(Bloomberg) — For Asia investors concerned about artificial intelligence stocks looking overheated, one top fund manager suggests a surprising reason to keep buying them: dividends.

Most Read from Bloomberg

“Tech companies we own in Asia all have a net cash balance sheet, they all pay a dividend today, and we expect them all to increase their dividends as their earnings grow in the next few years,” Sam Konrad, co-manager of the Jupiter Asian Income strategy, said in an interview. In contrast, US peers “don’t have the same focus on paying dividends,” he said.

While income funds are known for investing in lower-risk stocks with stable payouts such as banks or utilities, Konrad said his strategy boosted technology holdings to a record of about 32%, now its top allocation. Asia’s largest chipmakers Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. rank among its largest investments.

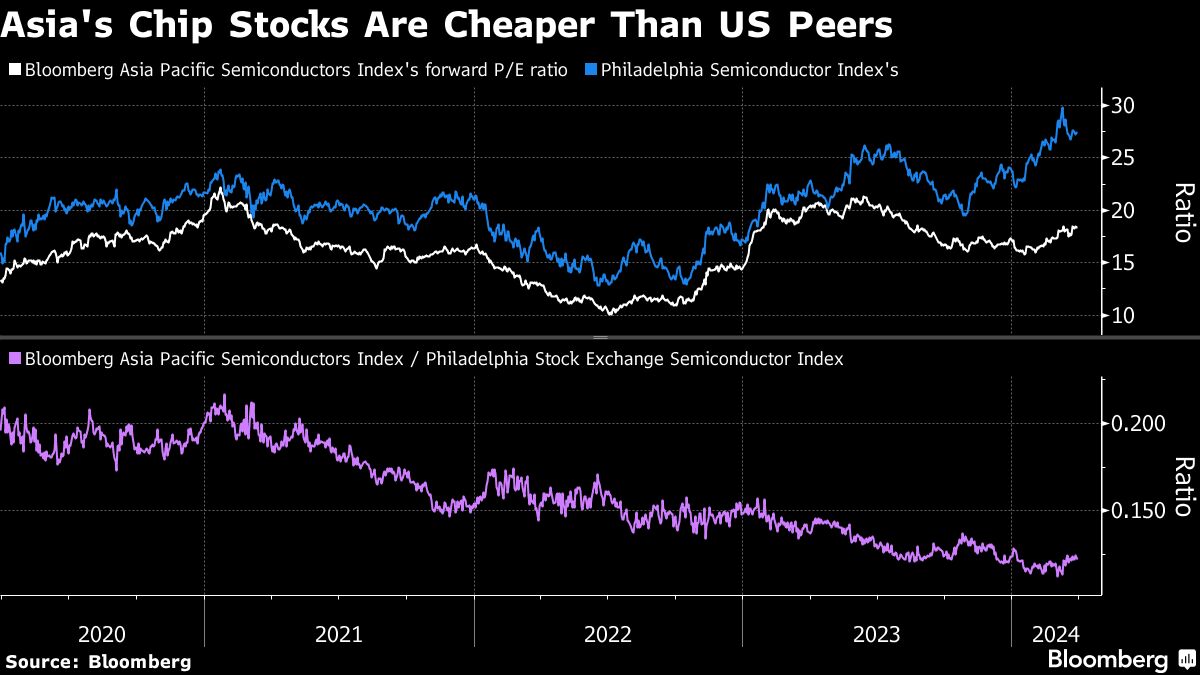

The AI boom has driven rallies in the region’s tech shares, though they have largely lagged the massive gains in US peers such as Nvidia Corp. That’s left them relatively cheap, and few investors look poised to call time on the momentum trade that’s sent many stocks to record-high levels.

“When we look at the valuations of the Asian tech stocks that we own and we compare them to US tech stocks or even to history, they are really attractive,” Konrad said. The $2 billion Jupiter Asian Income strategy beat 97% of its peers over the past five years.

TSMC is trading at about 19 times estimated earnings for the next year, in line with its five-year average, while the Philadelphia Semiconductor Index is at 27 times. MediaTek Inc. — the largest holding in Konrad’s portfolio as of February — has an indicated dividend yield of 5.2% for the 2024 fiscal year, while Nvidia’s is 0.02%.

Asia offers better growth in payouts as well. Dividends for stocks in the Bloomberg Asia Pacific Semiconductors Index are estimated to rise nearly 30% over the next 12 months compared with 20% for the Philadelphia chip gauge, according to Bloomberg-compiled data.

Konrad said he prefers “global leaders” that have been able to surpass US peers in terms of technology and capabilities. While the US is known for its high-profile design and consumer-fronting software companies, Asia still has many of the key, lesser known contractors and suppliers.

“We don’t know which of the US tech giants are going to develop the killer app or the killer products or service,” he said. “It doesn’t matter because whoever it is, they will need to have the semiconductors manufactured by the company that we own. They will need to have their AI data servers managed, manufactured by the company that we own in Asia. They want to buy their memory from the company that we own.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.