-

The rise of passive index funds could be fueling a bubble in mega-cap growth stocks, according to Bank of America.

-

Reinvested dividends from passive index funds could be mostly allocated to the biggest companies in the index, even if they don’t pay dividends.

-

“If passive equities are the vehicle of choice, inflows could continue to feed mega-cap growth companies,” Bank of America said.

The rise of passive index funds could be fueling a bubble in mega-cap growth stocks, Bank of America said in a note last week.

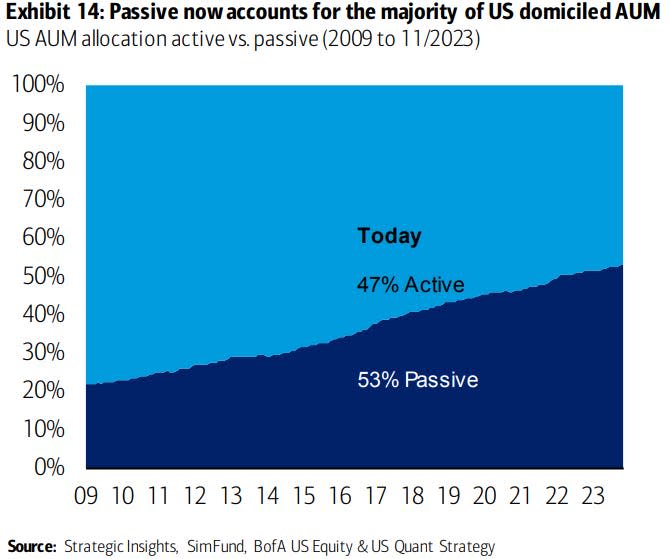

Bank of America’s equity strategist Savita Subramanian highlighted that passively managed funds, which are funds that simply buy the index, make up 53% of US domiciled assets under management, while actively managed funds make up 47% of assets under management.

At the expense of actively managed funds, the market share of passive funds is expanding at a rapid pace, as just 20% of US assets under management were in passive index funds in 2009.

But there’s a knock-on effect from the rise in passively managed stock market funds that could be pushing up the stock prices of mega-cap tech funds. That’s because reinvested dividends in passive funds can flow to the biggest companies within the index, even if they don’t pay dividends.

“Passive + reinvested dividends = mega-cap growth bubble,” Subramanian told clients.

“Passive index funds with dividends reinvested tend to allocate inflows based on market capitalization. But if dividend payers drop after their ex-date, driving shrinking capitalization, and dividends paid are allocated by market capitalization, favoring large companies that pay low or no dividends, an unintended consequence is undue inflows into larger, growthier companies,” Subramanian explained.

Subramanian said that as passive equities increasingly become the vehicle of choice for investors, inflows into such funds “could continue to feed mega-cap growth companies.”

The rise of passive index funds could be just one tailwind for mega-cap growth stocks in 2024. Subramanian said that consensus among investors is for mega-cap growth stocks to sell-off after delivering such a strong year of gains in 2023. That dynamic sets up for an interesting contrarian scenario that could play out in January.

“We hear from our clients that a broadening of market leadership is now as consensus as the unwavering bond love / equity hatred we heard at the end of 2022. The January pain trade may thus be higher TMT/mega-caps,” Subramanian said.

Read the original article on Business Insider