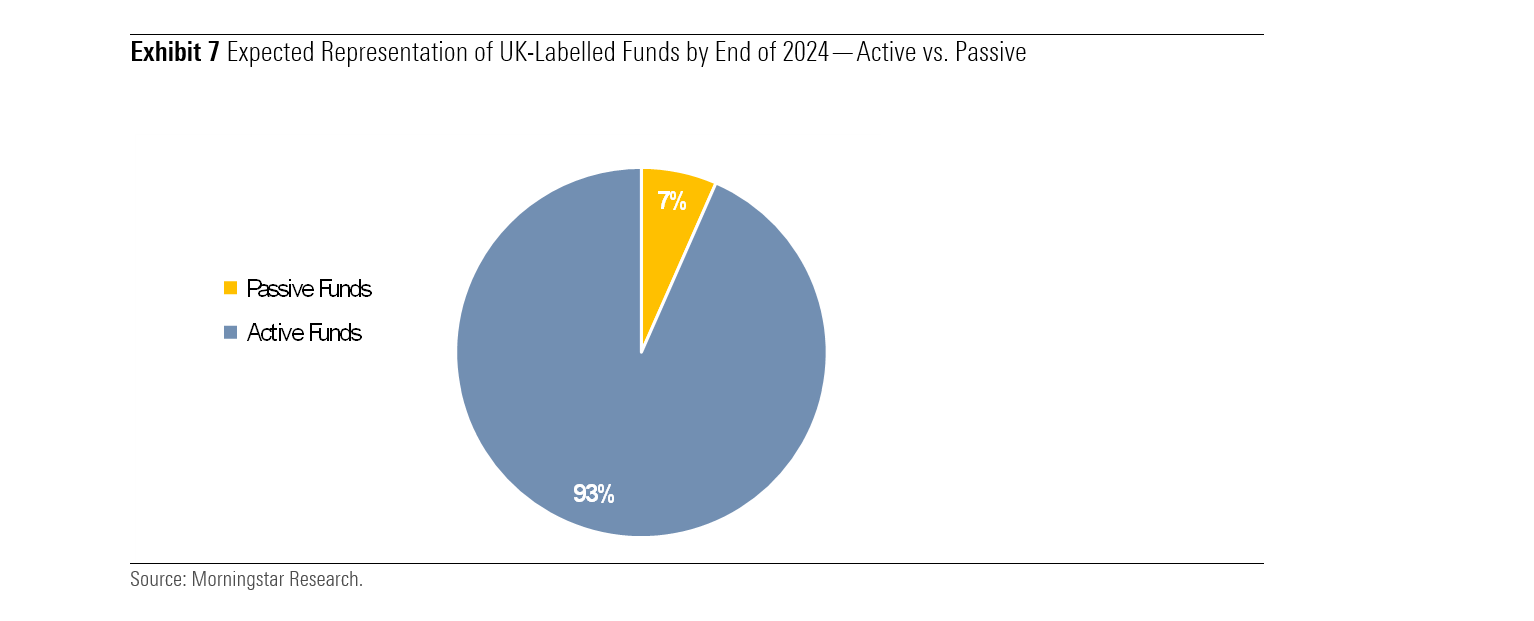

Passive Funds Will Be Significantly Underrepresented

Out of the 410 UK funds with sustainability-related terms in their names, only about 50 are passively managed, and of these, we predict that less than half will opt for a label, as the majority of UK-domiciled passive funds are exclusionary or tilted strategies.

Most passive funds available for sale in the UK (1,960 in total) are overseas exchange-traded funds, typically domiciled in Ireland or Luxembourg, which are currently out of scope. The limited number of labelled passive funds will reduce the choice offered to sustainability-oriented investors in the UK.