“What has been somewhat overlooked in recent years is the resilience of the asset class,” he said in an interview in Hong Kong. “There has been so much ample funding available in local markets, that a lot of companies have been able to term out maturity profiles without having US dollar bond access.”

Chan co-manages the US$27.5 million Asia Credit Bond Fund, which has gained 8.7 per cent this year, versus 3.4 per cent peer average, according to Bloomberg data. His top holdings at end-November included bonds sold by the Indonesia, lenders DBS Group of Singapore and Development Bank of the Philippines, and Sun Hung Kai Properties.

Dollar-denominated high-yield bonds issued by Asian companies have risen since late October to erase losses during the year. The Index has gained 0.8 per cent this year through December 26, following a 20 per cent decline in each of the preceding two years, according to the ICE BofA Index. Their high-grade peers rose 7.3 per cent versus a 10.5 per cent loss in 2022.

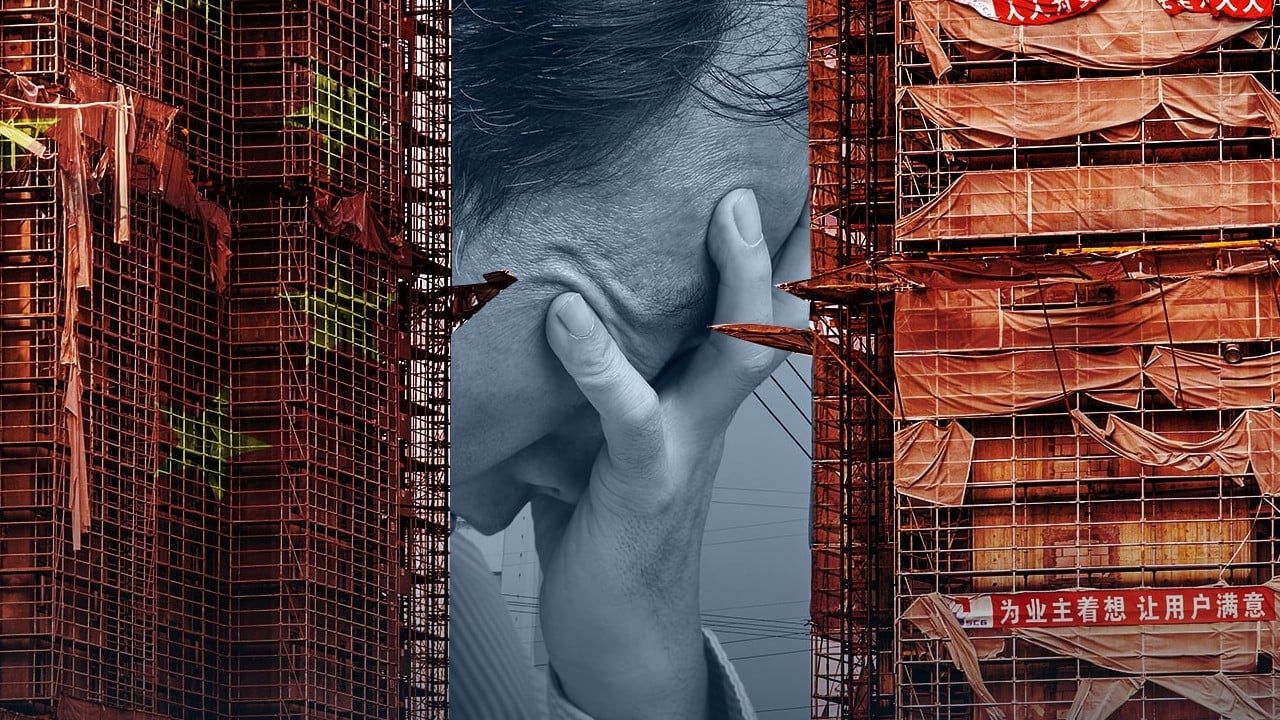

China’s junk bonds still a landmine after 22% loss in 2023 as defaults reign

China’s junk bonds still a landmine after 22% loss in 2023 as defaults reign

However, an index of such securities from Chinese issuers is still 21 per cent lower than at the start of the year, compounding a 33 per cent slump in each of the past two years. The index tracks 35 bonds with a market value of US$17.2 billion, 16 per cent effective yield, and about 12 percentage points more than Treasuries.

Expectations for Fed rate cuts in 2024 could embolden high-yield chasers, and positive performance with still-attractive “carry” is likely to support fund inflows, Goldman Sachs said in a report to clients on December 16. A smaller net supply of new bonds could also improve market technicals, it added.

Cracks in China’s property bonds push BEA to favour Macau, India and Indonesia

Cracks in China’s property bonds push BEA to favour Macau, India and Indonesia

Before Country Garden missed its debt payments, China’s property sector had racked up US$114 billion of defaults since 2021, or 94 per cent of all failures in Asia, according to a JPMorgan Chase report published last month. Another US$8 billion from the sector could still be at risk of default, it estimated.

Goldman forecasts a 2024 default rate of around 35 per cent for Chinese property high yield bonds, and 2.1 per cent for Asian high yield excluding China real estate. Asian investment grade credits could produce 6.7 per cent in total returns in 2024, while junk-rated debt outside the Chinese property sphere could deliver 9.5 per cent, it forecasts.

Many private developers will continue to face repayment challenges, and some may defer repayment via debt restructuring or even default, Fitch Ratings said in a report on December 26, citing sluggish contracted sales outlook and funding constraints, among others.

Non-defaulted private developers will need to repay 39.3 billion and US$5.5 billion of principal in the onshore and offshore bond markets in 2024, or 14 per cent and 41 per cent higher than the levels in 2023. Maturities will peak in March and August, it added.

“We expect banks to stay highly selective on new loans, so the visibility of financing support to private developers remains low,” it said.

Outside that troubled property sector, default risks are “quite manageable” for Asian junk bonds which offer attractive yields of about 12 per cent, Andy Suen, a portfolio manager at PineBridge, said in an interview.

“The negative impact of the China property sector has led to some dislocation opportunities in the broader Asian high yield market,” he said. “This is a good opportunity. You get a low-teen level of yields for much lower risk than investing in the equity market.”

Several funds that bet on Asian companies with the weakest credit ratings have suffered hefty losses amid China’s housing woes. However, their returns have been improving recently as the broader market stabilises.

The US$2.4 billion Pimco Asia High Yield Fund fell 1.9 per cent so far this year, after losing 14.8 per cent in 2022 and 11 per cent in 2021. The US$1.68 billion Fidelity Asian High Yield Fund has narrowed its losses to 1.5 per cent, after taking a 24 per cent and 14 per cent beating in preceding two years.

“There will be some defaults, in any given cycle,” Chan at T. Rowe said. “But there’s nothing big out there. With a bottom-up, focused approach, that should generally keep you out of any trouble.”